Some Covered California consumers are being duped into buying life, accident, hospital, cancer, stroke, heart attack, and discount dental plans when all they wanted was health insurance.

Consumers should be cautious when a health insurance agent wants to bundle a bunch of other products such as life and accident insurance with the Covered California health plan. These agents and marketing organizations are more interested in selling higher commission products such as life, accident, cancer, stroke, heart attack, and dental plans than they are health insurance. They may try to convince a consumer to drop the health plan to a Bronze level so they can sell questionable indemnity plan products as extra protection for the higher deductible.

Bundling Unwanted Insurance Products

Some health insurance agencies conduct business like a used car lot. They target a consumer’s monthly payment comfort level and then add-on various insurance options being mindful not to exceed targeted monthly amount. For example, if the consumer says they can only afford $300 a month, and the health insurance through Covered California with the monthly subsidy will be $200, the salesman adds on other frivolous insurance products to hit the $300 mark. If the $250,000 term life insurance policy would push the price to $350 per month, they will dial back the benefit amount to $100,000 to keep the overall package at or under $300.

Downgrading To Bronze Level Plan

A lucrative insurance product for the agent is accident indemnity insurance. Indemnity plans pay the insured a flat dollar amount for different accidental injuries or hospitalization. The pitch is that the accident or hospitalization plan will pay $5,000 in case of emergency which will cover most of the deductible of a Bronze plan. While there is some logic to bundling of an accident indemnity plan with a high deductible health plan there are draw backs. For instance, the $50 per month accident insurance doesn’t pay a dime if someone is hospitalized for an illness such as appendicitis or cancer. Have no fear; those salesmen can sell you cancer, stroke or heart attack plan to cover those rare illnesses also.

How Much Can You Afford To Pay?

What the sales people will always stress when the consumer asks about the cost is the monthly amount is the target amount. “You told me you only wanted to pay $300 per month. I’ve bundle a full protection health insurance program that didn’t go over your budget.” The sales people will not reveal the individual break down of the costs of each insurance product unless pushed to. They don’t want consumers to realize that the health insurance is actually less than half the cost of the overall monthly bill.

A favorite strategy of these bundled insurance scams is dropping down the health insurance from a Silver to a Bronze plan. A Silver plan with the Covered California tax credit might be $250 a month for some people while the Bronze may only be $1. The bundled used-car-lot insurance sales man convinces the consumer to move to a Bronze plan and then he loads up the package with life, accident, hospital indemnity, and a discount dental plan that equals $200 per month. The consumer gets screwed and the sales person makes a hefty commission.

Agents Push High Commission Insurance Products

Health insurance commissions are at the single-wide-mobile-home-dirt-floor level. They are low. Whereas selling a health plan might garner an agent $12 per month, selling $200 of accident insurance and discount dental plans could pay $40 per month plus bonuses. Follow the money. What’s good for the agent is always best for the consumer.

How can a consumer protect themselves from these bundled health insurance scams?

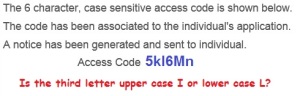

Access Code to link an existing Covered California enrollment to a new consumer account.

- If you are having someone enroll you or your family into a Covered California health plan, insist on getting the access code from the agent. After the application is submitted, an access code pops-up. This can be used by the consumer to create their own Covered California account and look at the data that’s been entered and monthly tax credit.

- Never buy life, accident, hospital, indemnity, cancer, stroke, heart attack insurance at the same time as health insurance. Tell the agent you only want to focus on health insurance and next month you will consider those other products.

- Don’t buy discount dental plans or association discount memberships. These discount groups are not real insurance. Discount dental cards and association membership discount groups are scams that provide no value to the consumer.

- If you are enrolling through Covered California only consider the dental plans offered through Covered California. Don’t let the agent talk you into a discount dental plan, which is not real insurance. The Covered California dental plans are pretty good. There are a variety of HMO and PPO plans with solid benefits equal to anything off-exchange at equivalent monthly rates.

If you feel you have been a victim of a scam or fraudulent activity contact Covered California and the Department of Insurance and report the license number of the agent and agency. I have long advocated that there should be a prohibition on agents about discussing any other insurance products other than health and dental plans when working with Covered California consumers. This would be similar to the rules regarding agents representing Medicare Advantage plans to Medicare beneficiaries. Such rules would eliminate consumers from being railroaded into buying insurance products that they have no interest in purchasing.