Some doctors are confused about the Covered California individual and family plans and how they are not different from the same plan sold off-exchange.

On a weekly basis I get calls from people telling me they can’t find doctors who will accept Covered California health plans. The prospective patient is told that the doctor will only accept off-exchange health plans and not Covered California health plans. This is after the health insurance company shows the physician as in-network. Are doctors really discriminating against Covered California consumers or do we just have a failure to communicate?

Discriminating doctor networks

Each health insurance company that offers either an EPO (Exclusive Provider Organization) or PPO (Preferred Provider Organization) for sale in the individual and family plan (IFP) market has a specific network of providers associated with it. IFP networks are different, and usually smaller, than networks for small group plans, large group plans, Medicare and some Medi-Cal plans. All the insurance companies I have talked with state that their IFP network is the same whether the plan is sold through Covered California or off-exchange directly from the carrier. (At one time Health Net had a different on and off exchange networks, but that won’t be the case in 2016).

We accept all PPO plans

If you think the above general description is confusing, it gets worse when you pile nationwide insurance plans and regional HMO health plans on top of what the doctor might accept. In short, it is hard for the physician’s front office staff to keep track of all the different health insurance plans they accept as being in-network. Even large physician groups can get confused and their websites are not frequently updated. The standard response to any prospective patient inquiring about insurance plans acceptance is, “We accept all PPO plans.” That’s a polite way of saying, “We are probably out-of-network and you will have to pay the full cost of services under your PPO plan.”

Legitimate discrimination based on participating networks

However, the small independent medical practices, where most of the network confusion seems to be happening, have started using a different reply to a patient’s question about health insurance. In response to the question of which individual and family plans does the doctor accept, many people are being told, “We don’t accept Covered California plans, only off-exchange plans. This statement may be true and not discriminatory under certain conditions.

Different Covered California networks

Covered California offers health plans for both individual and families and small employer groups through the Small Business program. The medical group or doctor’s offices may be certain they are not in-network with any Covered California IFP or small group plans. They may know they are in-network with IFP plans only sold off-network, like Cigna, and a variety of small group plans that are not offered through Covered California. The office staff may absolutely being telling the truth about the doctor’s network status with respect to Covered California.

Online provider search functions can be confusing

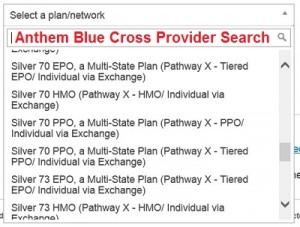

But what if the consumer does a provider search with a health plan and it shows the doctor as in-network? Unfortunately, it is all too easy to select the wrong network to search for when using the online provider directories from the carriers. Unless you work with the provider directories all the time, it is easy to get confused. In December 2015, the Anthem Blue Cross offered an EPO, HMO, PPO, and Tiered PPO networks to choose from. The EPO plans were being discontinued at the end of 2015. But if a consumer was in an EPO plan in 2015, they might erroneously select the EPO network when searching to see doctors for 2016. A consumer might select the PPO option without knowing that they lived in a Tiered PPO network county of Los Angeles, Orange, San Diego or San Francisco.

Should we expect consumers to understand all the different networks?

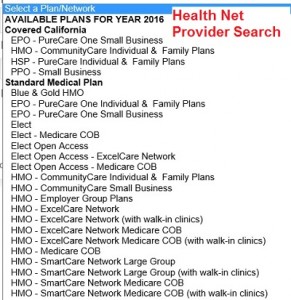

Both Blue Shield and Health Net note someplace in the network search description that some plans are affiliated with Covered California. Unfortunately, the small group network can be selected in error for Health Net and the Blue Shield drop down menu is cluttered with plans back to 2014. There can be additional issues with all the searches when it comes to the search radius around the entered zip code, medical specialties, physician groups, and for two different doctors with the exact same first and last name. To boil it down, it is easy for consumers to make one small error with the provider search conditions that yields results showing doctors that really aren’t in-network for their individual and family plan. One example is that the Health Net EPO plans will only consider a doctor listed as in-network if the office is within 30 miles of the plan member’s residence.

Who is updating the in-network provider database?

Another issue for consumers is that doctors can leave a practice and suddenly become out of network at a new group. I found a doctor in-network for Blue Shield in Marin County. More specifically, the medical group she was affiliated with was in-network with Blue Shield. However, she had left the group to join another medical practice across town and that medical practice was not in-network. The in-network medical group failed to notify Blue Shield that the doctor would no long be with the practice in 2016. Technically the doctor was still in-network through 2015, but she had stopped accepting appointments in November as she transitioned to the new medical group.

Doctors deny service to Covered California members

I’ve documented all these little confusing situations by doing the provider searches and calling the physician’s office after clients have told me their doctors aren’t accepting Covered California plans. While a large percentage of the network confusion comes from provider search errors and the complexity of the various networks, I have encountered some doctors who truly are denying health care services to people with Covered California plans. The health insurance companies I’ve spoken with declare that they don’t allow their contracted physicians to discriminate based on enrollment path.

Insurance companies don’t want discrimination

The health insurance companies don’t want their contracted providers to discriminate. They have built and had the health plans approved around a certain number of providers in the network as required by law. To have doctors or other providers deny service to a class of individuals, those who enrolled through Covered California, threatens the integrity of their network and could possible open them up to fines from regulatory agencies.

What are the incentives for doctors to discriminate?

But what is the incentive for a physician to deny services to a Covered California member? First, they may be under the impression that Covered California plans reimburse for services to the provider at a lower rate than the same plan purchased off-exchange. All the carriers have told me this isn’t the case. Reimbursements rates can be higher for the small group and other large employer group plans. And we have seen Blue Shield exclude Stanford Health Care from their individual and family plans for 2016 possibly because Blue Shield didn’t want to reimburse Stanford at the higher negotiated rates.

As part of our continuing efforts to help make access to health care more affordable for our members, Blue Shield of California is removing Stanford Health Care from our Individual and Family Plan (IFP) Exclusive PPO Network, effective January 1, 2016. Stanford Health Care remains a provider for all of our other plans outside of the IFP Exclusive PPO Network. – Blue Shield statement regarding Stanford

Anthem Blue Cross has created a Tiered PPO network where IFP members will pay higher coinsurance rates at certain hospitals. This is an effort to steer members toward hospitals where Anthem Blue Cross may have negotiated lower reimbursement rates for services.

Are Covered California members a greater risk of non-payment?

A second reason why physicians may not want to accept Covered California members is a perceived risk of non-payment for services. Most individuals and families who enroll through Covered California are receiving premium assistance to lower their monthly health insurance bill. While the health insurance premium may be affordable, an individual that has Bronze $6,500 deductible may not be able to pay for some treatment provided by the physician. Small medical groups may not want to pursue the collection of payment of services from a person who has a high deductible plan.

Some doctors don’t like the ACA

The logic of only accepting off-exchange plans is that if the individual or family can pay the full premium amount when the plan is purchased directly from the insurance company, the household will be able to pay for services rendered before they met their deductible or out of pocket maximum of the health plan. Finally, some physicians may have a philosophical aversion to participating in health plans that are sponsored by the Affordable Care Act.

Lack of information at the doctor office level

I’ve talked to several medical group offices regarding consumer complaints of the office not accepting Covered California plans. Some of the staff members are very familiar with the issues and go to great lengths to explain their legitimate reasons for not accepting Covered California plans such as they only accept the small group plans from a particular carrier. Other offices are ignorant about Covered California and IFP and are providing bad information to consumers based on their flawed knowledge or misconceptions.

Just update your darn website

What is amazing in this information age and ubiquitous websites for medical groups is the lack of information about what plans the medical office accepts. Doctors and medical groups should be mandated that they provide current and accurate information regarding what health plans they actually accept. The throw-a-way text on a web page that states, “We accept most major health insurance plans” is tantamount to admitting that the medical office is too lazy to notify their patients which plan the doctors are in-network with.

Doctors should be mandated to accurately inform patients of health plan network status

The medical groups know exactly which health plans they accept and they can inform their patients and prospective patients about their network status far quicker than any provider search from an insurance company. Doctors are obviously a cornerstone of our fractured health care system in California. They have a responsibility to properly inform everyone who calls or walks through their door what specific health plans they accept.

Doctor discrimination is foul

And to those doctors who are blatantly discriminating against Covered California members they should be ashamed of themselves. Covered California members are not second class citizens. If the doctor wishes not to accept patients who enroll in an individual and family plan through Covered California they should not be contracted with the carriers that offer both on and off exchange plans. Doctors’ discriminating on the basis of Covered California enrollment is no different than a doctor saying he or she will only serve white people. Those days are long gone and the physician community needs to come into the 21st century.

Who wants to be a secret shopper?

Perhaps it is time we had secret shoppers to test medical groups to see if they are legitimately denying services to Covered California members or if they are illegally discriminating against them.