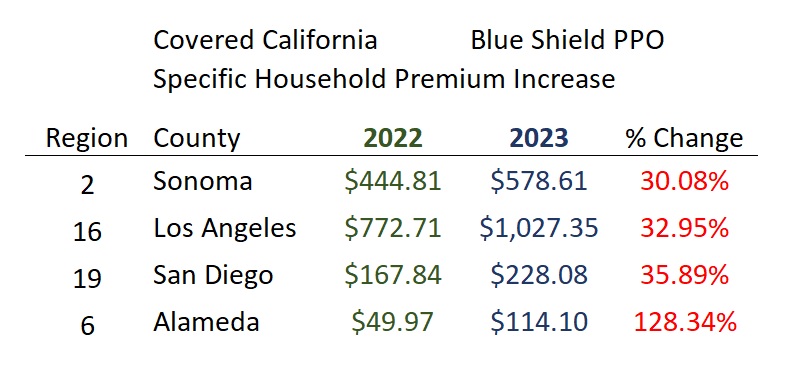

Many families are reporting premium increases of over 30 percent for the Blue Shield PPO plans through Covered California. While Blue Shield did have rate increases averaging approximately 11 percent for 2023, the real reason for the large Covered California premiums is rooted in the Affordable Care Act formula that determines the household subsidies.

Did Your Blue Shield PPO Covered California Premiums Explode For 2023?

The 3 main factors influencing the premiums through Covered California are the age of the applicant, any universal rate increase, and the ACA subsidy calculation.

Age Relate Rate Increases

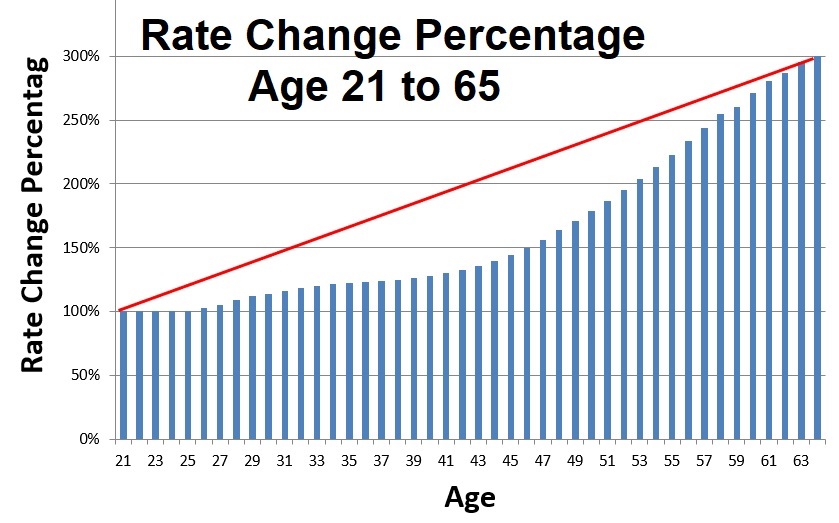

First, under the ACA, the health insurance premium of any health plan is governed by a simple rule. The rate for a 64-year-old can be no more than 3 times that of a 21-year-old. This means, in most instances, the health plan rate will increase with each year of age.

The health plans and insurance companies use a universal age adjusted percentage rate increase. For adults ages 48 through 58, the annual increase is approximately 4.5 percent. This means that just by getting a year older your health insurance premium will increase.

Inflation and Utilization Rate Increases

The health plans also apply a universal increase across all of the plans and ages in each of the 19 different rating regions in California. The regional rate increase reflects inflation and utilization of health care services within the region. For Blue Shield PPO plans, they include many popular doctors and hospitals such as UCLA, UCSF, UC Davis, and Sutter networks. These providers, not found in most other health plans, also command higher reimbursements for their services.

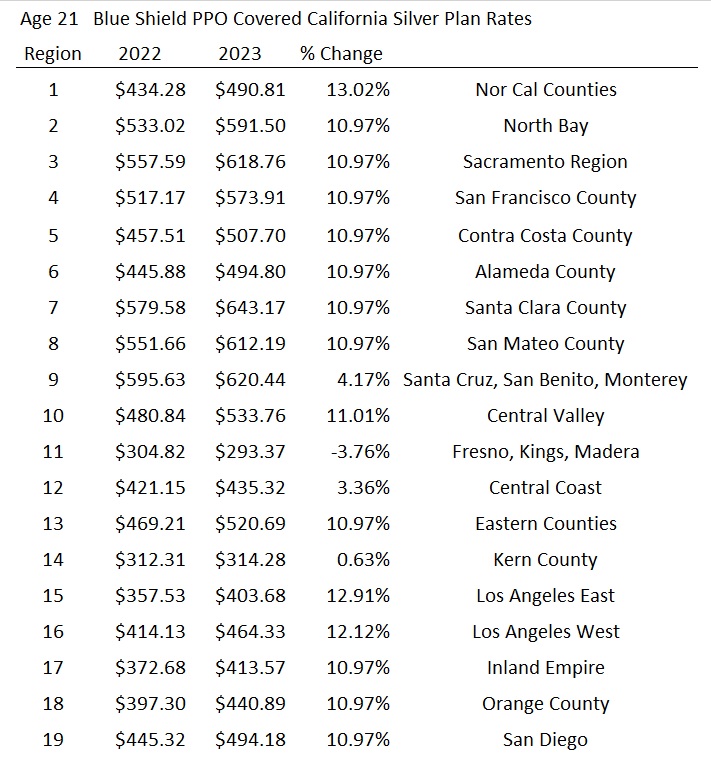

Blue Shield PPO Rates 2022 vs. 2023

To understand the magnitude of Blue Shield’s PPO rate increase, I compared the rate for an on-exchange Silver 70 plan, through Covered California, for a 21-year-old. The rates below do not reflect any subsidy an individual may be eligible for and we know the increase also applies up to age 64. Region 1 had the largest rate increase of 13 percent from 2022 to 2023. Los Angeles County regions 15 and 16 rate had increases over 12 percent. There were a couple regions with single digit increases and Region 11 had a rate decrease. Overall, the Blue Shield PPO plans increased approximately 11 percent across California.

Second Lowest Cost Silver Plan Rate Changes

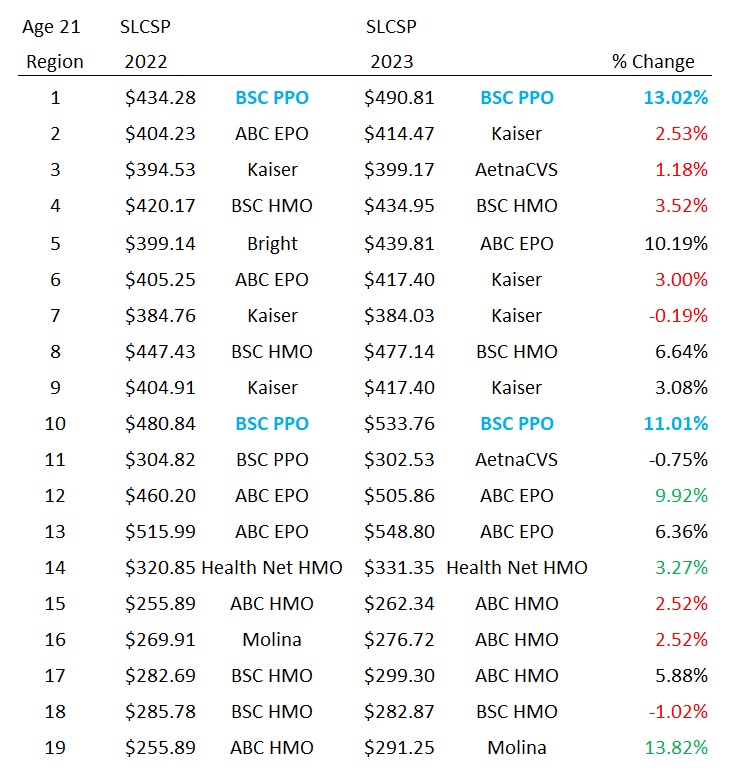

Next, I compared the rate change for the Second Lowest Cost Silver Plan (SLCSP) in the regions offered through Covered California. The ACA subsidies are designed to make the SLCSP affordable relative to a consumer responsibility percentage for the household income. Regardless of the metal tier (Bronze, Silver, Gold, or Platinum) or the carrier, the subsidy a family receives is all tied to the SLCSP.

The Blue Shield PPO Silver 70 is the SLCSP in regions 1 and 10 for both 2022 and 2023. The percentage change to the SLCSP mirrors the rate increase for the Blue Shield PPO full rates. Covered California consumers in regions 1 and 10 – with the same household income and size from 2022 to 2023 – will experience a modest rate increase mainly attributable to age.

Note, an increase in the federal poverty level income can push households into a smaller consumer responsibility percentage, which in turn, increases the subsidy. Overall, the FPL increase has a very modest impact on increasing the subsidy when the household income remains unchanged between plan years.

Dramatic Impact of SLCSP on Blue Shield PPO Premiums

Where households realize a dramatic increase in Blue Shield PPO Covered California premiums is when the SLCSP has a small increase or negative rate change. Consumers in regions 2, 3, 4, 6, 7, 15, 16 and 18, where the SLCSP rate increases were in the low single digits will see a smaller subsidy. In other words, the Blue Shield PPO plan rate increases in those areas was greater than the SLCSP that the subsidy is based upon. The subsidy did not keep pace with the Blue Shield PPO rate increase like they did in regions 1 and 10.

There are a couple of regions were the SLCSP increase was greater than the rate increase of the Blue Shield PPO plans. This translates into potentially larger subsidy off-setting any universal or age-related rate increase. Finally, adjusting the household income can strongly influence the subsidy.

Even though region 19, San Diego, had a SLCSP plan increase larger than the Blue Shield PPO, I still had a client experience a 35 percent premium increase for 2023. This family increased their income slightly for 2023. The higher income translated into a lower subsidy and a higher premium. The larger subsidy from the SLCSP rate increase could not over come the lower subsidy being applied to their Blue Shield PPO plan.

In summary, if your Covered California premium jumped 20, 30, 40 percent or more, it is not the fault of the insurance company. All things being equal from 2022 to 2023 (household size, income, region, etc.), the Covered California premium increases are most likely from the SLCSP not increasing in price as much as your preferred health plan.