While COBRA can be expensive, there are several reasons why you may want to keep the employer sponsored health plan when you separate from the company. Covered California can be a great option if it significantly lowers your monthly health insurance premiums, and it has the health care providers you want to visit.

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows individuals and their families to continue with the employer sponsored health plan after the covered employee has separated from employment. With the ACA (Affordable Care Act) there are fewer reasons to enroll in COBRA because individual and family health plans can no longer deny enrollment for preexisting conditions. In addition, the health insurance subsidies provided by Covered California (ACA marketplace exchange) usually means that families can get health insurance for less than COBRA rates.

Reasons To Keep Your Expensive COBRA Plan

However, even though COBRA may be more expensive than a Covered California plan with the subsidies, there can be good reasons to opt into a COBRA plan. The COBRA plan will be the continuation of the employer plan, usually without any employer contribution to lower the monthly health insurance premiums.

- Employer sponsored plans have larger provider networks than individual and family plans (excluding Kaiser.)

- You may be in the middle of treatment for a health care challenge and do not want to switch health plans. Continuity of Care provisions in a health plan should cover you if the new health plan does not include your providers.

- You may have already met a deductible or maximum out-of-pocket amount under the employer plan. When you start a new plan, deductibles and MOOP reset to zero and you must meet them again.

- If you have met the maximum out-of-pocket amount and the employer plan is covering all the health care and drug costs, it may not make sense to enroll in an individual and family plan.

- Some employers will make a contribution to the COBRA coverage for a specific period of time.

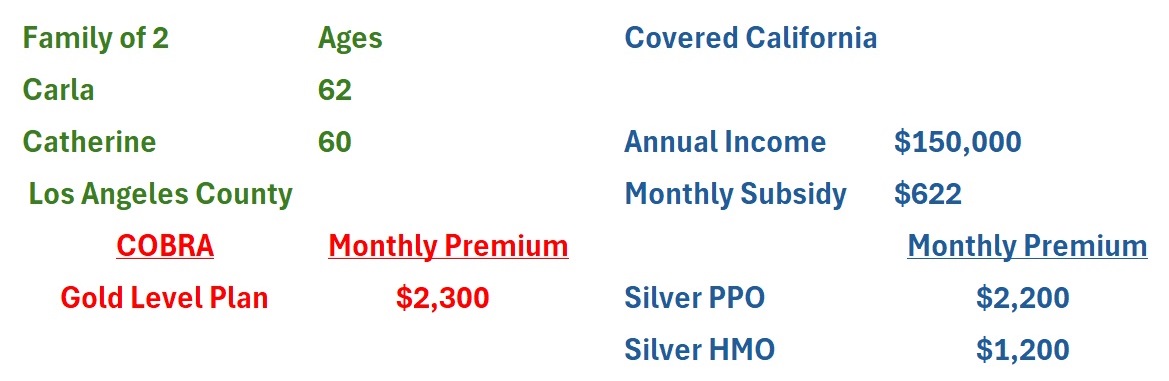

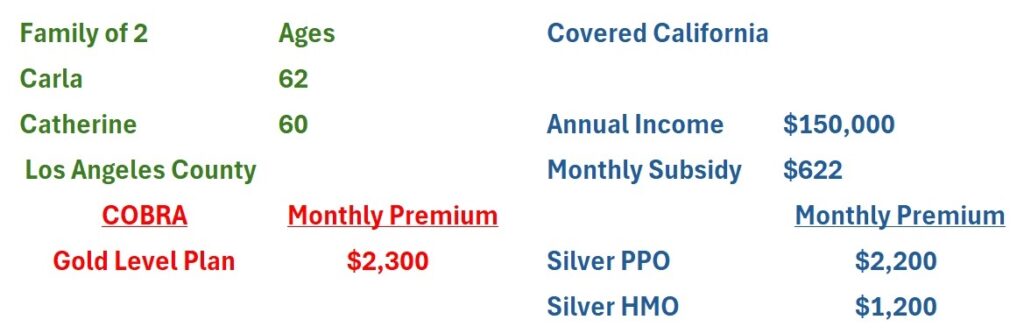

If the household income is still relatively high, the household may not be entitled to much of a subsidy. This may be another reason to enroll in a COBRA plan. As an example, Carla and Catherine decide to retire in the middle of the year. They will be offered COBRA at $2,300 per month for their Gold level health plan.

Because they will retire in the middle of the year, all the employment income they have earned will be factored into their annual household income for the purposes of determining their annual subsidy. With an annual income of $150,000, they are entitled to a $622 monthly subsidy. That makes a Silver PPO plan approximately $2,200 per month and a Silver HMO $1,200 per month.

When Covered California Subsidy Is Better Than COBRA

For Carla and Catherine, they do not believe it makes sense to enroll in a lower metal tier plan with higher cost-sharing through Covered California for the remainder of the year. In addition, any health care costs they have paid that went toward meeting any deductible or maximum out-of-pocket amount of the employer plan would be lost.

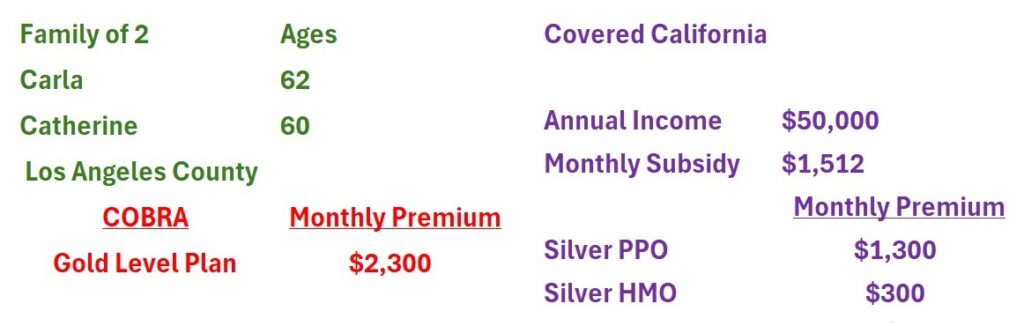

The subsidies offered through Covered California are based on the tax year. Because Carla and Catherine will not have employment income, their income will drop by $100,000 to $50,000. When the open enrollment period starts in the autumn, they review their options with the lower income. With an income of $50,000, they are eligible for a subsidy of $1,512, making a Silver PPO plan $1,300 and a Silver HMO plan approximately $300.

Flexibility of Family Plan Enrollments

At this point, it makes financial sense for them to enroll in Covered California for a full 12-month period as opposed to switching when their COBRA expires. The monthly premium savings are significant compared to continuing the COBRA plan. If either Carla or Catherine are receiving health care for an illness or injury, and the Covered California plan does not include the provider, they can use the continuity of care provision to continue to see those providers.

Another benefit of Covered California is the ability to select different health plans for different family members. Unlike employer plans and COBRA, all family members do not have to be enrolled in the same health plan. For example, Carla could enroll in a Platinum PPO plan through Covered California while Catherine selects a Bronze HMO plan. Each family member gets the health plan they want and the entire family saves money.