Beginning January 1, 2020, a new law requires all California residents to have health insurance or pay a penalty. This is separate from the “zeroed out” federal penalty, and your consumers should know the penalty for a family not having insurance in 2020 could be $2,000 or more. Of course, the greatest penalty is choosing to go without insurance and then receiving an emergency hospital bill of more than $100,000 or not catching a disease in time.

Covered California has partnered with the Franchise Tax Board to produce a 2020 Individual Mandate Penalty Fact Sheet that includes how to calculate a potential penalty. (Please note that the percentage of household income calculation requires knowing the consumer’s tax filing threshold. 2018 tax filing thresholds are available under the “Filing requirements: California gross income” section of the FTB’s Residency Status page, and 2019 thresholds will be posted when they’re available.)

If you are not covered by your employer’s health plan, or have other qualified coverage, you can go to CoveredCA.com to see if you are eligible for financial help

- Financial help may be available to lower your monthly cost for coverage

- You can shop and compare qualified health insurance plans

- Remember, you will want to select a plan that best suits your needs, and enroll during open enrollment which starts October 15th and ends January 31st

Some Individuals May Not Have to Pay a Penalty if They Qualify for an Exemption

Exemptions through Covered California:

• Affordability: If the lowest cost Bronze plan or employer plan exceeds 8.24% of your household income

• General Hardship: Homelessness, eviction or foreclosure, domestic violence, death of a family member, natural disaster, bankruptcy, medical expenses and other conditions.

• Religious Conscience: A member of a recognized religious sect or division who is opposed to acceptance of the benefits of any private or public insurance.

Exemptions through Franchise Tax Board:

Most exemptions from the mandate will be claimed when filing 2020 state income tax returns in early 2021. A full listing of exemptions can be found on the FTB website: www.ftb.ca.gov

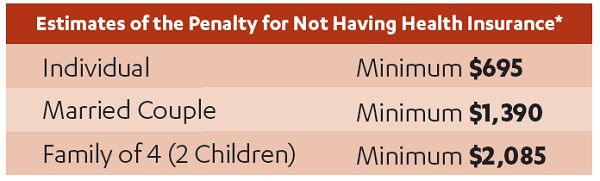

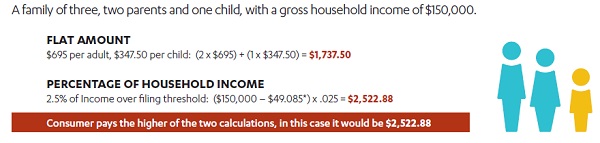

How To Estimate Individual Mandate Penalty

Individuals will pay the higher amount of the two calculations:

FLAT AMOUNT

You pay $695 per adult and $347.50 per child.

PERCENTAGE OF HOUSEHOLD INCOME

You pay 2.5 percent of your gross income that is above the filing threshold based on your tax filing status and number of dependents.