You can only enroll in health insurance outside of open enrollment if you have a qualifying life event for a special enrollment period. This condition of a qualifying life event applies to Covered California and directly with any health plan offered in your area for an individual and family plan.

Except for a few qualifying life events, you have a 60-day special enrollment period window to enroll in health insurance from the date of the event. The qualifying life events listed below are of May 2025. Proposed rule changes by the Trump administration may mean some events are no longer eligible for the special enrollment period.

- Involuntary loss of coverage

- COBRA subsidies ended

- Permanently moved to California

- Birth or adoption of a child

- Marriage or entered into domestic partnership

- Returned from active-duty military service

- Released from jail or prison

- Gained citizenship or lawful presence

- County under a State of Emergency

- Gained Deferred Action for Childhood Arrival (DACA)

- Paid penalty for not having health insurance

- Victim of domestic abuse or spousal abandonment

- Newly qualifies for health insurance stipend as app-based driver

- Loss of Covered California APTC health insurance subsidy, off-exchange

- Health plan network provider becomes non-participating provider where claim for services is denied, off-exchange.

- Non-calendar plan renewal, opt out of the group coverage, off-exchange

- Gain access to ICHRA or QSEHRA through employer arrangements, off-exchange

- Third party payor of premiums cancels future payments, off-exchange.

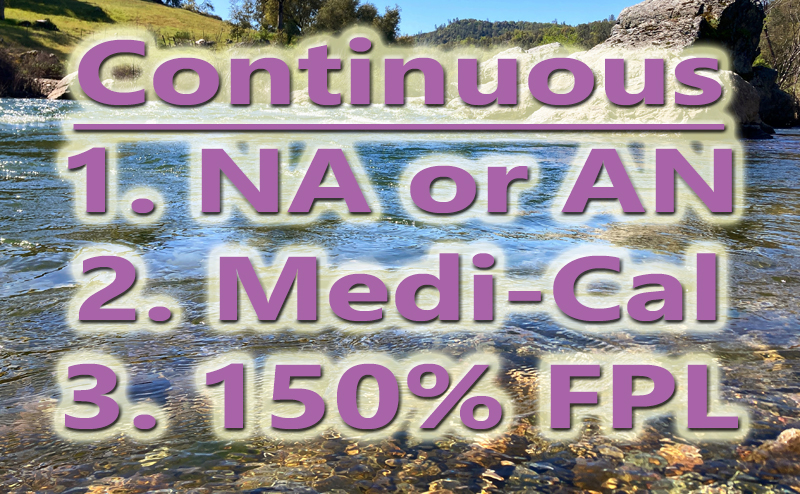

Continuous special enrollment period:

- Medi-Cal

- Federally recognized American Indian/Alaska Native

- Income between 138 and 150 percent of the federal poverty level

There are times when Covered California determines an individual is not eligible for the Advance Premium Tax Credit monthly subsidy. When this happens, the individual can apply for an off-exchange health plan. This may be beneficial because the Silver plans off-exchange are less expensive than the same health plan through Covered California.

Involuntary Loss of Coverage

Loss of coverage is a qualifying event, but it must be an involuntary termination. Circumstances that fall under involuntary loss are

- Divorce, legal separation, dissolution of domestic partnership.

- Death of primary applicant for the family plan.

- Primary applicant gains Medicare and is no longer eligible for an IFP.

- Loss of employment or reduction in hours that results in termination of group health insurance.

- Turning 26 years old and no longer eligible for parents group insurance

- COBRA or Cal-COBRA ends.

- Loss of Medi-Cal eligibility. Requesting Medi-Cal enrollment to be terminated is not a qualifying event. You must be determined you are not eligible because your income is too high.

Unfortunately, forgetting to pay your health insurance premium, that results in the termination of the health plan, is not a qualifying event.

COBRA Subsidies End

In general, if you have selected COBRA coverage after you separate from an employer sponsored health plan, you have health insurance and don’t qualify for a special enrollment period. However, if the employer is paying a portion or all of the COBRA premium and that subsidy ends, that is a qualifying life event.

Permanently Moved to California

When you establish permanent residency in California, an individual and family plan from another state or country will usually need to be cancelled. Most health plans require you to reside in the region where you receive health care services, in part, because the rates are based on a specific region. In addition, the out-of-state health plan may have no network of health care providers. Consequently, permanently moving to California is a qualifying life event.

Gaining Citizenship or Lawful Presence

If you did not have health insurance and you have gained citizenship or lawful presence residency, then you can enroll in health insurance. What is not a qualifying life event is moving from lawful presence residency, such as a green card, to citizenship. The rational is that you had the opportunity to enroll when you were lawfully present.

DACA Deferred Action for Childhood Arrival

Covered California states that if you have been granted DACA as of February 1, you can enroll in a health plan through December. This is a qualifying life event that the Trump administration would like to eliminate.

State of Emergency

When the governor declares a state of emergency within your county, that creates a qualifying life event to enroll in health insurance. Usually, the state of emergency is from a natural disaster such as a wildfire, earthquake, or flooding.

Paid Penalty for Not having Health Insurance

California has an individual mandate penalty. When you file your California income tax return, if you did not have health insurance during previous year, you must pay a penalty. When you pay the penalty, you trigger a qualifying life event for a 60-day special enrollment period to enroll in health insurance.

App-Based Driver Qualifies for Health Insurance Stipend

Under Proposition 22, app-based drivers who work enough hours to qualify for the app-based company to extend a monthly stipend to reduce the cost of health insurance for the driver, are eligible for special enrollment period.

Loss of Covered California Subsidies

There are times when an individual or family is no longer eligible for the Covered California Advance Premium Tax Credit (APTC) subsidy. When this happens, the household can enroll in a health plan outside of Covered California where the Silver plans are less expensive.

Third Party Payor

If a third party, such as a trust, determines it will not pay future health insurance premiums for the insured, loss of those payments is a qualifying life event to enroll in an off-exchange health plan.

Year-Round Enrollment

There are some programs and conditions that allow year-round enrollment.

MAGI Medi-Cal

For individuals with an income under 138 percent of the federal poverty level (FPL), 266 percent household income for children, you can apply at any time. If the family has no health insurance, they can apply through Covered California. Outside of open enrollment, if the family income is over 150% FPL and under 266% FPL, the adults won’t be offered Medi-Cal or Covered California health insurance, but the children will be enrolled in Medi-Cal.

150% FPL

If the household income is less than 150% FPL and above 138% FPL, adults can enroll in Covered California without any other specific qualifying life event. The SEP may be eliminated under the Trump administration.

Native Americans and Alaska Natives can enroll year-round with no specific qualifying life event.

Other Qualifying Events

Some individuals and families have unique circumstances or multiple situations that can trigger a special enrollment period. Consult with Covered California or a health insurance agent to review your situation. Covered California may allow some qualifying life events, while an off-exchange plan may not, and vice versa.

Documentation

Be prepared to show proof of your qualifying life event for the special enrollment period. With Covered California you can enroll as late as the last day of the month for an effective date of the 1st of the next month. For off-exchange health plans, some of the qualifying life events require you to apply by the 15th of the month for a 1st of the month effective date – April 15th for May 1st effective date.

YouTube video explaining the different qualifying life events.