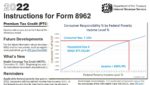

Without an extension of the enhanced subsidies of the Affordable Care Act, older Americans will be hit the hardest by high health insurance rates. The prime culprit is that there are no Affordable Care Act health insurance subsidies for incomes over 400 percent of the federal poverty level. This leaves older Americans potentially paying over 30 percent of their household income on health insurance premiums.