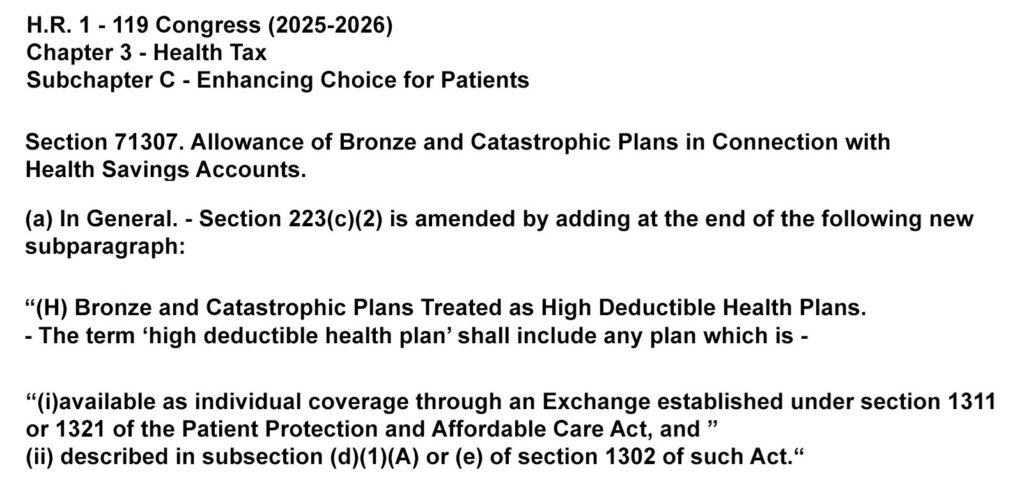

For 2026, Bronze 60 plans through Covered California are eligible for tax-deductible Health Savings Accounts. Minimum Coverage health plans are also eligible for the Health Savings Account tax deduction. There is a long menu of health, dental, and vision care you can pay for out of your Health Savings Account.

Many people who are not receiving any health insurance subsidy under the reduced Premium Tax Credit calculations for 2026 are opting to save money by enrolling in Bronze plans. Congress has designated Bronze 60 and Minimum Coverage plans as eligible for tax-deductible Health Savings Account contributions.

You can open a Health Savings Account with most banks and financial institutions. You then deduct the contributions to the Health Savings Account from your federal tax return. The maximum 2026 contribution for a single adult is $4,400 and $8,750 for family coverage. The money is always yours and it grows tax free.

Expenses paid out of Health Savings Account

Health insurance premiums cannot be paid out of the Health Savings Account. However, there are many expenses that can be paid out of the Health Savings Account. Virtually everything covered by the health plan can be paid out of the Health Savings Account plus other health related expenses.

The following list of covered expenses is from IRS publication 502 for 2024. Review the latest publication for changes to included and excluded expenses.

- Acupuncture

- Alcoholism treatment

- Ambulance

- Artificial limbs

- Artificial teeth

- Birth Control Pills

- Body Scan

- Braille books and magazines

- Breast pumps

- Breast reconstruction surgery

- Capital expenses for improvements to accommodate medical care and disability

- Car equipment to accommodate disabled drivers and passengers

- Chiropractor

- Contact lenses

- Crutches

- Dental treatment

- Diagnostic devices like blood sugar test kits

- Disabled dependent care expenses

- Eye exams

- Eye glasses

- Eye surgery such as laser eye surgery

- Fertility enhancement

- Guide dog and service animals

- Health institute when prescribed by a medical doctor

- Hearing aids

- Hospital inpatient care

- Personal protective equipment such as masks and hand sanitizer

- Laboratory fees

- Lactation expenses

- Lead-based paint removal

- Legal fees associated with guardianships

- Lodging when associated with travel for medical care

- Meals when associated with travel for medical care

- Prescription medicines

- Nursing services at home or at a care facility

- Optometrists

- Psychiatric care

- Psychologists

- Special education upon a doctor’s recommendation such as child’s tutoring

- Stop-smoking programs

- Transplants

- Transportation to and from medical care

- Weight-loss program when prescribed by a doctor

- Wheelchairs

- Wigs

- X-rays

Extra Benefit with Bronze 60 plans

Before the changes to Health Savings Account compliant health plans, you had to pay the full rate for most health care services under a High Deductible Health Plan. With the Bronze 60 plans now Health Savings Account compliant, you can pay the $60 copayment for office visits, urgent care, and $50 lab tests directly from the account. If you are self-employed and are not offered employer sponsored health insurance, you can deduct your health insurance premiums from your taxable income.

There are some restrictions on the Health Savings Account contributions. Review IRS Publication 969 for the current tax year to confirm you are eligible. Bronze 60 and Minimum Coverage plans, on and off the Marketplace Exchange, are eligible for Health Savings Account contributions.

Health Savings Accounts