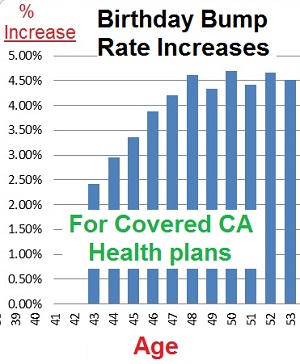

Reporting a change after a birthday to Covered California can trigger a health plan rate increase of 4.5%.

Many Californians have realized that when they report a change to their Covered California accounts during the year they are hit with higher health insurance premiums. This occurs when the change reported is after a consumer’s birthday. Any change within the Covered California CalHEERS online enrollment program automatically triggers the application for health insurance to be resubmitted for an eligibility determination. The new eligibility is calculated as of the individual’s age at the time of the reported change.

12 month rate guarantee

Individual and family health insurance rates purchased off the Marketplace exchange (outside of Covered California) are guaranteed to be the same for each of the twelve months of the year if the consumer enrolls with a January 1st effective date. Even though everyone will have a birthday during the year, the premium rate is based on your age at the inception of the policy. During the renewal period for the next year the rate will be adjusted for the new age. Unless you move to another rating region, there are 19 different regions in California, the rates won’t change.

Birthdays will trigger rate increases during the year

The guaranteed rate scenario does not hold true with Covered California. Anytime a consumer must make a change to their Covered California account, the entire application is re-submitted to determine eligibility for the Premium Tax Credits. The change can be as inconsequential as updating an email address or as important as the mandated reporting of a change to income. Regardless of the reported change, the eligibility is re-determined with your current date of birth.

Reporting a change to Covered California can cause rate increase

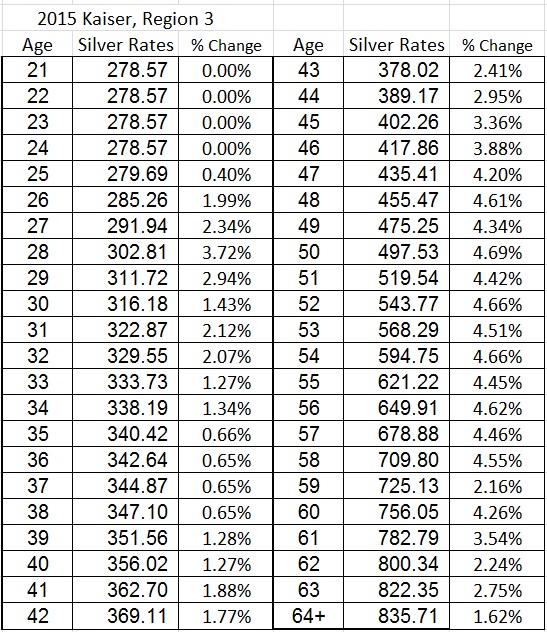

If the reported change occurs after you have had a birthday from your original enrollment, your new health insurance premiums may increase based on your older age. For example, a consumer enrolls in a Covered California Kaiser Silver plan in Region 3 at age 50. The premium rate would be $497.53 per month. The consumer has a birthday in April and is now 51. In June the consumer reports a change of income because of a new job. The consumer’s new health insurance premium, before any tax credits are applied to reduce it, is now $519.51 per month. This is a monthly increase of 4.42%

Health plans vary rate increases by age

Under the Affordable Care Act health insurance premiums for a 65 year old can only be three times greater than that of a 21 year old. In other words, health insurance companies are limited to a 300% increase in rates between 21 and 65 years old. What surprises many people are that the incremental age increases are not uniform. Sometimes there is no increase in premium from one age to the next. At other points in the age range, consumers may experience a 4.5% increase in rates just for having a birthday and reporting a change to their Covered California accounts.

Rate increases by age are not uniform

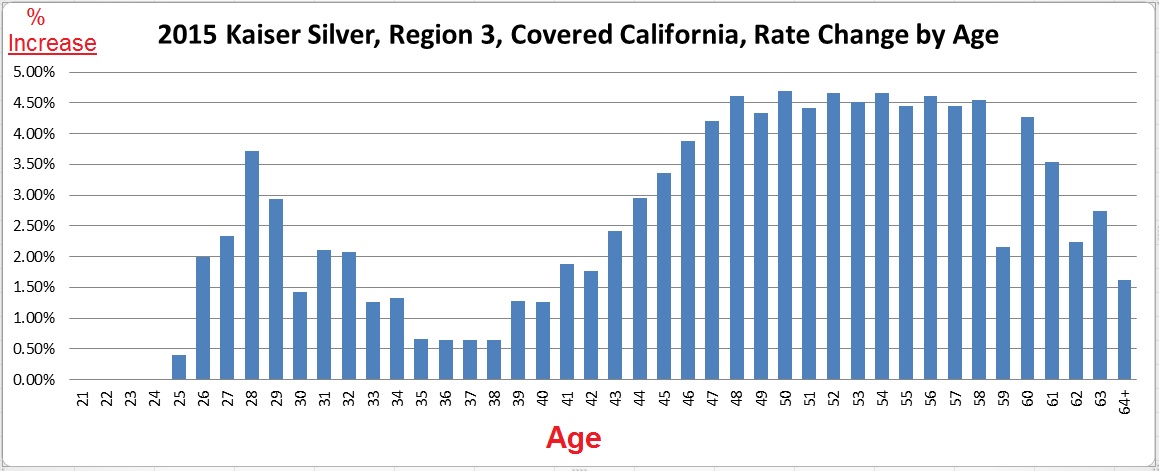

In the example below is a graph of the percentage rate increases by age for a 2015 Kaiser Silver plan in Regions 1, 3, and 5 sold through Covered California. The premium for a 65 year old is 300% that of the 21 year old. The health insurance premium doesn’t change for ages 21 through 24. Then there is a big spike in rate increases up to the age of 28 and then it tapers off and remains under 1% for ages 35 through 38. From ages 46 to 58 you are guaranteed an age related premium increase of at least 3.5%.

The rates by age used for developing the graph are shown at the end of the post.

Report a change, expect a rate increase

The Covered California process of re-determining eligibility based in a small change to the application certainly favors the health plans and insurance companies. They are able to get a premium increase based on age that they can’t realize with their off-exchange plans. The lesson is that unless if you have to report a change such as income or new address, don’t make small changes to your Covered California account because you might get hit with a premium increase just for being honest.

2015 Kaiser Covered California Silver plan, Region 3, rates by age showing the percentage increase from one age to the next.