Calculating the Covered California Premium Tax Credit subsidy, 2018 IRS Tax Forms.

The IRS has moved the pieces of the form 1040 puzzle around for 2018. In large measure this was to accommodate changes to the tax code under the 2017 tax reform legislation. While form 8962 is still used to calculate a tax household’s Premium Tax Credit subsidy they received through Covered California, reporting either the credit or the repayment has been moved.

To be honest, few people are really interested in the forms and calculations for determining the health insurance Premium Tax Credit (PTC) they may have received, or will receive, through Covered California. In most instances the tax preparation software handles all the number crunching and feeds the dollar amounts into the specified fields on the appropriate Schedules of the 2018 form 1040. The PTC can be difficult to calculate and previous year changes to the household composition can complicate the matter. However, if a tax payer has a variety of nontraditional income sources, for the purposes of estimating any future PTC eligibility, it can be helpful to understand the calculations and the flow of the dollar amounts onto the form 1040.

Reconciling The Premium Tax Credit With New IRS Forms

The Affordable Care Act created a formula and subsidy mechanisms for making the Second Lowest Cost Silver Plan (SLCSP) affordable to individuals and families. In short, the ACA states that a household should not have to pay over a certain percentage of their income on health insurance. The ACA Covered California subsidy is the difference between what the ACA says the family is expected to spend on the health and the cost of the SLCSP. If the annual premium for the SLCSP is $1,200 more than what the ACA says is the family’s reasonable annual contribution, Covered California sends $100 each month ($100 x 12 months = $1,200) to the health plan. The consumer pays the balance.

But the subsidy revolves around the estimated household income. Of course, this income, known as the Modified Adjusted Gross Income (MAGi), is never exactly what the family estimated it would be at the end of the year. Consequently, the tax payer has to reconcile their final MAGI and the subsidy they received during the year with the actually Premium Tax Credit they were eligible for. This all occurs on form 8962. Below is a simplified version of the process.

- Take the Modified Adjusted Gross Income plus that of your tax dependents who must file a federal tax return.

- Compare that to the federal poverty level (fpl) for your household size. If over 100% and under 400% of the fpl, you are eligible for the Premium Tax Credit (PTC).

- Take the MAGI and find the Applicable Figure (found in the instructions for form 8962 and otherwise known as a percentage of your household income) and calculate what your household responsibility or annual contribution for health insurance premiums should be.

- Determine difference between your calculated annual contribution health insurance responsibility and the annual cost of the Second Lowest Silver Plan is your Premium Tax Credit.

- If the total amount of the Advance Premium Tax Credit (APTC) subsidy (as reported on your 1095A) is less than the calculated PTC for your family, you will be due an additional tax credit on your taxes.

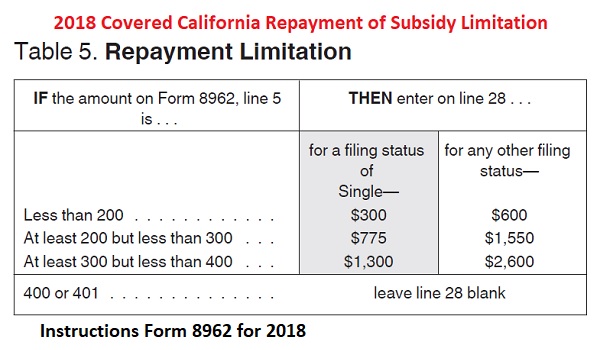

- If you received too much APTC during the year, you will have to repay some of the excess payments. If your MAGI was over 400% you have to repay all the APTC back, otherwise there are repayment limitations.

IRS 2018 Repayment Limitation of the Advance Premium Tax Credit Subsidy if MAGI is under 400% of the federal poverty level.

Line Changes For Reporting Covered California Subsidy

On the old 1040 tax forms you report any repayment of excess Premium Tax Credit on line 46, and any additional PTC owed to you on line 69. For 2018, repayment of the PTC subsidy is reported on Schedule 2 Tax (line 46) and additional subsidy tax credit is listed on Schedule 5 (line 70) Other Payments and Refundable Credits. It’s important to know where to find these numbers if you are trying to forecast for the next year and are using the past figures as a guide.

If you are self-employed or the owner of a small business who can deduct your family’s health insurance premiums, you will have to work with Schedule 1 also. The new Schedule 1 holds all the additional income streams not listed on the new 1040 (lines 1 – 5) as well as deductions to the tax payer’s Adjusted Gross Income – all these dollar amounts used to be on the first page of the 1040.

As a side note, once Covered California has paid a monthly APTC to the health plan, there is no way for the tax payer to claw back that amount. A consumer can increase their estimated income to reduce future APTC payments. But the month’s already paid are out the door. Also, if you increase your income, you could lose any future APTC subsidy even if your income is still below 400% of the fpl. If in the prior months, Covered California forwarded an APTC subsidy amount that totals the entire estimated for Premium Tax Credit for the new household income, the subsidy in future months ceases. This results in the consumer paying the full premium amount of the health plan for the remainder of the year.

Health Insurance Premium Deduction

Self-employed and small business owners can deduct health insurance premiums, subject to certain conditions, from their AGI. For Covered California participants this would be the amount they actually paid to the health plan for their health insurance. If the tax payer has to repay some of the APTC, because they underestimated their income and received too much subsidy, that increases the deduction and reduces the AGI. If the tax payer overestimated their income through Covered California, and is entitled to addition PTC subsidy, that will reduce their health insurance premium deduction and increase their AGI.

The AGI is the foundation for the MAGI. Any change to the AGI will necessarily affect the MAGI. A change to the MAGI impacts the applicable figure, household annual contribution, and the final PTC dollar amount. Unfortunately, the tax payer plugs in the health insurance premium deduction BEFORE the final PTC amount is calculated. If the PTC amount is different, either more subsidy or a repayment of subsidy, that new number must be updated on Schedule 1, which in turn changes the AGI.

This circular reference can go on for several iterations. The IRS has acknowledged the circular reference and noted two different calculation methods in publication 974.

After completing Worksheets W and X, you may choose to use either the Simplified Calculation Method or the Iterative Calculation Method to compute your self-employed health insurance deduction and PTC. The Simplified Calculation Method is shorter, but in some cases will not produce a result as favorable as the Iterative Calculation Method.

Form 8962 also has steps for calculating subsidies in the event of a divorce or marriage during the year. These calculations are even more complicated than the straight forward MAGI and PTC determinations. The fragmenting of the 1040 form into additional Schedules also seems to overly complicate tax preparation strategies with respect to the Premium Tax Credit. But when has government ever made anything simpler?

You might also be interested in New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

2018 IRS Forms Relevant To The Premium Tax Credit Reconciliation

2018

- Underpayment_Penalty_Calculation_form_2210

- Underpayment_Penalty_Instructions_form_2210

- 1040_Form_2018

- 1040gi_Instructions_2018

- 1040 Schedule 1 Form

- 1040 Schedule 2 Form

- 1040 Schedule 5 Form

- Schedule C_f1040sc_2018

- Schedule C Instructions_i1040sc_2018

- 8962 Form Premium Tax Credit_2018

- 8962 Instructions Premium Tax Credit

- Publication 974_2017

- HSA IRS Maximum Contributions Plan Design

- House 2017 Tax Cut Bill 115hrpt409

- Senate House Conference 2017 Tax Cut Bill115hrpt466

- Law change affects moving, mileage and travel expenses _IRS

- Deduction for Qualified Business Income Sec 199A FAQs_IRS

- Qualified Business Income Deduction IRS reg-107892-18

- Section 199A Calculating Wages W-2