When it comes to selecting an individual or family metal tier health plan, many people question whether they should opt for the less expensive Bronze 60 plan or the more expensive Silver 70. While it is hard to predict the future, the Bronze 60 can be the better choice to save money and protect you against massive health care expenses just as well as the Silver 70.

What does the number after the metal tier signify?

The number after the metal tier indicates the actuarial value of the plan. It is an average percentage of medical costs covered for the average person. The average person with a Bronze 60 can expect to have 60 percent of their medical costs covered during the year. That is an average determined by all of the people in the insurance pool. Some people may only have 10% of the costs covered if most of their medical care is subject to the deductible. Another person who reaches the maximum out-of-pocket costs with total medical expenses exceeding $100,000 may have 90% of their costs covered under the Bronze plan.

Maximum Out-of-Pocket Amount

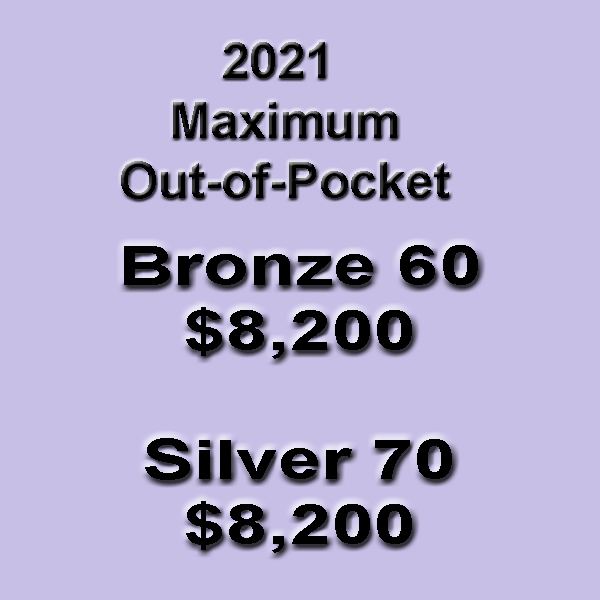

The maximum out-of-pocket amount is the same for the Bronze 60 and Silver 70: $8,200 for 2021 for an individual. Once you hit the maximum out-of-pocket, the health plan covers all the in-network expenses 100% for the rest of the year. Let’s say you have a major medical event, such as surgery with stay in the hospital overnight, in February. You meet your maximum out-of-pocket amount with either the Bronze 60 or Silver 70 plan, both plans cover the medical expenses for the rest of the year exactly in the same manner. But if you have the Bronze 60 plan, you will be paying a lower premium for the remainder of the year.

If you consider health insurance to be a form of asset protection, both the Bronze 60 and the Silver 70 have the same protection in the event of a major medical crisis. Your maximum liability is $8,200. The Gold 80 plan also has a $8,200 maximum out-of-pocket amount and the Platinum 90 is $4,500. Family maximum out-of-pocket amounts are double the individual number.

Cost Sharing Benefits

Both the Bronze 60 and Silver 70 include all of the no cost preventive office visits and tests. Health care services such as routine physical, mammograms, childhood tests, and colonoscopies that fall under the list of preventive health care services are covered no cost to you. Both metal tier plans include pediatric dental and vision benefits for children.

For diagnostic office visits for issues – for example, you have a pain in your gut – the Bronze 60 allows you three visits at a set copayment amount to a general doctor, specialist, or urgent care. Bronze 60 includes unlimited routine lab tests at $40. All other medical services and prescription medications will be subject to the $6,300 deductible. Once you reach the deductible, you pay 40% of the cost until your total expenses equals the maximum out-of-pocket amount.

Silver 70, on the other hand, has most health care service at a set copayment or 20% coinsurance. Very few health care services are subject to the medical deductible of $4,000. It’s possible to hit the maximum out-of-pocket amount in the Silver plan without ever triggering the medical deductible.

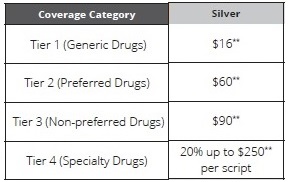

There is a $300 pharmacy deductible in the Silver plan. After it is met, most drugs are subject to a lower copayment or coinsurance. The Bronze 60 has no real pharmacy coverage. However, the cost of prescription medications is applied to meeting the maximum out-of-pocket amount for both the Bronze and Silver plans.

Rate Differential

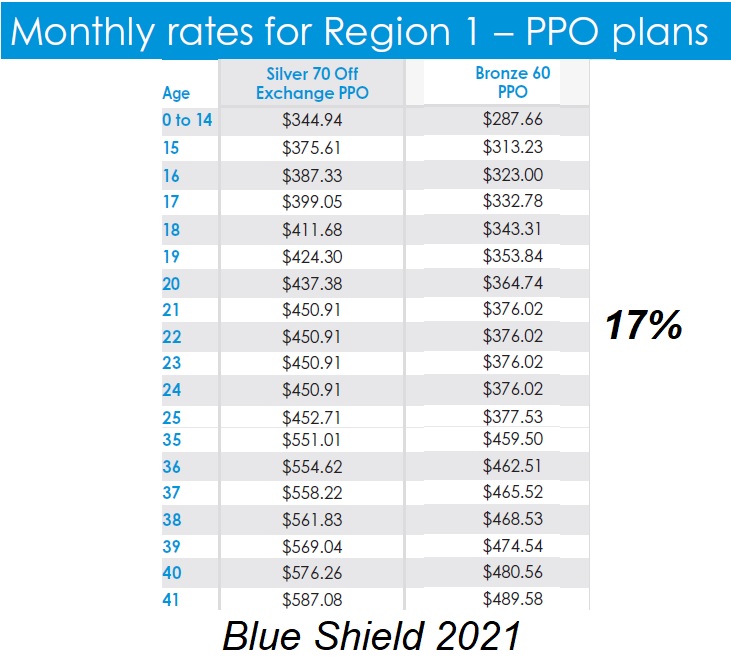

Within the same carrier and plan type, for the off-exchange plans there, will be a 15% to 17% differential in premiums between the Bronze 60 and Silver 70 plans. The Blue Shield PPO Silver 70 off-exchange plans will cost about 17% more at the same age and plan region. The Covered California Silver 70 plans, which are almost identical to the off-exchange plans, have an additional surcharge of 10% to 15%. The Bronze 60 plans are the same rates regardless of whether they are purchased through Covered California or direct from the carrier off-exchange.

For a 40 old individual, there will be an approximate $100 difference between the Bronze and Silver plans with the same insurance company. Because of the way the subsidy is calculated at Covered California, the difference could be greater or it may be smaller. Many people may be offered a Bronze 60 plan for $1, while the Silver plan could be $200 per month. However, if we assume a $100 difference, that is $1,200 per year savings with the Bronze plan.

The big unknown is how you will use health care services in the next year. If you historically visit a doctor for the occasional sports injury, allergies, or to have wax removed from your ears, even if you visit the doctor more than 3 times (the Bronze 60 limit), you may still be money ahead with the Bronze plan.

Who should enroll in the Silver 70 plan?

The value of the Silver plan is manifested with the lower cost-sharing: primary care office visits $40, specialist visit $80, labs $40, x-rays and diagnostics $85, imaging $325. Then there is the reduced cost of the prescription medications: preferred drugs $55, non-preferred drugs $85, specialty drugs 20%, capped at $250 for a 30-day supply. The drug benefit value of the Silver 70 plan can exceed the difference between a Bronze and Silver plan.

Individuals who should almost automatically select a Silver 70 plan

- People with health challenges that require frequent visits to the doctor for monitoring or rehabilitative therapy

- When expensive medications have been prescribed to treat an illness

- Children who act like children and fall from trees or stick a gummy bears up their nose

- Children who act like adults

- Adults who act like children

- Whenever an enhanced Silver 73, 87, or 94 plan is offered

All of the enhanced Silver plans have reduced cost-sharing. The maximum out-of-pocket amounts are lower as are many of the copayments for health care services over the standard Silver 70. A Silver 87 is better than a Gold 80 plan and a Silver 94 is better than a Platinum 90 plan.

To save money, you can also split the family up onto different metal tier health plans with different carriers. Covered California makes this super simple. The children might be in a Silver PPO plan and the adults in a Bronze HMO plan. If you don’t have to manage a chronic illness, don’t take expensive prescription medications, and are generally sound in mind and body, the Bronze plan will save you money. Just take the savings and stick it into a savings account in case you do need to pay for some extra health care services.