The IRS gives you a yellow penalty card for not maintaining minimum essential health insurance coverage.

Anyone who did not have health insurance for a period of more than three months during 2014 will have to pay a penalty on their IRS federal tax return. This penalty is also known as Affordable Care Act Shared Responsibility Payment. The ACA has given taxpayers who went without having health insurance for a period during 2014 a break on calculating the penalty. However, households subject to the Shared Responsibility Payment (SRP) will still have to crunch some income numbers to get the final amount.

Steps for determining the penalty

This post is not in lieu of any tax advice from a qualified tax professional. As of the writing of this post the IRS is still in the process of releasing some forms and instructions which may change the nature of the information contained herein. However, the basis of this post comes from the December, 2014, release of the IRS Publication 5187, Health Care Law: What’s New for Individuals and Families, which can be downloaded at the end of the post.

Calculating the individual mandate penalty

The prospect of paying a penalty is actually less burdensome than having to calculate the Shared Responsibility Payment (SRP) by way of the IRS instructions. Thankfully, the ACA has made the individual mandate penalty for 2014 easier to calculate than it will be in subsequent years. But if you don’t take some time to get the SRP correct, you might get one of the dreaded IRS letters in the mail claiming they don’t understand what you filed. Before you start crunching numbers, you might not have to pay the penalty for a variety of reasons.

Step 1: Determine if you had Minimum Essential Coverage

If you or any of your dependents had any combination of the following situations or health insurance for the 12 months of 2014, you don’t owe a penalty. http://www.irs.gov/Affordable-Care-Act/Individuals-and-Families/ACA-Individual-Shared-Responsibility-Provision-Minimum-Essential-Coverage

Employer Group Plans

- Employer coverage including self-insured plans

- COBRA

- Retiree health insurance plan

Individual Health Insurance

- Health insurance purchased directly from the carrier

- Health insurance purchased through an exchange like Covered California with tax credits

- Private health insurance offered through a student health plan

- Health coverage provided through student health plan that is self-funded by a university.

Government Sponsored Programs

- Medicare Part A coverage

- Medicare Advantage plans

- Medicaid/Medi-Cal

- Children’s Health Insurance Program (CHIP)

- TRICARE that meets chapter 55, title 10 of US Code.

- Veterans Affairs health care

- State high-risk health insurance pool.

- Peace Corps health coverage

- Department of Defense Nonappropriated Fund Health Benefits Program

- Refugee Medical Assistance

Any of the above Minimum Essential Coverage (MEC) health plans that you had for part of the year can be combined with one of the exemptions from coverage to avoid any Shared Responsibility Payment or penalty.

Step 2: Determine if you had any exemptions

There are numerous exemptions for taxpayers and their dependents from the mandate to have health insurance if they didn’t qualify for any government Minimum Essential Coverage. For example, you may have been incarcerated for the first four months of 2014, and then received Medicaid for two months before getting back on with your employer’s group plan. Incarceration is a legitimate exemption from having to maintain Minimum Essential Coverage, along with many other exemptions.

Some exemptions need a certificate from Marketplace

IRS guidance indicates that either the Marketplace (Healthcare.gov or a state exchange such as Coveredca.com) or the IRS grants certain exemptions. See p5172 Health Insurance Exemptions for more information, download at end of post. For more detailed information visit http://www.irs.gov/Affordable-Care-Act/Individuals-and-Families/Questions-and-Answers-on-the-Individual-Shared-Responsibility-Provision .

2014 Open Enrollment Waiver

There was also a little problem with the extended open enrollment for 2014. If someone enrolled by March 15th, there health insurance wouldn’t become effective until April 1st. This would have meant that those consumers would have been without health for three months and subject to the SRP. To give these consumers some relief from inadvertently exceeding the short term coverage gap exemption during open enrollment the Centers for Medicare and Medicaid Services (CMS) has granted a one-time exemption for consumers caught up in the date issue.

Specifically, if an individual enrolls in a plan through the Marketplace prior to the close of the initial open enrollment period, when filing a federal income tax return in 2015 the individual will be able to claim a hardship exemption from the shared responsibility payment for the months prior to the effective date of the individual’s coverage, without the need to request an exemption from the Marketplace. Additional detail will be provided in 2014 on how to claim this exemption. – Shared Responsibility Provision Question and Answer, CMS, 10/28/2013

See IOEP_Coverage_Gap_Hardship_CMS file at the end of the post.

Form 8965 Health Coverage Exemptions

You’ll use Form 8965 to file the exemption for the months you were without the Minimum Essential Coverage. In addition to the special Initial Open Enrollment Period coverage gap exemption there are several others. Some of the exemptions you will need to have the Marketplace (federal or state exchange) issue you an exemption certificate to include on the f8965. Other exemptions will be granted by the IRS.

- Health insurance is unaffordable: either employer group plan, federal or state exchange plans cost more than 8% of your household income. This provision may come into play for states that did not expand Medicaid up to 138% of the federal poverty line. Claimed on IRS tax return.

- Short Coverage Gap: a short gap in coverage less than three months.

What qualifies as a short coverage gap?

In general, a gap in coverage that lasts less than three months qualifies as a short coverage gap. If an individual has more than one short coverage gap during a year, the short coverage gap exemption only applies to the first gap. Claimed on IRS tax return

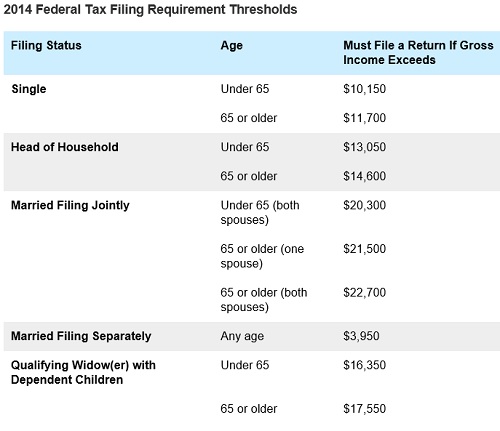

- Household income below the federal tax filing threshold: This is an income amount under which you don’t have to file an income tax return and is also used in calculating the SRP. Claimed on IRS tax return

- Certain noncitizens: neither U.S. citizen, national, nor alien lawfully present. Claimed on IRS tax return.

- Member in a health care sharing ministry: Granted by the market place exchange or claimed on IRS tax return. Must be a nonprofit 501(c)(3) in existence since 1999.

- Members of a federally recognized Indian tribe: Granted by the market place exchange or claimed on IRS tax return.

- Incarceration: Granted by the market place exchange or claimed on IRS tax return.

- Member of certain religious sects: These religious groups must have been recognized by Social Security Administration since 1950 to be valid. Only granted by the Marketplace, Healthcare.gov or state exchange.

Hardship

- Income below federal tax filing threshold. Granted by IRS only.

Taxpayers whose gross income is below their applicable minimum threshold for filing a federal income tax return are exempt from the individual shared responsibility provision and are not required to file a federal income tax return to claim the coverage exemption. However, if the taxpayer files a return anyway (for example, to claim a refund), they can claim a coverage exemption with their return. – Publication 5187

- The cost of employer group health insurance for two or more family members exceeds 8% of the household income as does the cost of coverage for the whole family. Granted by IRS only. This hardship does not necessarily make the household eligible for the ACA tax credits.

- Eligible for Indian or Alaska Native health care services.

- Financial or domestic hardship: individuals and families that experience certain hardships during the year will be granted an exemption from the penalty. See Financial_Hardhship_Exemptions_CMS

- Homeless

- Evicted in past six months, facing eviction or foreclosure

- Received shut-off notice from a utility

- Recently experienced domestic violence.

- Death of a close family member.

- Substantial loss of property from fire, flood or natural or human-caused disaster.

- Filed for bankruptcy in the last six months.

- Medical debt from unreimbursed medical expenses in the last 24 months.

- Family care provider for ill, disable or aging member with unexpected increase in expenses

- Child determined ineligible for Medicaid or CHIP when someone other than the parent or guardian (the adult who will claim the child as a dependent on the federal taxes) has been ordered by court to provide medical support. This exemption only applies to the months ordered by court.

- Appeal filed after being deemed ineligible for tax subsidized health insurance: individual appeals decision of the marketplace exchange denying tax credits or cost sharing reduction to the individual and they have no health insurance during the appeal process. Above granted by Marketplace only.

- No access to affordable health insurance or coverage based on projected household income. Granted by Marketplace only.

- Ineligible for Medicaid because your state doesn’t participate in expanded Medicaid under the ACA. Granted by Marketplace only.

- Nonrenewal of health insurance and the options are unaffordable. Granted by Marketplace only.

Certificates and Exemptions

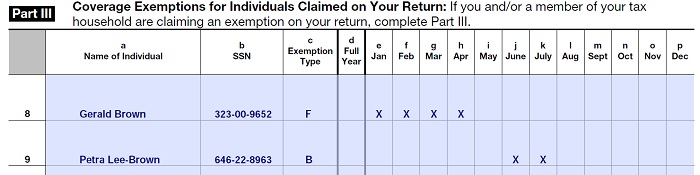

Certificates of exemptions granted by the Marketplace federal or state exchange will be reported on Part I of Form 8965. Exemptions granted by the IRS because household income is below the filing threshold will be reported on Part II of Form 8965. Other exemptions will be reported with IRS using Part III of Form 8965 for each person in the household.

Indicate which months you are granted an exemption from ACA health insurance mandate for each family member with an X.

Step 3 Calculating Individual Mandate Penalty or SRP

Oddly enough, there is no special IRS form or worksheet for calculating just the Shared Responsibility Payment. This calculation is included with the instructions for form 8965 (i8965), the same form you use for claiming an exemption from health insurance. Maybe the IRS figures most people won’t qualify for an exemption so they should make it easy to calculate the penalty right in the exemption instructions.

Easy 2014 formula

Fortunately, the SRP will be phased in over the next couple of years and the calculation for the penalty for 2014 is pretty straight forward. The penalty for not having health insurance in 2014 is the greater of

- 1% of the household income above the tax return filing threshold for the taxpayer’s filing status, Or

- The family’s flat dollar amount ($95 per adult and $47.50 per child under 18) with a maximum of $285.

Filing Threshold Income

Subtract the federal tax filing threshold amount from your MAGI to determine ACA penalty income.

Individuals and families must file a federal tax return if their gross income exceeds a certain amount for specific filing status such as Single, Head of Household, Married Filing Jointly, etc. This is known as the filing threshold. The filing threshold amount (found on page 6 of the instruction for Form 8965) is subtracted from the household’s Modified Adjusted Gross Income. This new income figure becomes the basis for calculating the SRP.

Example p5187

Married couple with 2 children, $70,000 income:

Eduardo and Julia are married and have two children under 18. They did not have minimum essential coverage for any family member for any month during 2014 and no one in the family qualifies for a coverage exemption. For 2014, their household income was $70,000 and their filing threshold is $20,300.

To determine their payment using the income formula, subtract $20,300 (filing threshold) from $70,000 (2014 household income). The result is $49,700. One percent of $49,700 equals $497.

Eduardo and Julia’s flat dollar amount is $285, or $95 per adult and $47.50 per child.

Because $497 is greater than $285 (and is less than the national average premium for bronze level coverage for 2014), Eduardo and Julia’s shared responsibility payment is $497 for 2014, or $41.41 per month for each month the family was uninsured (1/12 of $497 equals $41.41).

Penalty Capped

For high income earners and are subject to the 1% of income penalty rule, the Shared Responsibility Payment is capped at the national average of the Bronze plan for 2014.

The annual payment is a flat dollar amount or 1% of income…

- But capped at the cost of the national average premium for a bronze level health plan available through the Marketplace in 2014. For 2014, the annual national average premium for a bronze level health plan available through the Marketplace is $2,448 per individual ($204 per month per individual), but $12,240 for a family with five or more members ($1,020 per month for a family with five or more members). – IRS Individual Shared Responsibility Provision

Modified Adjusted Gross Income

The Modified Adjusted Gross Income (MAGI) is used to determine both the amount of any tax credit that household may be eligible for, financial hardship exemptions and also for determining the Shared Responsibility Payment penalty. The MAGI includes the income of all dependents the primary tax filer claims on his or her federal taxes. Consequently, if you use just your Adjusted Gross Income to determine your Shared Responsibility Payment, you might be under reporting the penalty if you didn’t calculate your MAGI.

Exemptions, Penalties and Tax Credits all in one year!

It’s possible that some families will have multiple situations to report on their taxes. They may have received a hardship exemption for some months, have a penalty for other months when if they declined coverage, and ultimately have to reconcile Advanced Premium Tax Credits from enrollment in health insurance through the Marketplace for part of the year. If this sounds like your situation, snuggle up close to a tax preparer and make him or her some cookies and coffee because it might take a while to finish that tax return

Instruction Caution!

Don’t try to apply all the instructions for calculating the Shared Responsibility Payment of Form 8965. The ACA provision of limiting the individual mandate penalty for 2014 trumps the very complicated SRP instructions. I’ll report any updates to the IRS guidance on this post as soon as I learn about them.

[wpfilebase tag=file id=382 /]

[wpfilebase tag=file id=381 /]

[wpfilebase tag=file id=379 /]

[wpfilebase tag=file id=376 /]

[wpfilebase tag=file id=378 /]

[wpfilebase tag=file id=380 /]