Blue Shield is starting their third year of billing nightmares that never seem to get fixed.

Blue Shield of California’s billing system that created major headaches for individuals and families in 2014 continues to stumble into 2016. Even through changes to the enrollment website, the simple tasks of determining an applicant’s eligibility and properly applying a premium still seems elusive to Blue Shield in several instances. For whatever reasons, several of the Blue Shield units – underwriting, eligibility, billing, member services, and IT- don’t seem to talk to one another.

Blue Shield Split Quote rat’s nest of problems

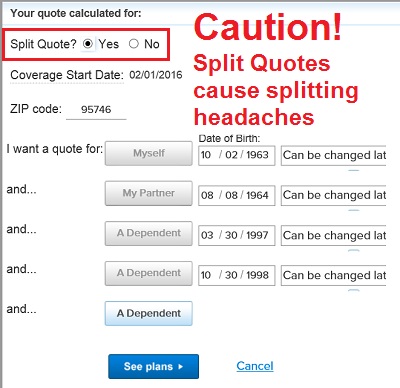

One of the big rat’s nests of problems is generated by their Split Quote system. The promise of the online Split Quoting system is that different family members can enroll in different health plans all on one application and the family would receive one invoice. This is great for family members who want a base Silver plan while one household member may require a higher benefits health plans such as Gold or Platinum. As wonderful as the Split Quote system sounds, it has never once worked correctly for me. See also Blue Shield Billing problems of 2014

Blue Shield’s Split Quote system have never worked correctly and leads to nothing but problems.

Payments never applied properly

The Split Quote system is like a bomb going off and with shrapnel and application parts being thrown all over the place. When the applicant makes the first premium payment, it is only applied to the primary applicant and none to the other household members. No one is smart enough at Blue Shield to fix this problem. And no one is smart enough to contact either the agent or the member and tell them that the payment has been improperly applied. We only learn about it when the member gets a statement detailing that the second health plan has not been activated for lack of payment. Yet the first policy has a credit balance.

Not everyone has the same last name

Another issue that Blue Shield can’t comprehend is that household members may have different last names. When a Split Quote gets blown up and household members have different last names it all gets thrown over to the underwriting department. The underwriting unit used to be the people who combed through the application looking for pre-existing conditions in order to deny the health insurance application. Now they are looking for ways to hobble the application because they don’t understand how spouses can have different last names.

Underwriting department is the big bottle neck of progress

The underwriting department had always been sequestered away where no one could actually explain anything to them. That hasn’t changed at Blue Shield. You still can’t talk to underwriting to inform them that the poorly designed online Split Quoting system some IT professional created has resulted in a total mess. You can’t tell them that the 21 year old son living at home and attending college really doesn’t need to prove his residency to you. He electronically signed the application. Why won’t underwriting believe him, or his other siblings, or his mother, or his father!

Never the same answer twice

We are two weeks into a submitted online enrollment and not one of the five applications that were submitted as one application has been approved. The binder payment was made with the application and it hasn’t been applied to anyone’s account. In two days the New Year will begin and this family has no health insurance. Blue Shield continues to drag their feet. Each phone call requires reciting the whole scenario over and over like a bad ground hog day movie. Each time some customer service representative says they will call back…that never happens. Each time we are told some different form of progress has been made, but nothing has really changed.

Poor IT results in huge back log of problems

Even when the Blue Shield underwriting department allegedly needs some form of information to complete the application, neither the prospective member nor I ever receive communication asking for the information. On December 29th I was told that underwriting was just beginning to work on applications submitted on December 14th. Blue Shield billing is just a plain mess generated by their horrible online applications. Blue Shield actually makes Covered California look like a well-oiled machine.

Blue Shield wastes precious time of staff, agents and members

The Blue Shield billing nightmare has been going on for years now. You would think they would have straightened out the kinks in the system. But that seems not to be the case. Perhaps Blue Shield is hopelessly beyond repair. While the execution of the health insurance is no worse than any other carrier, the Blue Shield enrollment, eligibility, and billings systems waste thousands of hours of Blue Shield’s time fixing the issues. A similar amount of time is wasted by agents and members on the phone trying to push Blue Shield to acknowledge the rat’s nest of billing problems they’ve created and get the health insurance they have already paid for.