California PPO plans offer the illusion of covering out-of-network costs but there are high deductibles before cost-sharing is triggered.

PPO plans once upon a time offered security of going out-of-network to receive health care services for a moderate premium compared to in-network providers. It is an illusion that California individual and family PPO plans still offer the freedom to see any doctor without paying a hefty price. The PPO plans offered to individuals and families, either through Covered California or off-exchange, come with very high out-of-network deductibles and even higher maximum out-of-pocket amounts for 2018

Preferred Provider Organization

PPO is an acronym for Preferred Provider Organization. Health plans have contracted with a variety of providers (doctors, labs, hospitals, physical therapists, etc.) to create a preferred provider network. When a member of a PPO, or EPO, plan visits a contracted in-network provider, the provider agrees to receive a negotiated or contracted rate for their services. Sometimes the health plan member pays only a set copayment for the visit and the health plan pays the rest of the contracted rate.

Even individuals in high deductible Bronze plans, who may have to pay the full amount for the health care services, still receive the benefit of only paying the negotiated rate and not the full retail amount. This can be particularly helpful if the health care service is something like outpatient surgery or even an inpatient hospital stay.

PPO Out of Network Deductibles And Maximum Out of Pocket

PPO plans offer some coverage if the health plan member seeks services from a non-contracted or out-of-network providers. Because these providers don’t have a contract with the health plan, the member shares the costs with the health insurance company in the form of a percentage. The health plan member may pay 50% of the billed amount and the health plan pays the remainder.

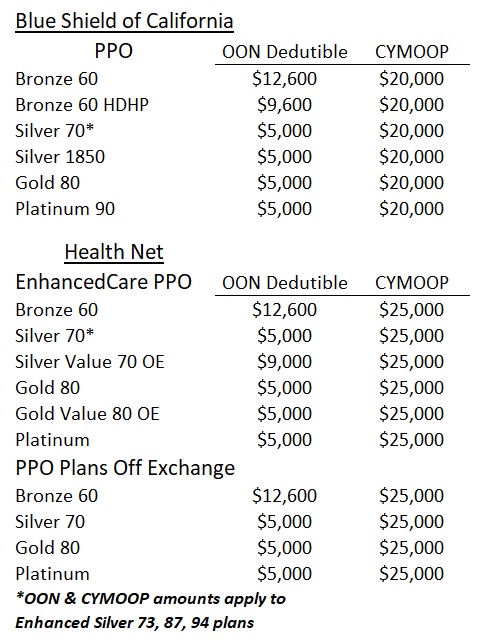

While sharing the out-of-network costs may sound like a good deal, today, PPO health plan members must meet an out-of-network deductible before the health plan shares any of the costs of the service. Most plans will have a $5,000 out-of-network deductible before the 50% cost-sharing begins. Standard Bronze plans will have a $12,600 deductible and the High Deductible Health Plan (Health Savings Account) will have a 9,600 out-of-network deductible.

Only Blue Shield and Health Net will offer PPO plans in California for 2018 and both have high OON deductibles and maximum out-of-pocket amounts.

Blue Shield has a $20,000 calendar year maximum out-of-pocket amount while Health Net PPO plans have a $25,000 maximum out-of-pocket amount for 2018. Generally, when you meet your annual or calendar year maximum out-of-pocket amount using in-network providers, the health plan will cover any subsequent in-network services at 100%. This isn’t the case with out-of-network providers however. (Some American Indian and Alaska Native plans may different OON benefits.)

The health plans don’t recognize the invoiced amount of the health care services from out-of-network providers as either accruing toward the deductible or for their cost-sharing of 50% before the maximum out-of-pocket amount is met. The health plans apply a Usual and Customary Rate (UCR) or the Allowable Amount. This limits their responsibility for payment and increases the health plan members costs.

For example, let’s say you receive a health care service from an out-of-network (OON) provider and are invoiced for $1,000. The health plan may look at the service provided and determine from their list that the Allowable Amount is $800. If you are in your deductible phase of the out-of-network benefit, the health plan may only apply $800 toward meeting your out-of-network deductible. If you have met your deductible, and are now in the cost-sharing phase, the health plan will pay 50% of the $800 or $400. That means you are responsible for 50% of the Allowable Amount PLUS the remainder ($200) not recognized by the health plan. If you have met your annual maximum out-of-pocket (MOOP) amount, the health plan will only cover the Allowable Amount and you will still be responsible for the remaining $200.

Blue Shield Evidence of Coverage

Using Non-Participating Providers:

Non-Participating Providers do not have a contract to provide health care services to Members. When you receive Covered Services from a Non-Participating Provider, you are responsible for both:

- the Copayment or Coinsurance (once any Calendar Year Deductible has been met), and

- any charges above the Allowable Amount (which can be significant).

- “Allowable Amount” is defined in the EOC. In addition:

- Any Coinsurance is determined from the Allowable Amount.

- Any charges above the Allowable Amount are not covered, do not count towards the Out-of-Pocket Maximum, and are your responsibility for payment to the provider. This out-of-pocket expense can be significant.

- Some Benefits from Non-Participating Providers have the Allowable Amount listed in the Benefits chart as a specific dollar ($) amount. You are responsible for any charges above the Allowable Amount, whether or not an amount is listed in the Benefits chart.

So is it really worth going out of the PPO network? In most cases, you will maximize the benefits of your health plan if you can stay in-network. You may have favorite doctors not in the PPO network that you want to see and will gladly pay their fees. Just make sure you run the invoice through the health plan so it is at least acknowledge and accrues toward meeting the OON deductible and MOOP amount.

It’s possible that something really big happens to you or someone in your family. Perhaps you want to receive services from a highly respected cancer specialist out-of-network. In this case, most people are willing to take the financial burden of going out-of-network, even if it means that the costs will be at least $25,000. But if the health plan covers $75,000 for treatment to save your life, or that of your child or spouse, being on the hook for $25,000 plus unreimbursed costs over the Allowable Amount may be worth it.

The possibility of covering expensive out-of-network costs, even for one health plan member out of thousand, is one of the reasons why PPO plans tend to command higher rates in the market place. But you should be under no illusion that any California IFP PPO plan will offer any significant coverage for minor or routine out-of-network services.