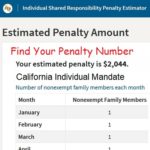

The penalty is the higher of the flat rate amount or the income percentage. With the income, California takes your income and subtracts the filing threshold dollar amount. They then multiply the remainder by 2.5 percent. If the percentage amount is greater than the flat amount, that is the amount that is added to the income tax return as a penalty.