Blue Shield of California will be implementing several changes to the delivery of their pharmacy prescription benefits in an effort to disrupt the existing drug cost structure. The ultimate goal for Blue Shield is to lower the cost of prescription drugs for them and their members. In 2025, plan members may see various changes to their pharmacy prescription drug coverage.

Retail Pharmacy Network

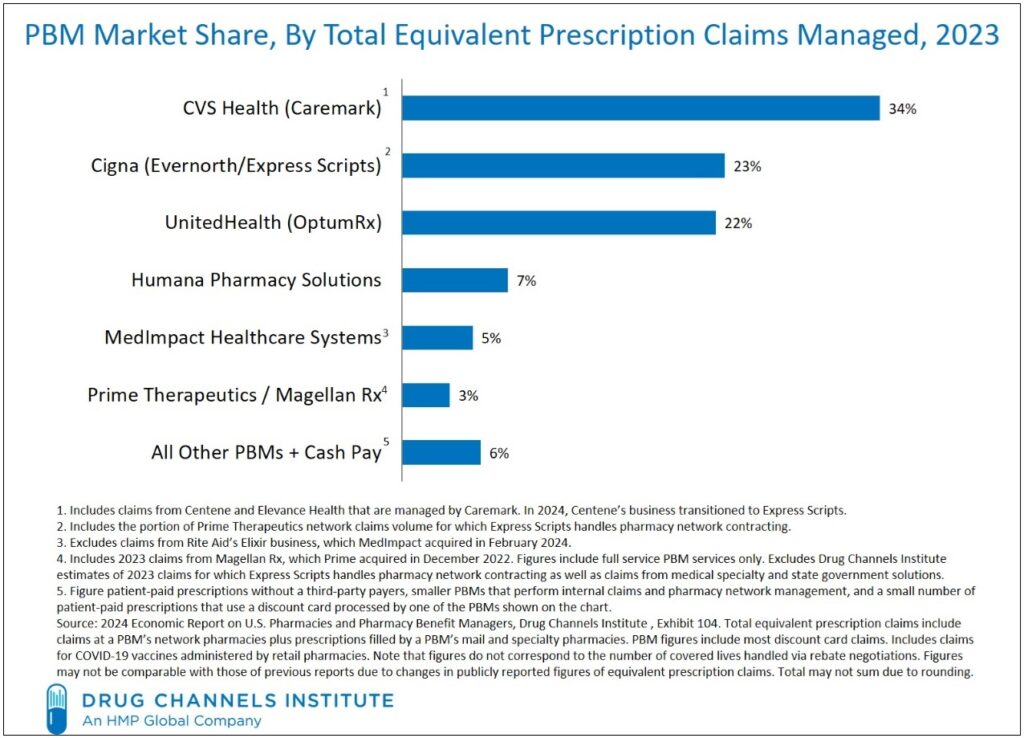

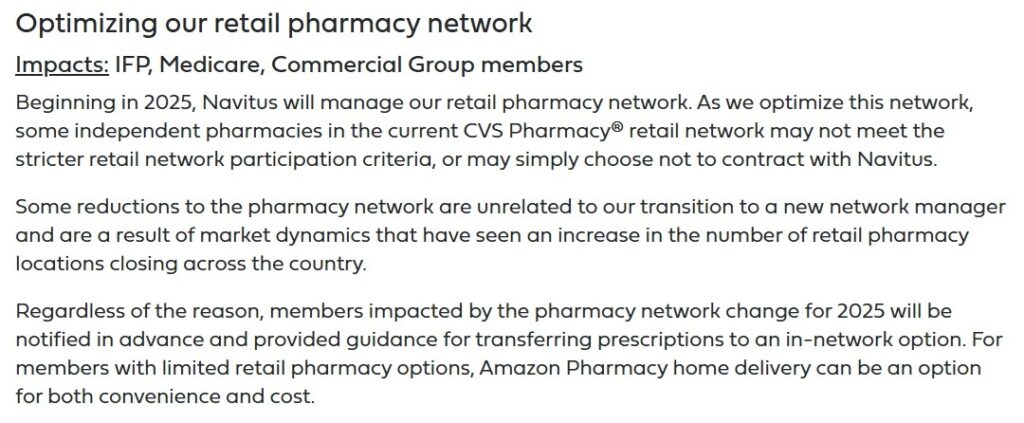

Blue Shield of California will transition to Navitus pharmacy network manager in 2025. Plan members will not experience anything different when they go to their preferred pharmacy. However, health plans have become increasingly frustrated over the operations of the large Pharmacy Benefit Manager companies. The three largest three Pharmacy Benefit Managers are all owned by large health insurance companies.

Blue Shield of California, as well as other health plans, would like to break away from the large Pharmacy Benefit Managers and some of their distorted incentive and pricing structures. Unfortunately, the Pharmacy Benefit Managers perform many tasks involving price negation, handling the payments process from pharmacy to health plan, and managing the pharmacy network.

What are PBMs? https://news.blueshieldca.com/2024/11/19/what-are-pharmacy-benefit-managers-and-how-do-they-affect-your-health-care

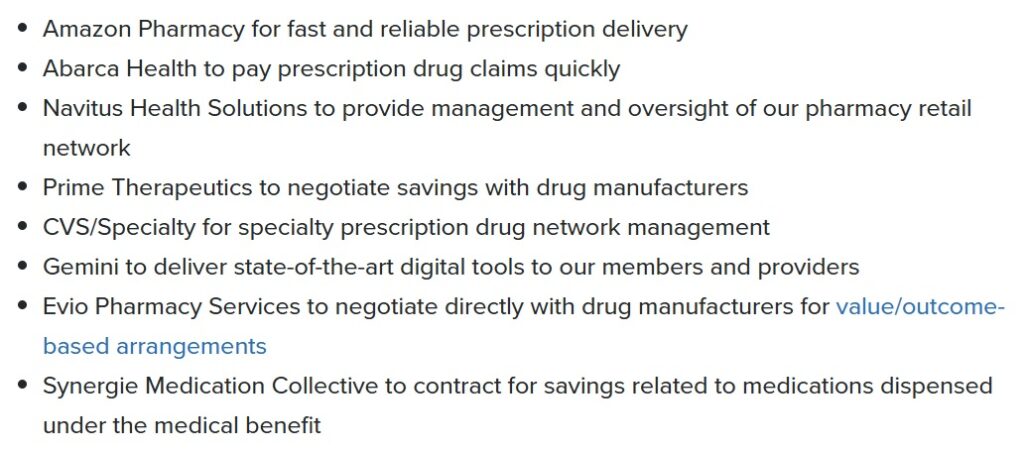

To back fill some of the tasks performed by a large Pharmacy Benefit Manager, Blue Shield has contracted with several companies cover some of those operations.

Blue Shield will be contracting with several different companies to fulfill their pharmacy benefits for their health plans. Some of the changes replace some of the services of a pharmacy benefit manager such as drug price negotiation and digital payments for drug claims.

Blue Shield reimagining pharmacy https://news.blueshieldca.com/2024/08/29/how-were-reimagining-pharmacy-care-at-blue-shield-of-california

Not entirely a result of the pharmacy network management changes, some local pharmacies may no longer be in-network for Blue Shield members. Because some plan members may be left without a convenient pharmacy location, Amazon Pharmacy will be available.

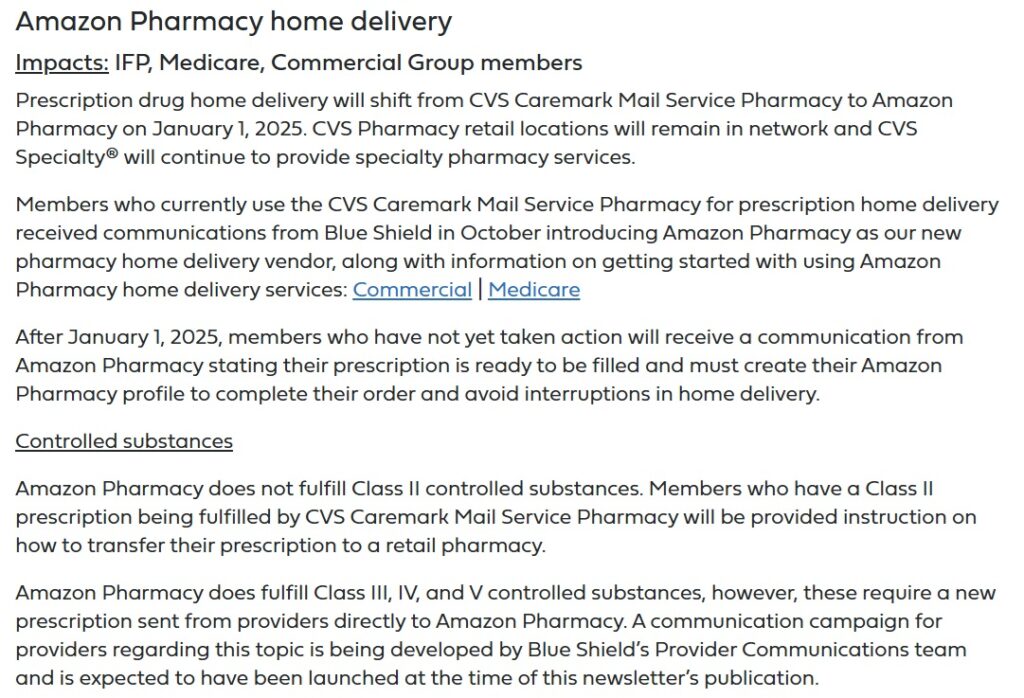

Amazon Pharmacy

Blue Shield is shifting their home delivery of prescription medications from CVS Caremark Mail Service to Amazon Pharmacy. This will cause some members to create an Amazon Pharmacy profile. Because Amazon Pharmacy does not fulfill Class II controlled drugs, those prescriptions will still go through CVS Caremark.

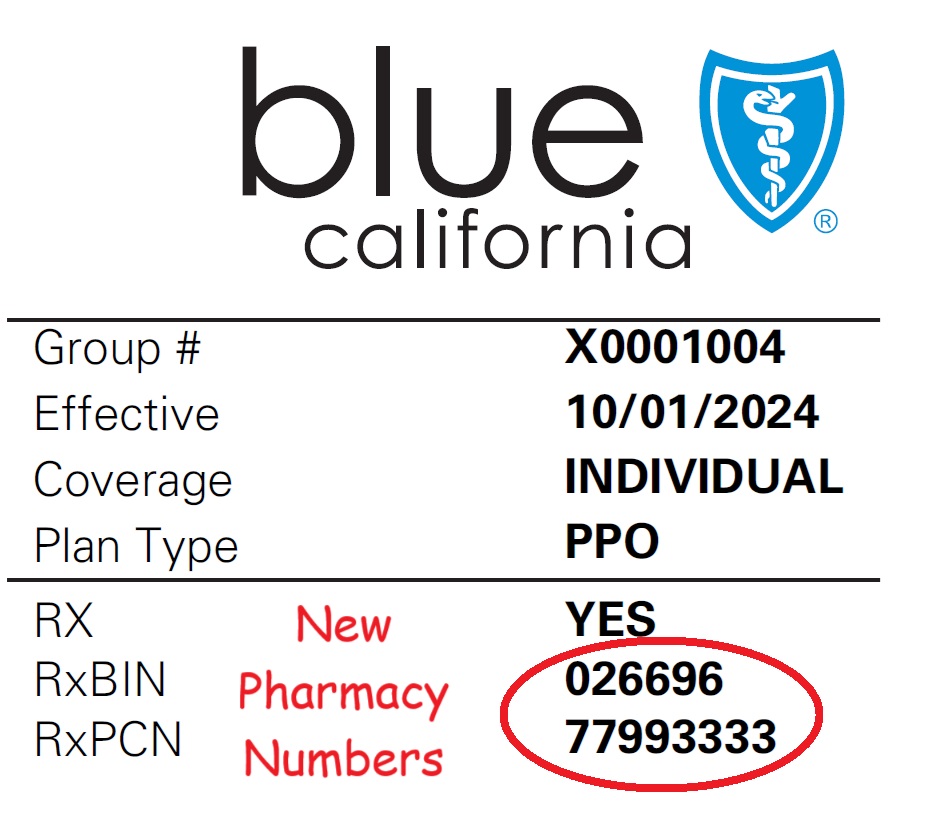

New Member ID Cards

All of the changes to the Blue Shield pharmacy coverage will necessitate new member ID cards. Even if you have not changed your Blue Shield health plan, you will receive a new member ID card. The new cards will have updated pharmacy information for the pharmacist to process the prescription claim with the new pharmacy network manager.

Direct Pharmaceutical Contracting

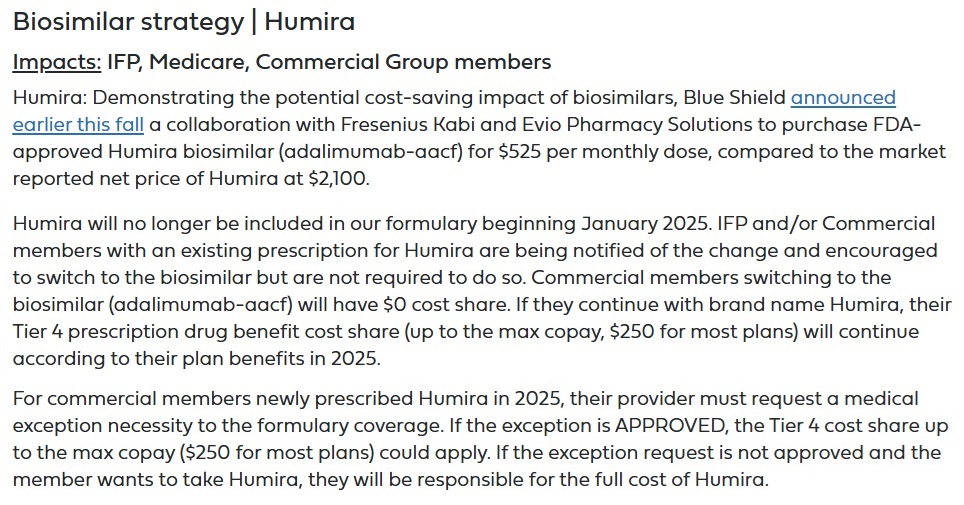

Blue Shield of California will be purchasing a biosimilar for Humira. The Humira biosimilar (adalimumab-aacf) will cost $525 per monthly dose versus retail price of $2,100 for Humira. As explained by Blue Shield, the biosimilar for Humira was often times kept off the drug formularies created by the Pharmacy Benefit Managers. For 2025, Blue Shield will offer the biosimilar for Humira at $0 to plan members.

Humira will not be on the Blue Shield drug formulary but can be added through drug formulary exception process. When added, Humira will be a Tier 4 drug and will have a maximum copayment for most plans of $250. Humira will still be on the drug formulary for Medicare plans.

Biosimilars explained https://news.blueshieldca.com/2024/10/23/biosimilars-explained

Cost Transparency

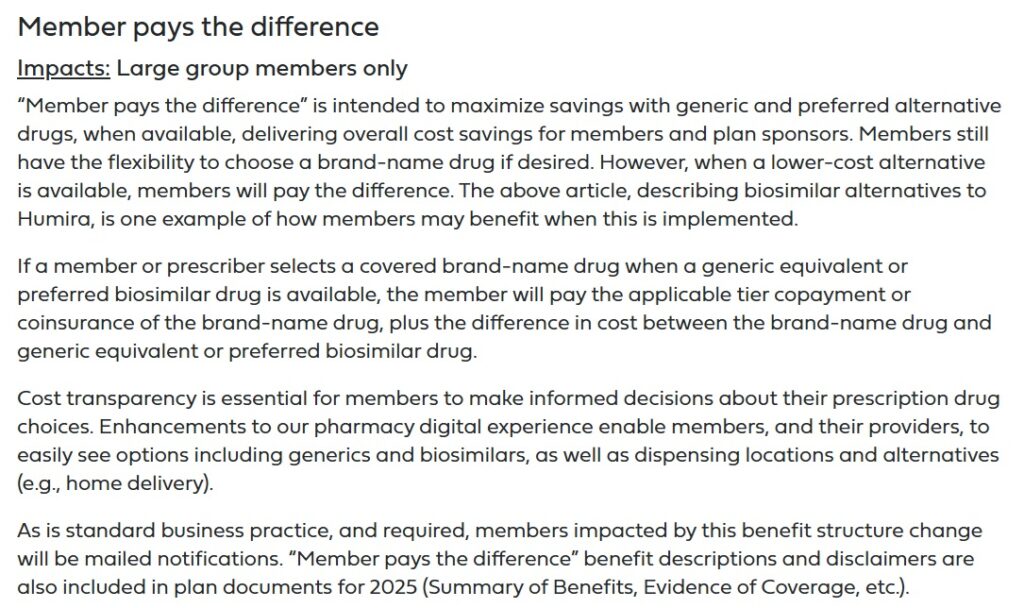

For large group members only, Blue Shield will offer plan members the option to pay the difference between the preferred generic and the Brand name drug. This allows plan members to see the, what can be, a large price differential between and Brand name drugs.

New Conditions for Weight Loss Drugs

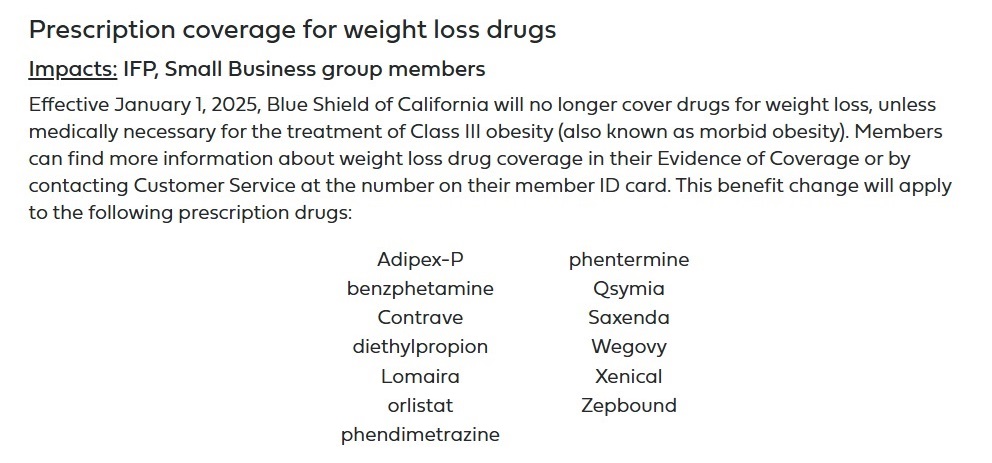

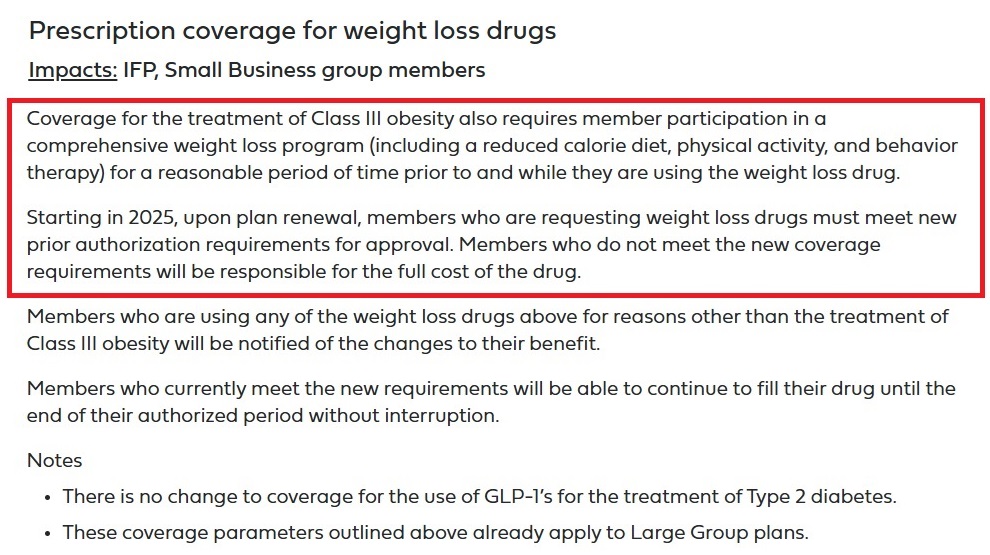

In 2025, Blue Shield will be tightening the conditions necessary to cover certain weight loss drugs. The GLP-1 (glucagon-like peptide-1) drugs such as Ozempic and Wegovy will still be available for the treatment of Type 2 diabetes. Blue Shield will only approve the use of a GLP-1 for weight loss if the individual falls into Class III obesity. In addition, the individual will have to document they have participated in a comprehensive weight loss program prior to and while using the drug.

Why Blue Shield of California?

Blue Shield of California is one of the largest California insurance companies with its corporate headquarters in the state. While they have plan members in other states through their group health plans, the vast majority of their premium dollars and claim expenses occur in California. They also offer health plans in the entire state.

Anthem Blue Cross also offers plans throughout California. However, Anthem Blue Cross operates in 13 other states and is headquartered in Texas. Consequently, Anthem is not solely focused on California and must navigate the laws and regulations in other states. They can also drastically reduce their presence in California, like they did shortly after the ACA went into effect. Blue Shield of California must live and die in the state.

Kaiser Permanente also has a large presence in California with many plan members. A big distinction between Kaiser Permanente and other carriers is that they run their own pharmacies and are less subject to games played by the Pharmacy Benefit Managers.

AetnaCVSHealth has a growing presence in California. They are also associated with CVS Health Caremark Pharmacy Benefit Manager and will not challenge the arrangement.

Cigna and UnitedHealthcare offer group plans in California, but like Aetna, are closely aligned with their own Pharmacy Benefit Managers.

Molina and Health Net are not statewide, operate in other states, and Health Net is owned by Centene out of Missouri.

The remainder of the carriers are relatively small. The regional carriers are Western Health Advantage, Valley Health Plan, Chinese Community Health Plan, Sharp Health Plan, Inland Empire Health Plan, L.A. Care, and Sutter. With the exception of L.A. Care, that operates solely in Los Angeles County, these smaller carriers just don’t have the clout to attempt to disrupt the pharmacy status quo. They must accept what the Pharmacy Benefit Managers offer or dictate to them.

L.A. Care has significant plan membership within their Medi-Cal, Individual and Family, and Medicare Advantage plans. They are a client of Navitus in an effort to reduce and control pharmacy costs.

This makes Blue Shield of California unique among the health insurance companies offering plans in California. They are involved in virtually every market for health insurance including Medi-Cal, Medicare, Individual and Family, Small Group, and Large Group market. They have a huge exposure to pharmacy claims across a broad swath of the population.

Drug costs are significant driver of health insurance premium rates. Any carrier who can reduce the cost of pharmacy drugs to members and drug claim expenses can begin to moderate rate increases in favor of the consumer. Credit to Blue Shield of California for attempting tackle the crazy pharmacy drug costs. None of the other carriers seem to be stepping up to the plate to try and reduce what appears to be obviously inflated drug costs to consumer and health plan by disrupting the pharmacy benefit manager structure.