Choosing the correct metal tier health plan is difficult because health insurance is to protect you from future events that can’t always be forecasted. However, your life, or that of a family member, may fall into certain categories that can help guide your decision. The good news is that all California individual and family plans have an annual maximum out-of-pocket maximum to provide some protection from catastrophic health care bills.

Comparing Metal Tier Health Plans

Health insurance is unique in that it not only protects you from catastrophic health insurance bills, it can also help reduce the costs of many routine health care services and prescription medications. It’s as if your car insurance gave you discounts on oil changes, tire rotations, or replacing your brakes. While some of us we need routine maintenance, most people don’t know when their transmission is going to die and it needs to be replaced.

I work with a variety of individuals and families and their health care expectations seem to fall into three categories: 1. Asset Protection, 2. Routine Maintenance, 3. Future Planned Procedure

Asset Protection

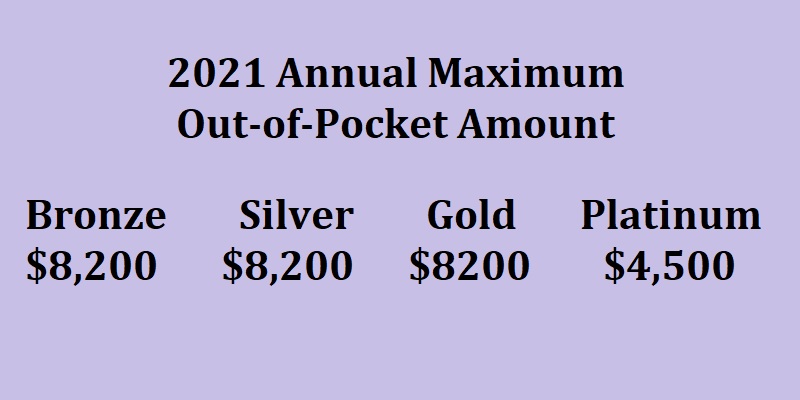

In California for 2021, the Bronze, Silver, and Gold metal tier plans all have a maximum out-of-pocket amount of $8,200. When the plan member accumulates a patient responsibility of $8,200 from copayments, coinsurance, and deductibles for health and prescription medications, the health plan covers the rest of the costs at 100 percent for the remainder of the year. Platinum plans have a $4,500 maximum out-of-pocket.

If the maximum out-of-pocket is the same for the Bronze, Silver, and Gold plan, why are the rates different? The Silver, Gold, and Platinum plans have set copayments for many routine health care services and they include prescription drug coverage. The Bronze plan has a three office visit limit with a copay and essentially no drug coverage.

The Bronze plans amount to asset protection. It is there to protect your assets (savings, home, cars, etc.) from uncovered medical bills. Bronze plans are most appropriate for individuals who have no chronic health challenges that need routine health care services and for people who are not taking any brand name medications.

You can play the ‘what if’ game. What if a person with a bronze plan injures their knee and needs arthroscopic surgery? The costs of the initial office visits, outpatient surgery, and rehabilitation therapy may not meet the $8,200 maximum out-of-pocket amount. The person may have been better served with a more expensive Silver plan. But if there is no history of mountain bike or skiing accidents that results in torn ligaments or broken bones, perhaps paying an extra $1,400 per year for a Silver plan is not worth it.

Routine Maintenance

Some individuals experience a temporary or long-term health challenge that necessitates many routine visits to a health care professional or have been prescribed expensive medications. In this scenario, a Silver plan will usually mitigate the out-of-pocket costs. For example, someone may be going through a very difficult time in life and needs to see counselor a couple times per month. Another individual may have been diagnosed with a disease that requires frequent lab test, imaging, doctor visits, and prescription drugs to beat the illness.

The set copayment for many of these routine health care services in the Silver, Gold, and Platinum plans can easily save more money per month than the cost differential with the least expensive Bronze plan. It is a little bit trickier to know if a Gold or Platinum plan, with the respective lower copayments and coinsurance relative to the Silver plan, will be save money over a lower metal tier plan with a lower monthly rate.

The Gold and Platinum plans have no medical or pharmacy deductible. The Silver plan medical deductible only really applies to overnight hospitalization and skilled nursing facilities. You can hit the maximum out-of-pocket amount in a Silver plan and not even have a health care service subject to the deductible.

If a person knows with a high level certainty the number health care services they will use in the coming year (office visits, labs, tests, imaging) and their prescription medication, then a spread sheet tabulating those services at the different copayments could help better identify the best Silver, Gold, or Platinum metal tier to save money.

Future Planned Procedure

Finally, there are those folks who know they have a high-cost medical service in the coming year such as hip replacement. The procedure or set of procedures are defined with a set recovery period. The initial reaction is to get the highest level of coverage, meaning the lowest member out-of-pocket amount. But we have to remember that once the annual maximum out-of-pocket is met, the health plan covers all expenses 100 percent.

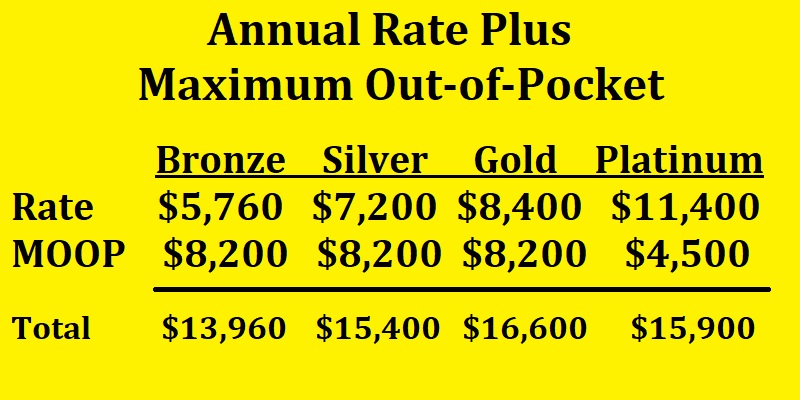

Even if the maximum out-of-pocket is met, the member must still make the monthly health insurance premiums. Consequently, a Bronze plan may cost less overall than a Gold or Platinum plan. If the maximum out-of-pocket is met in February, after the big surgery, the member would continue to pay the lower Bronze rate. This could mean saving $1,440 over the Silver plan and $2,640 over the Gold plan in our Grass Valley example.

The Bronze plan would even cost less than a Platinum plan (annual rate plus maximum out-of-pocket) by approximately $1,940. The next year, the person could increase their plan to a Silver level if they will be on continued prescription medications to save money. This strategy, selecting a Bronze plan in the face of an expensive health care procedure, needs to be carefully considered. If there is a possibility the operation won’t occur, and the condition is treated with lower cost health care services, then a Bronze plan may end up costing more.