Major health plans cut agent commissions for individual and family plans in California for 2018.

With the onset of the open enrollment season for 2018, health insurance agents have been greeted with a fresh round of commission cuts from the health plans. Health insurance agents who enroll 45% of all Covered California individual and family plan members will realize significant decreases of income as Anthem Blue Cross, Blue Shield and Health Net restructure and cut commissions paid on enrollments for 2018.

Cutting Health Insurance Agent’s Commissions

The first punch to the agent’s gut occurred on October 6th when Health Net announced they were moving from a commission percentage based on the total premium amount to a flat per member per month (pmpm) compensation. Health Net notified agents that they were scarping their 2% commission rate and moving to a $14 pmpm for all individual and family plan (IFP) renewals and new enrollments. The rational was that the new parent company, Centene, did not have a computer system set up to compute commissions on a percentage basis. But in a letter to agents they said they were modernizing systems to reflect the changing face of our industry – I think that would be a frowny face from my perspective.

At Health Net of California, Inc. and Health Net Life Insurance Company (Health Net), we’ve been modernizing systems and processes to reflect the change face of our industry. As always, our priority is to help you do what you do best – connect your clients with right-fit health coverage. So we’ve restructured our 2018 broker compensation package to maintain long-term stability, drive growth and reward you for your hard work. – Health Net

Health Net PMPM

They want to reward me for my hard work by cutting my commissions. Please Health Net, kick me again as I writhe on the ground. To be fair, in some instances, the $14 pmpm will be a higher commission rate than the 2% on the total premium. Unfortunately, any client account that has a monthly premium over $700 will yield a small commission to agents from Health Net under the new compensation scheme. According to Covered California the average premium per person in Northern California is $496 per month and $379 in Southern California. This means a household of two family members enrolled in a Health Net plan will yield a smaller monthly commission to the agent in 2018 because of the switch from 2% to $14 pmpm.

Blue Shield Slashing PPO Commissions

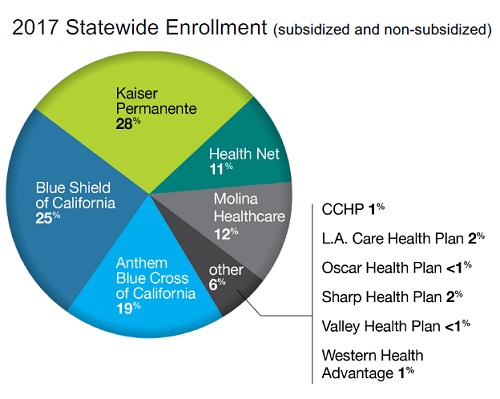

The next shoe to drop – on the agent’s head – was the 50% cut to commissions on PPO plans from Blue Shield. Blue Shield was handed a huge gift of enrollment increase as Anthem Blue Cross decided to stop selling IFP health insurance in most of California. Blue Shield has 25% of all enrollments through Covered California in 2017 and Blue Cross has 19%. In the Bay Area, Sacramento region, and Southern California where Blue Cross will be closing plans, Blue Shield and Health Net will probably pick up most of the business. It’s possible that Blue Shield will be the larger carrier by enrollment in 2018 for health insurance through Covered California. There is no better time to cut commissions than when your market share is increasing.

On October 30th Blue Shield informed agents they were cutting their PPO commissions from approximate 2.5% down to 1.4% for new enrollments and 1% for renewals. However, as an incentive to push their HMO plans, Blue Shield will pay 2.4% on new HMO members and 2% for renewing members.

As we experience changes in the California IFP market, we remain committed to you, your clients, and all the people who rely on IFP plans. Every day, you help make Blue Shield of California one of the state’s most sought-after health plans to cover Californians, and we couldn’t do it without you. Because you never stop, we never stop. – Blue Shield of California

Yes, I never stop coughing at the ingratiating phlegm of statements some of these carriers use in an attempt to endear themselves to agents. Because you never stop, we thought we’d try to trip you up by cutting commissions down to the bone. That’s correct; agents are seen as the fat in the system.

Kaiser Permanente, for their large membership base, has always had one of the lowest agent compensation structures. They pay a ‘reward’ of $100 per person for new enrollments and $50 per person for renewals. (I’ve earned larger rewards for returning a lost dog to their owner.) Kaiser reward system translates into $8.33 per month for new enrollments and $4.17 for renewals. Applying the new Blue Shield PPO commission to the average Northern California rate, agents will earn $6.94 for new enrollments and $4.96 for renewals per month.

All I can assume is that Blue Shield looked at the 28% market share of Kaiser, understood they pay some of the lowest agent compensation rates, and decided that if they were to be number one in the market, they had to whack on the agent commissions.

Covered California market share by carrier in 2017.

Anthem Blue Cross Trapped In California

Anthem Blue Cross desperately tried to leave the California IFP market. Somehow Covered California grabbed them by the ankle as they were trying to run through the door, like a woman trying to run away from Harvey Weinstein, and forced them to stay in Regions 1, 7 and 10. That translates into sparsely populated Northern California counties (Region 1), super high income Silicon Valley Santa Clara Valley (Region 7), and an odd collection of San Joaquin Valley counties (Region 10) where the CEO of Anthem Blue Cross must have a relative living.

Anthem Blue Cross notified agents on Halloween that the compensation would be cut to $9 pmpm for new and renewing members from approximately $14 and $12 respectively in 2017. On the bright side, the new compensation schedule does not apply to existing business, but since they are leaving most of the state, there is not that much membership that will carry over into 2018.

Blue Cross didn’t attempt to patronize agents with hollow words of praise like Health Net and Blue Shield did. Their announcement was tinged more with resignation that they even had to remain in California. Also absent from the perfunctory notification was any gleeful proclamation of a bonus program. (Anthem really does not want to sell IFP in California.)

Health Insurance Agent Compensation

As a point of reference, agents typically earn $500 for a Medicare Advantage enrollment, 10% commissions on Medicare Supplements, and 5% on small group employer health plans. The other health plans offered through Covered California have compensation structures ranging between $12 and $16 pmpm. However, servicing the IFP market, especially if the household is going through Covered California, will easily command three to five times the work on the part of an agent than other above mentioned types of health insurance.

Bonus, Bonus, Bonus!

Similar to a carnival barker enticing young teenagers to step right up and be rewarded for their skillful participation in a rigged game of throwing hoops or balls at moving targets, Health Net and Blue Shield rolled out their own rigged bonus programs. The bonus programs reward agents for enrolling new members into their health plans. The bonuses are above the monthly compensation structure. They are also an implicit nod to how the new commission structures are slowly strangling agents. But they are trying to put on a happy face with the bonus program as they slowly turn the garrote around the agent’s neck.

Bonus If Client Is Over 40

The Health Net bonus reward program will pay $100 per person if the individual is between the ages of 40 and 64 with an effective date of January 1, 2018. It only applies to their CommunityCare HMO, EnhancedCare PPO and off-exchange PPO plans. It does not apply to enrollments into the PureCare HSP or PureCare One EPO plans. In other words, agents can get a bonus for enrolling older people in more expensive health plans relative to the other options available in the market place.

Please Add Dental And Vision Insurance, Please

Blue Shield is offering a bonus of $100 per HMO enrollment and $125 if the enrollment includes a specialty product such as dental or vision insurance. The HMO bonus goes up to $225 if the agent can enroll over 100 members in an HMO with specialty insurance. There is no extra bonus for enrolling a Blue Shield PPO member until the agent reaches 100 new enrollments. At that magic level, Blue Shield will pay a $25 bonus or $50 per person if a dental or vision plan is tacked on. Agents can earn up to $100 per member with a specialty plan if they enroll over 1,000 PPO members.

Blue Cross Members Excluded

Unlike Health Net, Blue Shield will pay bonuses on enrollments through the January 31, 2018 Open Enrollment season. But here is the big kicker; no enrollment received through Covered California due to Anthem’s exit from the market will be eligible for the bonus. Of course, it is Anthem’s closure of plans in most of California that will fuel Blue Shield’s market growth in 2018. I’m not sure where Blue Shield thinks all these new consumers are going to come from. Are agents supposed to hound their Kaiser clients to switch? Good luck with that proposition.

This is why I hate the insurance industry and insurance sales. It all revolves the never ending greed for money. These bonus programs reward production, new sales, to the detriment of existing customer service on the part of the agent. They dangle a sparkling jewel in front of agents only to snatch it away because of their carefully designed conditions that precludes the possibility of actually reaching the goals.

I don’t see myself as a producer, as the insurance industry likes to characterize agents. I see myself as an enrollment counselor. The absolutely counter-intuitive scenario has occurred in which as my service to consumers has increased, I am compensated less. Agents not only have to know about health insurance, in today’s market we need to understand

- How the Covered California enrollment application works

- Who qualifies for Medi-Cal in the household?

- How to determine the Modified Adjusted Gross Income.

- Which immigration documents need to be supplied?

- The difference between EPO, HMO, HSP, and PPO plans.

- Which doctors and hospitals are in-network?

- Which drugs are covered?

Our service to clients doesn’t stop at issues or problems with the health plan, we need to supply support to

- Assistance for changes to the Covered California income section

- Adding and removing family members

- Explaining the 1095-A and how to get a corrected copy

- Explaining to clients how to work with their local county Medi-Cal office

While I can’t speak for other agents, I don’t discriminate on the basis of the client’s income. If their income is too low for the Covered California monthly tax credit subsidy, I complete the application that makes them eligible for Medi-Cal. Agents are not compensated for assisting people in Medi-Cal. This includes many families whose children are automatically Medi-Cal based on the household income.

Agents provide more assistance to consumers than the Covered California enrollment call center staff because we help individuals and families find the right health plan based on their unique health challenges or needs. We call the health plans on behalf of clients when there is a problem with enrollment or billing. We’ll take the time to understand the family’s income to make sure that it is properly reported to Covered California and avoid the expensive repayment of the Advance Premium Tax Credit on their federal tax return.

Don’t Shower Praise Without Compensation

Frankly, I’m tired of hearing from both the health plans and Covered California about how important and valued the agent community is. Agents enroll 45% of the consumers through Covered California. Peter Lee, Executive Director of Covered California, always stands up in front of the room to tell agents they couldn’t have done it without us. I actually have a lot of respect for Mr. Lee as he has guided Covered California through the Syrian landscape of health care proposals supported by the Trump Administration. But he may have to find out if Covered California can do it without agents because these cuts to commissions are forcing agents out of the IFP market place. At the very least, agents will be cutting back their own marketing and enrollment of IFP clients.

I’m an independent agent who works out of my house. I can’t imagine running an office with staff I have to pay. Between no compensation for Medi-Cal and dwindling compensation for IFP, how can an agent with a team of customer support representatives justify the time and effort to enroll consumers either off-exchange or through Covered California health plans?

Covered California Earning 4% Commissions

The Covered California budget is largely based on the 4% fee they assess health plans on the total premium for each enrollment. Let me repeat that, Covered California receives 4% of the total premium for each consumer enrolled in a health plan through their program. The Marketing Matters research paper that Covered California sponsored noted that agent commissions had dropped to 1.6% on average with the implementation of the ACA. With the new commission cuts, that average will drop even lower.

Revenue Down, Workload Up

But what has stayed constant, and actually increased with the chaos of the 2018 enrollment season, is the service agents give to clients. Agents now have to determine if a client should stay in Covered California or go off-exchange because of the Silver plan surcharges. Thousands of Anthem Blue Cross members are being renewed into the least cost metal tier plan through Covered California. What would have been a passive renewal had Blue Cross remained in California, now becomes an active renewal as all the options have to be considered for the client.

I truly enjoy my work as an agent in the IFP market. I have clients from San Diego to Eureka. I have great conversations with people from all over California, and a few outside as well. But how can I take the time to listen to people and understand their health insurance requirements and challenges if I’m making less than a Covered California customer service representative? I don’t have $111 million dollars like Covered California to advertise my services. What agent does?

The health plans and Covered California may give lip service to the value of the agent community, but it is not reflected in the compensation we receive. I’m not trying to get rich as an insurance agent. My net revenue listed on my Schedule C for 2016 was $34,000. If the new compensation schedules significantly erode my insurance revenue then I will have to find other income streams. Maybe Covered California will hire me to answer phone calls; I hear they have a great benefits package.

CoveredCA_Marketing_Matters_9-17

Marketing Matter: Lessons from California to promote stability and lower costs in National and state individual insurance markets.