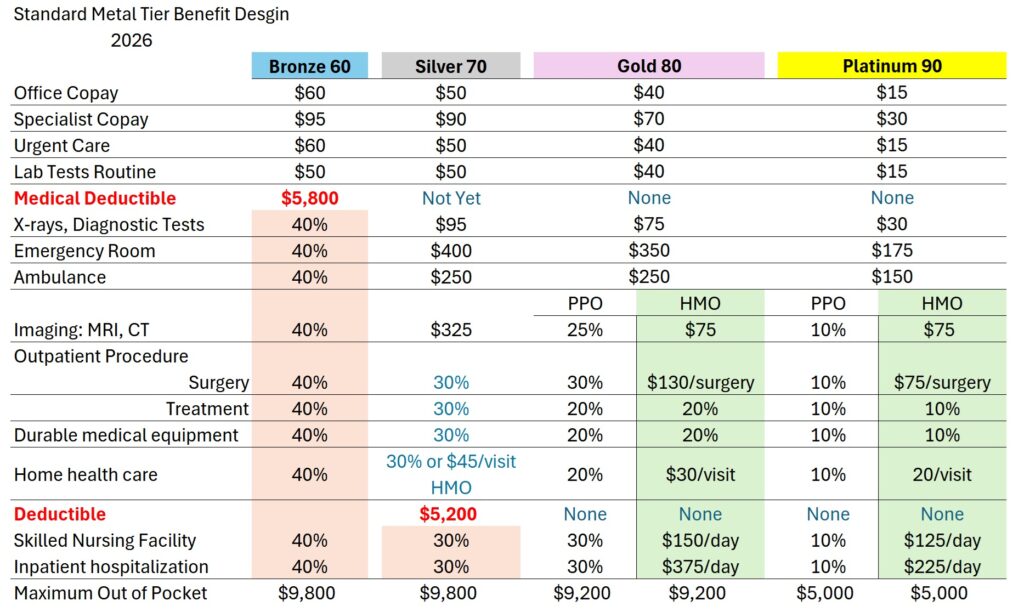

California 2026 individual and family standard metal tier health plans can have both a medical deductible and coinsurance. All plans have some routine health care services that are NOT subject to a deductible or coinsurance.

Unfortunately, it can be confusing to know when the deductible applies and what coinsurance means. Coinsurance is simply a percentage of the cost of the health care service that the health plan member is responsible for.

When are Deductibles and Coinsurance Triggered

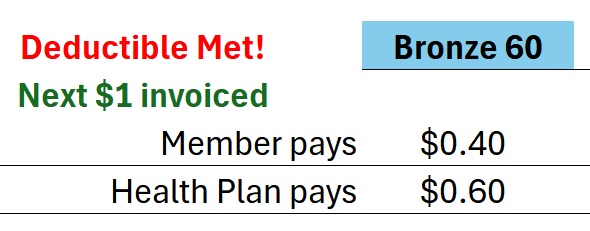

The Bronze 60 has many health care services subject to the $5,800 medical deductible. The plan member must accumulate $5,800 in health care services subject to the deductible for coinsurance to be triggered.

After the deductible is met, the member then goes into coinsurance. The plan member pays forty cents of the next dollar of invoiced health care services, and the health plan pays sixty cents. The copayments, deductible, and coinsurance add to meeting the maximum out of pocket amount.

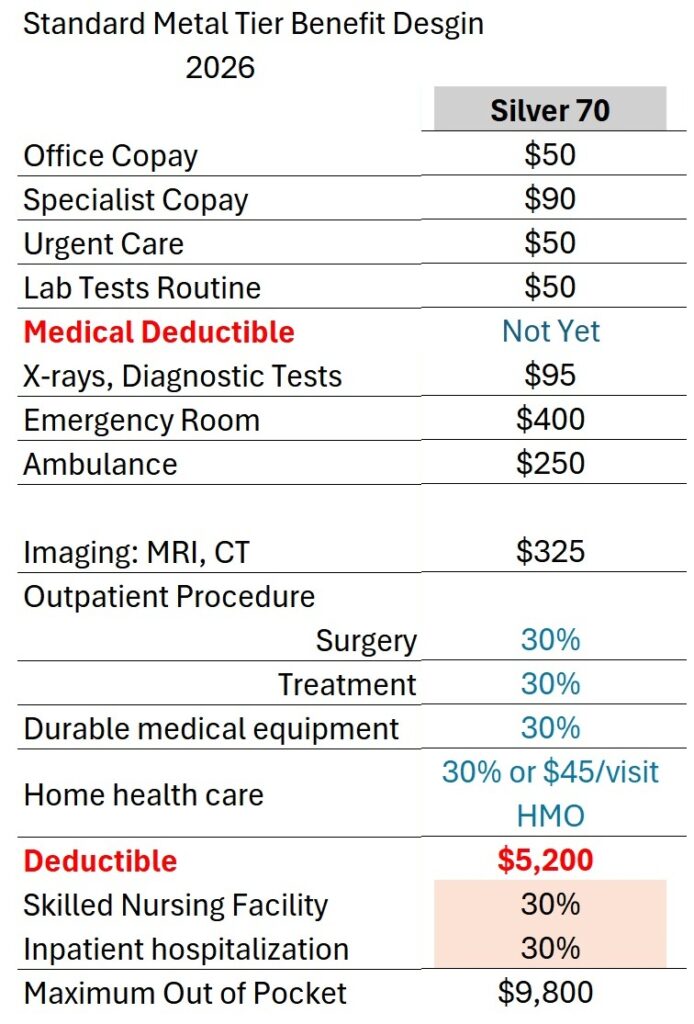

The Silver 70 plan has most routine health care services NOT subject to the medical deductible. The plan member either pays a set copayment or 30 percent coinsurance for the service.

Many Health Care Services are Coinsurance Only

Under the Silver 70 plan standard metal tier plan design, only skilled nursing facility residence and inpatient hospitalization is subject to the $5,200 medical deductible. When the plan member has accumulated $5,200 in costs for these services, they go into coinsurance. The plan member pays thirty cents of the next dollar invoiced and the health plan pays seventy cents.

Some Silver 70 health care service are only subject to the coinsurance; no deductible is applied. For example, if the plan member needed a set of crutches, they would pay 30 percent of the cost of the durable medical equipment.

Some Plans have NO Medical Deductible

The coinsurance percentage only situation occurs with Gold and Platinum plans. Neither the Gold nor Platinum plans have medical deductibles. However, HMO versions of Gold and Platinum plans will apply a set copayment to some services and not use the coinsurance percentage. (Kaiser offers a less expensive Gold coinsurance health plan.)

With the Gold plan, the coinsurance percentage will vary from 20 to 30 percent. Surgeries, skilled nursing, and inpatient hospitalization will have the highest coinsurance percentage at 30 percent. The Platinum plans generally have 10 percent coinsurance unless it is an HMO.

Silver 73, 87, and 94

The enhanced Silver plans of 73, 87, and 94 mirror the design of the Silver 70. Only skilled nursing or inpatient hospitalization is subject to any medical deductible.

Regardless of type of plan, all the copayments, coinsurance, and applicable medical deductible, in addition to prescription drugs, accumulate to meeting the plan members maximum out of pocket amount.

YouTube video on Deductibles and Coinsurance.