It’s back…the federal individual mandate and penalty for not having health insurance may have been killed for 2019, but California has resurrected the corpse for 2020. In addition to adding money for extra subsidies to reduce the cost of health insurance, California passed its own version of the individual mandate and penalty that will come alive for the 2020 plan year. Unlike the new subsidies that will sunset after 3 years, the penalty will live forever!

While the Affordable Care Act individual mandate, and pursuant penalty for not having health insurance, may have been unpopular with consumers, both the insurance companies and Covered California liked it. They both felt it drove individuals and families to enroll in health plans. Covered California points to the lack of a federal individual mandate as the reason new enrollments into Covered California health plans was flat for 2019.

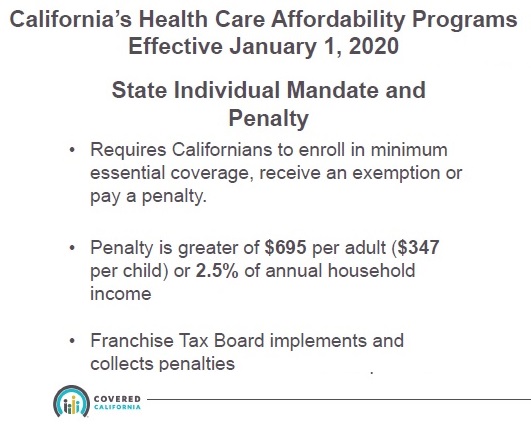

Individual Mandate Penalty for California

California legislation passed, and then signed by Gov. Newsom in 2019, created a new penalty on California residents for not enrolling in minimum essential coverage for 2020. The California individual mandate will mirror federal ACA rules governing penalties. The federal ACA penalty for not having health insurance was set to $0 beginning in 2019, effectively killing any motivational factor it might have had in driving consumers into the health insurance marketplace.

California’s individual mandate penalty will require residents to prove they either had minimum essential coverage during the year, have a valid exemption, or pay a penalty. The penalty will be the greater of $695 per adult ($347 per child) OR 2.5% of the household income. The verification of creditable minimum essential coverage and/or the ultimate penalty will be reconciled when residents file their state income tax returns with the Franchise Tax Board.

The penalty assessment will be based on the months the individual or household did not have the minimum essential health insurance coverage. If the California individual mandate mirrors the federal penalty, then, if an individual only had health insurance for 6 months of 2020, the penalty would only apply to those months the person did not have health insurance. As of October 2019, Covered California is still working with the Franchise Tax Board on the reconciliation of the new subsidy program and details for the penalty assessment.

The proposed details released regarding how the penalty will be assessed and applied by Covered California thus far, may change in the future. But we know there will be a penalty and it will be collected by the Franchise Tax Board.

Minimum Essential Coverage

Californians who have creditable minimum essential coverage will receive a 1095-A, B, or C form from the insuring entity. Minimum essential coverage is defined by the Affordable Care Act and must include certain coverage benefits. Health insurance that qualifies as minimum essential coverage is Medi-Cal, Medicare, individual and family plans, small group plans, large group employer plans, and several government sponsored health plans. In addition, Covered California will recognize enrollment in health care sharing ministries as coverage that avoids the individual mandate, even though those plans do not meet minimum essential coverage.

Similar to the defunct federal individual mandate, there will a variety of exemptions that Californians can apply for to avoid the penalty. Covered California was granted the rule making authority for verifying the hardship or religious conscience exemptions from the penalty. Hardship exemptions include financial hardship and other life circumstances that would prevent an individual from obtaining coverage. There will also be exemptions granted for individuals and families belonging to a religious sect who don’t participate or believe in traditional health care services. All of the applications for exemptions will have to go through Covered California. If approved, they will issue a Certificate of Exemption.

Cal Health Ins Penalty