Blue Shield of California members are receiving letters indicating that they have lost their Covered California subsidies.

Blue Shield has been sending confusing letters to their members that seem to indicate that the individual or family has lost their Covered California subsidy and they will now have to pay the full premium amount. These premium rate scare letters are automatically generated and do not necessarily reflect the full premium amount will be the consumer’s responsibility. Unfortunately, these confusing letters are throwing consumer’s into a panic generating phone calls to Covered California, Blue Shield, and insurance agents.

Premium rate letters scare consumers

Several of my clients have called me after they received a letter from Blue Shield that seems to indicate they are losing their subsidy and will now have to pay the full premium amount of their health insurance. A quick check of the client’s Covered California and Blue Shield accounts shows nothing amis. Sometimes these letters were generated after we had reported a change of income. But the Covered California account and the Blue Shield member portal shows the appropriate subsidy being applied to reduce the monthly health insurance premium.

Blue Shield notification of change

The Blue Shield premium rate scare letters that began to be sent out sometime in March of 2016 needs to be read very carefully. The letter is more of a notification that something has changed on the account. It lists the full premium amount and notes that any change to the Advance Premium Tax Credit or subsidy will be reflected on the member’s next health insurance invoice.

Dear member,

We’re writing to confirm that we made a the change(s) you requested to your health plan contract. The monthly rate payment for your contract has been changed to [the full dollar amount] as a result of the change(s):

- SUBSIDY AMOUNT CHANGE

As a result of your requested change(s), we have also been notified by Covered California that your Advance Premium Tax Credit (APTC) has changed. Your next bill will reflect both your new APTC and your new monthly premium. If you have any questions about the reason for the APTC change, you need to contact Covered California at (800) 300-1506 because only Covered California can determine your APTC eligibility and amount. To ensure you receive an accurate APTC amount, remember to report income changes to Covered California, who will inform you if you need supporting documentation.

Sincerely,

Blue Shield of California Installation and Billing

Where’s the subsidy amount listed?

It’s wonderful that Blue Shield is being proactive in notifying their members that they have received an update to the member’s account. However, the update or change may have been as small changing the phone number which would not trigger an adjustment to the subsidy and final premium amount. The missing data field that would clear up all sorts of confusion is the actual APTC that Blue Shield will be applying to the full monthly premium amount.

Letter seems to indicate a loss of all Covered California subsidy

Because they left the crucial APTC amount off of the letter, and consumers are only reading the full premium amount in the letter, the logical conclusion on the part of the Blue Shield member is that they have lost their subsidy and now must pay the full amount. Every time I have called Blue Shield they have told me that the Covered California APTC subsidy is still in place. Essentially, the notification of change(s) is just a horribly drafted letter that results in a heightened level of anxiety and anger on the part of the consumer.

Sometimes the monthly rate is dropping

In one instance, a client’s monthly subsidy was increasing, decreasing her monthly premium bill. For some reason, Covered California told Blue Shield they were increasing the APTC by $2. But the language of the letter sounded as if the family was losing their subsidy altogether.

Some consumer are actually losing their APTC subsidy

There may be consumers who are actually losing their APTC subsidy. This can happen because the household failed to supply the necessary proof of income or other documentation that Covered California requested but not received. But the notification letter should inform the consumer what is actually happening to their APTC, not just a letter saying that a change has been made to their account and you will see the results on your next bill.

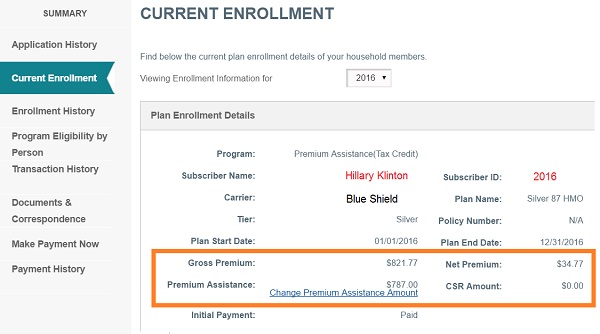

Have your Certified Insurance Agent check your Covered California account

If you receive one of these premium rate scarce letters from Blue Shield, always check your Covered California account first. On the Summary Page, go to the Current Enrollment page and review the Gross Premium, Premium Assistance and Net Premium amount. This should match with the Blue Shield online account. If both the Covered California and Blue Shield premium amounts are the same, and Covered California still shows all the household members enrolled and active, there should be no problems. Any reported changes to the Covered California such as income change, new address, or a change of household members will affect the monthly premium and APTC subsidy. If you have any questions, call your health insurance agent who can start checking your accounts and making calls to confirm the current full premium amount and the APTC subsidy.