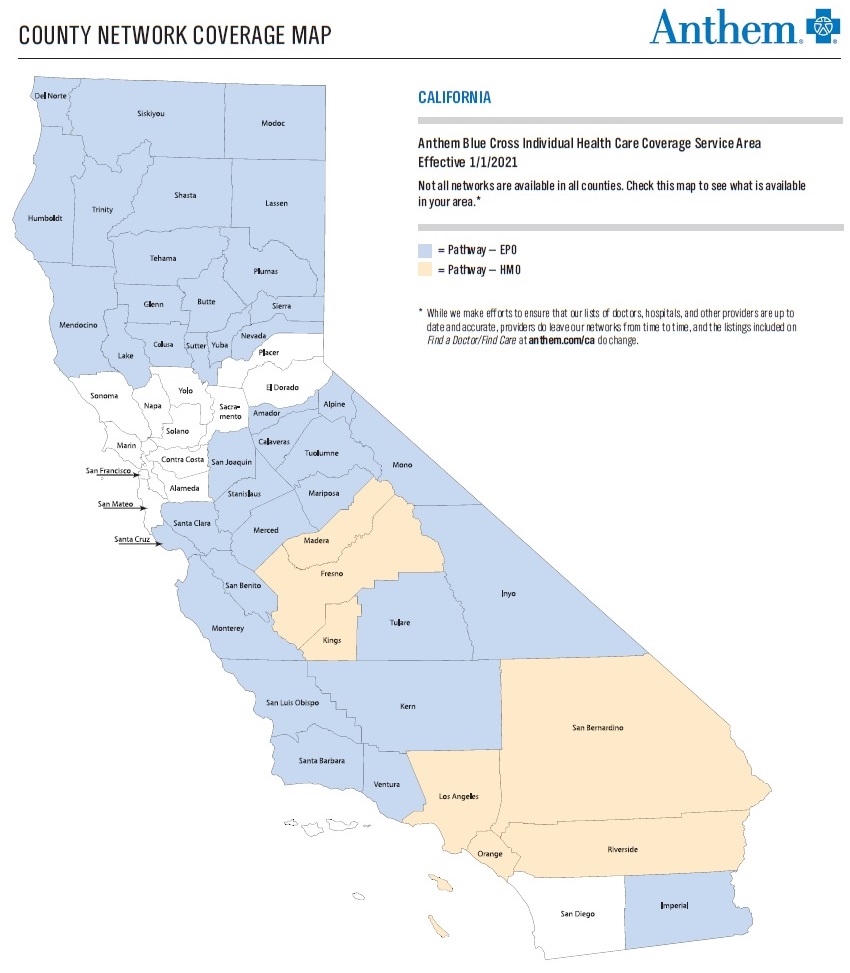

Anthem Blue Cross will continue to offer their EPO individual and family plans in many counties of Northern and Central California plus Imperial county. The Blue Cross HMO plans will be clustered in the San Joaquin Valley and Southern California, excluding San Diego county. No Blue Cross health plans will be offered in Bay Area, North Bay or along the I-80 and I-50 corridors.

Blue Cross EPO and HMO California Plans

In Region 1, Northern California counties, the two carriers will be the Anthem Blue Cross EPO and the Blue Shield PPO. A few counties in Region 1 will have access to the Blue Shield HMO plans. A quick review of the rates between the two carrier shows the Blue Shield PPO plans to be more expensive than the Blue Cross EPO plan in all metal tiers except Bronze plans, where the rates seem very close. The EPO (Exclusive Provider Organization) plan benefits have no out-of-network coverage, just like an HMO plan.

Madera, Fresno, and Kings counties will be offered the Blue Cross HMO plans. All the counties surrounding the aforementioned will be offered EPO plans. The odd outlier is Imperial County that will be offered EPO plans, but most of Southern California, (Los Angeles, Orange, San Bernardino, and Riverside) will only get the Blue Cross HMO plans. San Diego County is cut out of any plan offerings.

Blue Cross will offer the standard benefit design metal tier plans through Covered California and off-exchange, direct from the carrier. They will also offer a few non-standard benefit design plans available off-exchange. Blue Cross will offer a Silver HMO plan off-exchange with no medical deductible and 0 percent coinsurance for medical services. The copayments are a little higher than the standard Silver 70 ($50 office visit, $85 specialist visit, emergency room visit $750) and the maximum out-of-pocket is $8,550 versus the $8,200 for a standard Silver 70.

The significant difference between this Blue Cross $0 medical deductible plan is that the inpatient hospital copayment is $1,500 per day, up to 5 days per admission, and outpatient surgery is a $750 copayment. It also carriers a slightly higher pharmacy deductible at $400. The rates for the Anthem Silver Pathway HMO with no medical deductible are about 6 percent less expensive than the standard Silver 70 HMO plan in Region 16 of Los Angeles County.

The off-exchange EPO plans also include some non-standard Bronze plans with higher deductibles. These plans are generally less expensive than the standard Bronze 60 plan design. But you must look carefully at the summary of benefits to see if the trades-offs in benefits are worth the decrease in rates. For example, with the Bronze 7100 EPO, you must meet the deductible of $7,100 before you go into 20 or 50 percent coinsurance. The standard Bronze 60 plan gives you three office visits at a set copayment and a slightly lower maximum out-of-pocket amount at $8,200.

Regardless of the plan type (EPO, HMO, PPO) the big component of making a health plan decision is if your doctors and preferred hospitals are in-network with the plan. Always check the carrier website to determine network status of the provider.

2021 Blue Cross IFP

- Summary of Benefits

- Continuity of Care Blue Cross TA Request Form

- HSA Blue Cross Reference 2021

- Map Blue Cross California Coverage IFP 2021

- Pediatric Dental Vision Embedded Benefits Blue Cross 2021

- Plan Summary Blue Cross California 2021

- Plans Blue Cross Covered CA 2021

- Plans Direct Blue Cross Medical IFP 2021

- Rates Blue Cross California IFP 2021