What are the roots of health care cost increases?

One of the big complaints about the Affordable Care Act is that it fails to address the rising cost of health care in the United States. Before you can tackle the problem you have to know the origin. Anthem Blue Cross has enumerated a list of reasons why they believe health care costs are rising and what they are doing to slow the increases. Download report -> [download id=”57″] Caution! large file, 3.5MB. Click images to enlarge.

Anthem Blue Cross wants to buck rising costs

Bucking the trend of rising health care costs is Anthem’s response to questions about what is driving

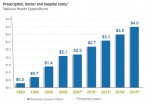

Rate of rising health care costs.

health care costs, and, in turn, insurance premiums, from their perspective. For the most part the summary is an honest and accurate picture. They cite where their statistics came from and are not shy about comparing the U.S. to other countries with lower costs.

Health insurance: gate keeper to care

Anthem’s viewpoint is important because health insurance is the gate keeper to health care services. Without insurance your overall level of care in the United States will be greatly diminished. Health insurance companies are also on the front lines of cost containment as they pay for a good chunk of health care services.

Technology monster

Whereas desk top computer have gotten more powerful and less expensive, health care technology has gotten bigger and more

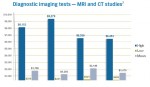

Disparity in imaging costs.

expensive over the years. The cost of new technology accounts for 1/2 to 2/3’s of the growth in new health care spending according to the Anthem report. Not only have the test gotten more expensive, American’s utilization of expensive imaging tests has also increased. The report states, “For every 1,000 Americans we perform 91.2 MRI exams and 227.9 CT exams.“

Diplomatic Anthem

Anthem Blue Cross is trying to be diplomatic by pointing out the numbers without discussing the perpetrators. Hospitals and clinics buy expensive imaging equipment to stay competitive and then encourage doctors order tests so they can recoup their investment. This is also part of the “defensive medicine” mind set of some doctors. More insidious are the doctors that refer their patients to clinics for diagnostic imagery when they have part ownership in the facility.

Insurance must be neutral in care management

Insurance companies can’t dictate which tests a doctor can order or at which clinic the procedure is performed. With a gentle swipe at doctors, hospitals and clinics, Anthem shows the huge price disparity in the market for the same diagnostic imaging services. If insurance companies tell the patient they have to use the less expensive provider, then Americans start yelling that the insurance companies are interfering with the doctor-patient relationship.

More drugs, higher prices

Anthem points out that prescription drug spending has shot up 600% over 20 years with 2 out of 3 Americans filling a prescription at

U.S. vs. foreign drug prices.

least once every year. In addition, our drug prices are higher than other countries by any where from 33% to 50% more.

How much of the increased drug use is from pharmaceutical marketing, patient demand, and doctors prescribing to make the patient happy? Even though insurance companies negotiate drug prices with pharmacies, they still don’t control peppy pill prescribing physicians. For the insurance companies to insist on alternatives to prescriptions such as diet and exercise to combat certain illnesses creates the specter that insurance companies are trying to dictate health care.

Over simplification of data

Unfortunately, a simplified presentation of prescription drug statistics can be misleading. The United States has a fractured market for prescription drugs. There are those folks with no insurance who pay over the counter retail pricing, individuals with high deductible prescription plans, group plans with excellent pharmacy benefits and Medicare Part D prescription drug plans which subsidize drug costs. These different market segments, with various insurance benefits, influence consumer behavior and ultimately reported drug costs and utilization.

Evil government regulations

Within the “Other” category as to why health care costs are rising, Anthem pegs burdensome compliance with regulation. On this item Anthem is less than forthcoming and a little disingenuous. Anthem estimates the health insurance companies spend $170 billion dollars on filing reports. The big head ache is that each state regulates its own insurance industry. Therefore, each insurance company must comply with virtually duplicate filings for each state where they sell insurance.

50 different states, markets, regulations

The upside for insurance companies is that they get to lobby each state for favorable business legislation like being able to deny people insurance because they look funny or special tax breaks. But Anthem doesn’t mention how the dysfunctional insurance system in the U.S. also helps increase their profits. A cost creating regulation in one state can be offset with favorable laws that allow the insurance company to cover fewer benefits in their plans.

Anthem cost control initiatives

Health insurance companies have much of the data on health care costs. They are in the best position to make suggestions and start initiatives to reduce redundancies and increase efficiency. For their part Anthem is involved in programs to reduce costs associated with newborn deliveries and software to help physicians determine best treatment options. They have also been offering 24 hour nurse lines, applications for members to monitor medical treatment and education for future mothers.

Patients have a voice

Some of the cost containment programs like the Anthem MyHealth Advantage, which alerts members when their medical treatment doesn’t meet proven best practices, are aimed squarely at getting patients to get more involved in their own medical treatment. Health insurance companies need their members to ask questions about treatment options and cost. Anthem’s hope is that an informed patient will help buck the trend of rising health care costs by choosing higher value, less expensive care options.

Which root will we trim?

Even if Anthem is a little too diplomatic concerning the provider’s role in rising health care costs and their own self-serving slant, it is still a good document for general background information. The larger point of Anthem’s discussion is that rising health care costs have several roots. There is no one culprit that is driving costs. It will take a collective effort of providers, insurers and members to slow the escalating costs of health care.