Insurance agents are uniting to bash and defeat Prop. 45, the California ballot initiative that would give the Insurance Commission the power to deny excessive health insurance premium rate increases. The latest campaign rhetoric by agents makes Prop. 45 sound worse than the Affordable Care Act. This organized opposition to Prop. 45 only serves to reinforce the public image that insurance agents care more about their commissions than they do about their clients.

Benefit Mall leads grass roots agent rally

Benefit Mall, a field marketing organization based in Dallas, Texas, is leading the grassroots campaign to get health insurance agents to vote no on Prop. 45, but more importantly, donate money. (See their email blast to agents below.) The website directed at agents is called Agents of Action. I guess the name is supposed to conjure images of an insurance agent super hero coming to the rescue of the beleaguered health insurance company battered by the forces of socialism.

Who’s the client?

It appears that Agents of Action was developed and is maintained by the California Association of Health Underwriters (CAHU). The money to create the website came from CAHU, LISI, Inc., National Association of Health Underwriters (NAHU), WarnerPacific Insurance Services and Word & Brown Insurance Administrators. The primary allegiance of all these organizations is to the health insurance companies and not the consumer.

More fiction than fact

The campaign rhetoric against Prop. 45 is just as misleading as the run up to the passage of the ACA and the scare tactic of “death panels”. Cue the sinister voice over –

Proposition 45 is bad for agents and even worse for our clients. The initiative gives one politician sweeping new authority over healthcare, including rates, co-pays, deductibles, commissions and even what health insurance covers. That’s too much power for one person. – Agents of Action website

This statement is hyperbole at its finest.

Bad for agents

The worst thing for agents was the health insurance companies slashing the commissions by 40% to 60% back in 2010 when the ACA first went into effect. The reduction of the sales expense, better known as the agent commission, helped the health insurance companies meet the new medical loss ratios imposed by the ACA without having to cut the fat out of the CEO pay at the top. I never heard CAHU, NAHU or any of the general agents fighting against the commission cut.

Bad for clients

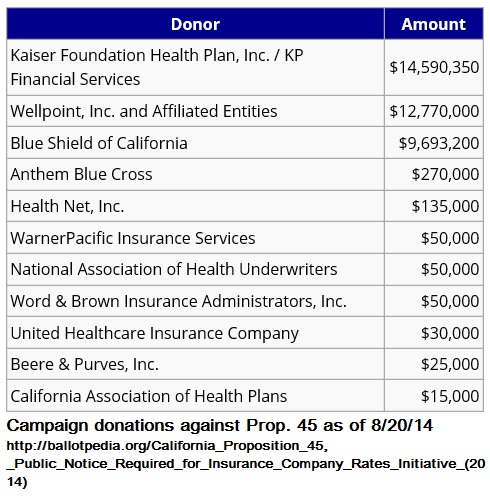

Biggest donations to defeat Proposition 45 are all connected to the health insurance industry.

I fail to see how denying an excessive rate increase is bad for my clients. How can the individual and family health plans get any worse with today’s narrow provider networks, billing issues and multiple problems at Covered California? Maybe we need the Insurance Commission to get involved and fix some of the problems consumers have been facing this past year. (See: Lightning strikes twice for one CC family)

Sweeping authority

Insurance Commissioner Dave Jones will never get sweeping authority under the current and fractured health insurance rate review process in California. With the exception of the Health Net EPO plans, the Department of Managed Health Care reviews all the other health plans offered through Covered California and most outside of the exchange. Covered California purportedly has their own rate negotiating division and has signed contracts regarding the benefit design of the health plans. Commissioner Jones is left with a shrinking pool of small group plans to regulate.

Too much power for one person

This is pure campaign theater. These people argued against the ACA because it gave too much power to bureaucrats. Now it’s too much power to an elected official. Of course, if the Insurance Commission was a Republican, like insurance salesman Ted Gaines, who never saw a rate increase he didn’t like (Cha-ching), then it wouldn’t be too much power in the hands of one elected official for these groups.

Independent commission?

This and other campaigns against Prop. 45 use the term “independent commission” as the euphemism for Covered California. They want us to keep the independent commission that is currently negotiating rates and benefits. Covered California is not independent. The Board members are political appointees and the chairperson is Diana Dooley who is the Secretary of California Health and Human Services which oversees the partner organization of Covered California, the Department of Managed Health Care.

Independent bureaucracy

Covered California is an independent bureaucracy that is in direct competition with agents, just like the health insurance companies. Covered California would rather sell all the health insurance direct to consumers and not have to support agents submitting applications. To portray Covered California as some sort of benevolent agency that agents want to keep is another myth propagated by the opponents of Prop. 45. Believe me, if Covered California vanished tomorrow and we went back to denying health insurance for pre-existing conditions the foes of Prop. 45 would applaud the return to “American values” of profit over people.

Another voice for the health insurance companies

The agent organizations like CAHU and NAHU along with the general insurance agencies are so closely aligned with the insurance companies they have forgotten who pays their bills – health insurance clients. These organizations just parrot whatever the health insurance companies tell them to say. Health insurance companies are afraid of change. Prop. 45 represents another change to the system and a potential loss revenue if the Insurance Commissioner made them reduce their 17% increase down to 12%.

Covered California hates Prop. 45

Even Covered California is against Prop. 45 because it represents change. Covered California may have to coordinate with the Insurance Commissioner’s office when it comes time to reviewing, negotiating and approving premium rates. This is more of a turf war for Covered California. They don’t want to give up or cede any of their power to the Insurance Commissioner. Download the thinly veiled hit piece against Prop. 45 by Covered California called an analysis by its authors at the end of the post.

Were rates too high in 2014?

Honestly, Prop. 45 is kind of a mess with its provision to order rebates back to 2012. But the whole California health insurance market place and rate regulation is a mess. Why did Kaiser and other HMOs decrease some of their rates 2% – 5% for 2015? Were they over charging the consumer in 2014? Would Prop. 45 allow the Insurance Commissioner to deny the rate decreases? Who knows?

Health insurers fear the Prop. 45

In addition to contributing millions of dollars to defeat Prop. 45, the health insurance companies are also lobbying their appointed agents to pledge their opposition to the rate regulating proposition. In what I thought was a routine business email from one of the carriers about their new health plans for 2015, this little message from the sales representative was tucked inside.

I will be hosting a number of seminars, and/or webinars in late October and early November to cover “What’s New” with Blue. Meaning, what’s changing in Individual, Senior and Small Group as well as pending legislation like Prop 45. If you do one thing this weekend, log on to www.agentsofaction.org to learn more about how devastating this ballot initiative will be to our livelihood if passed……

As I communicated to the representative, business emails should never contain political views or requests for political support. Furthermore, I challenged him to have his health insurance company send direct mail advertisements to their members urging them to vote NO on Prop. 45 instead of getting agents to be their mouthpiece. Health insurance companies are cowards. I educated the sales rep. that Prop. 45 didn’t threaten my livelihood. The health insurance companies slashed the sales commissions years ago and blamed it on the ACA. If health insurance companies value the assistance of agents helping them market and enroll new members, they can return the commission level to pre-2011 rates.

Profits over people

I am certain Prop. 45 won’t do anything to fix the rolling website mess at Covered California or their pathetic customer service. Regardless of whether Prop. 45 passes or fails, both Covered California and all the health plans will continue to be the primary competition of insurance agents. All the interests behind the defeat of Prop. 45 have profit and revenue as a motive over consumer protection. Yes, even Covered California, which must be self-supporting in 2015, is more of a sales organization than a consumer protection agency.

Bow down to the health plans

But as an agent I am disgusted that organizations such as CAHU, who are supposed to represent agents, continue to engage in misleading campaign rhetoric and so blatantly support the health insurance companies over the consumers. They need to change their name to the California Association of Healthplan Underlings because they will never be caught speaking ill of their insurance plans and they’ll never fight for agents or consumers.

See also: Prop. 45, good or bad for California

Appeal for campaign donations

“NO on 45” Campaign: Get Involved. Stay Up to Date

Dear Kevin,

As a follow-up to our previous communication regarding Proposition 45, BenefitMall would like to remind you to visit the AgentsofAction.org website and make your commitment to vote “NO” to Prop 45 on November 4, and to get your clients, colleagues, family and friends to do the same.

We would also like to share with you a few excerpts from a recent update provided by Alan Katz, one of those leading CAHU’s campaign against the initiative. Below are the highlights of his update on both the grassroots campaign and the broader “NO on 45” effort.

1. Polling: The latest Field Poll from last week showed Proposition 45 leading with 41% in support, 25% opposing and 33% undecided. Compare this to a July poll that showed 69% of likely voters supporting the initiative, only 16% opposing it and 15% undecided. A drop in support of 28% is a big move in the right direction.

So what should we take away from the poll? That we can defeat Proposition 45. We’ll do that not by getting overconfident, but by accomplishing the hundreds of things necessary to win. One of those things is using this poll to motivate those who had already given up to get back in the fight.

2. Fundraising: We are close to meeting the fundraising goal for our grassroots campaign. To date we’ve raised roughly 80% of our targeted budget, with several large pledges in the process of being fulfilled that will get us to 100%. We’ll have the resources we need to get things done. BenefitMall is one of the organizations that has already made a significant contribution to the “NO on 45” campaign.

3. Coalitions: This campaign was launched and is led by CAHU, but it’s now significantly larger. NAIFA-California and IIABCal have joined us, and they’re bringing money, resources and people. They will help us greatly expand our outreach.

4. Grassroots: You may not be aware, but we are the grassroots campaign against Proposition 45. The broader campaign is focusing on paid media. We’re the only effort aiming to bring 100,000 NO votes to the polls on November 4. This is a significant responsibility, but it’s also a tremendous opportunity. Elections in California can be very close, so your contributions and other commitments to help defeat Proposition 45 can make a real difference.

Again, the campaign is coming together well. The website (www.AgentsofAction.org) is live and has already collected hundreds of names and commitments, with the goal of getting 100,000 “NO” votes to the polls. This will be an important block of votes, and we are are counting on brokers from across the state to get to the polls along with their clients, colleagues, family and friends.

For more information on how you can support the “NO on 45” campaign, please contact your local BenefitMall Sales Team.

Sincerely,

Brett Winingham

Regional Vice President, Western Region

[wpfilebase tag=file id=159 /]

re