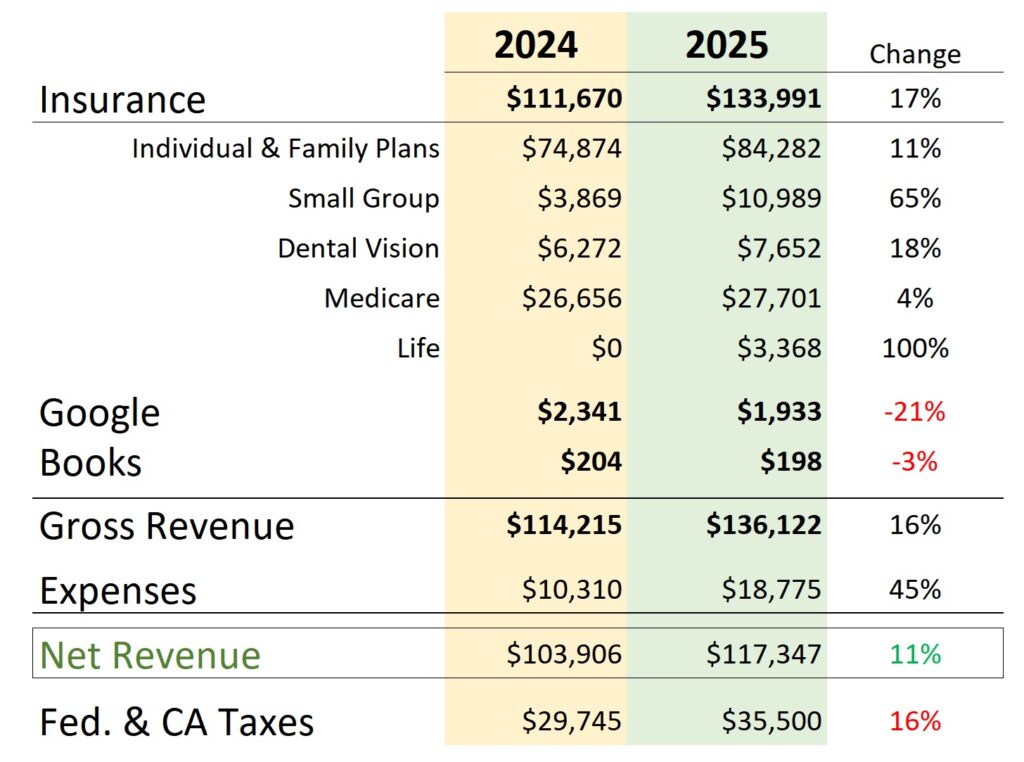

As I predicted, 2025 was a good insurance income year for me. I have also predicted that 2026 will see my insurance revenue drop if everything remains the same. Some of my revenue streams were down in 2025 and my expenses were up. Overall, I realized a net increase of 11 percent to my net income over 2024.

Insurance Commission Revenue Up for 2025

Commissions from my individual and family plan enrollments, mainly through Covered California, increased 11 percent over 2024 to $84,282. Small group commissions jumped 65 percent to $10,989 because I added a small group. Medicare commissions were flat with just a 4 percent increase over 2024 to $27,701.

Google advertising revenue dropped by 21 percent over 2024. I attribute this in part to artificial intelligence. More people are turning to AI to get their questions answered, correctly or otherwise. This reduces page and video views, which in turn lowers advertising revenue.

My gross revenue for 2025 was $136,122, an increase of 16 percent over 2024. Unfortunately, my expenses took a big jump to $18,775, an increase of 45 percent. When I subtracted my expenses from gross revenue, my net revenue is approximately $117,347 for 2025. This represents an 11 percent increase from 2024. Of course, federal and state taxes, because of the revenue increase, jumped 16 percent to $35,500.

2026 Insurance Income Poised to Drop

Whereas I was optimistic about 2025, I am pessimistic about 2026. Because the enhanced subsidies were not passed by Congress, I’m seeing people drop health insurance. I anticipate more people will drop health insurance during the year because they just will not be able to afford the high health insurance premiums.

We continue to see the trend of health insurance companies switch from a commission percentage to a per member per month (PMPM) agent compensation. Overall, the PMPM compensation will suppress agent income, especially for agents like me who tend to have individuals as clients who are older.

Medicare Commissions Evaporating Away

Medicare is becoming a barren commission landscape. Virtually all of the carriers stopped paying compensation on Part D drug plan enrollments. Of all the Part D enrollments I did in 2025 for the 2026 plan year, not one will pay a commission to me.

Many Medicare Advantage plans are similarly not paying commissions for enrollments. At least for the 2026 plan year, we saw many Medicare Advantage plans remove the plans from quoting engines so agents could not see and enroll people into the health plans. It is a way to suppress enrollments while remaining compliant with the Centers for Medicare and Medicaid Services.

I attempted to diversify in 2025 with the understanding that 2026 will be a difficult year. Unfortunately, I spent a bunch of money – note the high expenses for 2025 compared to 2024 – that will not have any return on the investment. Sometimes you need to take a risk. Sometimes you just waste money.

Consequently, for 2026, I will continue to focus on individuals, families, small groups, and Medicare. All I can do is offer my services and accept the commission landscape as it is presented to me. However, this may mean avoiding certain products where I am not even modestly compensated for my time.

YouTube video on Kevin Knauss Insurance Income for 2025