It is counterintuitive, but for 2022, increased competition in the health insurance market for Contra Costa County will increase the premiums for Covered California members in the region. How is this possible? The subsidies are based on the Second Lowest Cost Silver Plan. Bright HealthCare, a new health plan, will offer Silver plans in 2022 with rates lower than the previous Second Lowest Cost Silver Plan for 2021. This means a lower subsidy for Contra Costa consumers, increasing their health insurance premiums.

Competition Deflates Contra Costa Covered California Subsidies

A similar subsidy deflation occurred in 2021 when Oscar health plans entered San Mateo County. The Oscar Silver plans became the Second Lowest Cost Silver Plan (SLCSP) in the county with a rate lower than the 2020 premiums for Chinese Community Health Plan. Bright HealthCare rates seems to have displaced the previous SLCSP Blue Shield PPO plans in Contra Costa County.

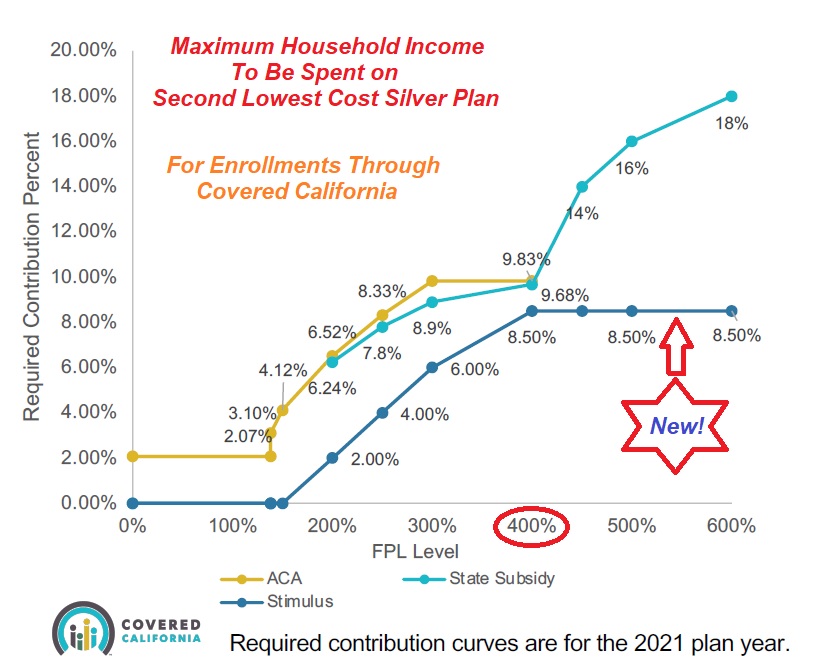

The SLCSP is the benchmark rate for determining the subsidies dispensed by Covered California. The Affordable Care Act subsidy formula is configured to make the SLCSP premium a certain percentage of the household income. For upper income individuals, at least through 2022, the subsidy curve is set so that no household will have to pay more than 8.5 percent of their household income for the Second Lowest Cost Silver Plan. The subsidy determined by this formula can be applied to any plan or metal tier.

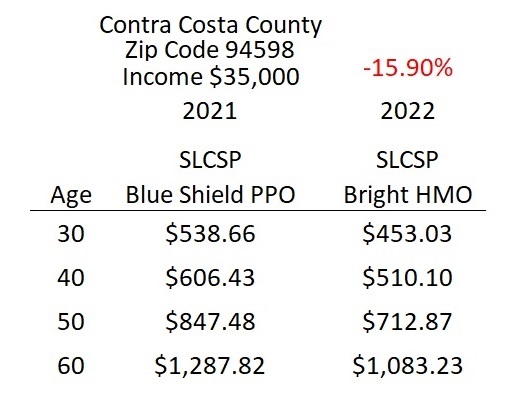

In 2021, for most consumers in Contra Costa County, the Blue Shield PPO plans were the SLCSP. For 2022, Bright HealthCare HMO plans will be the SLCSP. The problem is that the 2022 Bright health insurance rates are approximately 15.90 percent lower than the 2021 Blue Shield PPO rates. Because the subsidy keys off of the SLCSP, everyone in Contra Costa County will see a decrease in the Covered California subsidy to lower their health insurance premiums.

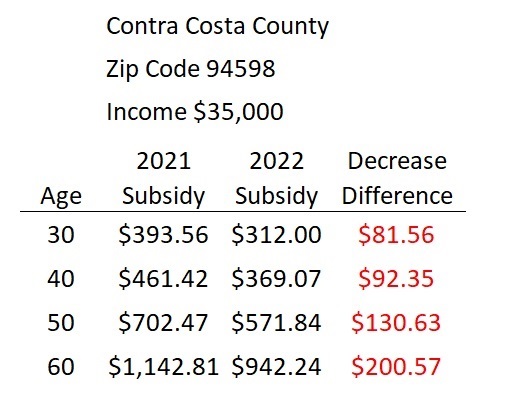

The lower SLCSP translates into a $200 loss of monthly subsidy for an individual who is 60 years old and earning $35,000 annually. A 60-year-old individual, after the monthly subsidy, paid $145.01 for the Blue Shield PPO SLCSP in 2021. In 2022, a 60-year-old, earning $35,000, will pay $299.43 monthly for a Blue Shield PPO Silver plan. This is an increase of $154.42 per month.

Increased Premiums For Age and Loss of Unemployment Insurance

But wait, it gets worse. The 60-year-old of 2021 is now a year older with the rate for age 61. Plus, if the current carrier, regardless of metal tier Bronze, Silver, Gold, or Platinum, had a rate increase, the subsidy decreased is magnified as it covers a smaller portion of the overall rate. If your Bronze plan went up 5 percent, and the SLCSP decreases 15 percent, the subsidy will be a small percentage of the total monthly rate than in 2021..

Finally, if the household was the recipient of the unemployment insurance benefit subsidy – that brought the 2021 income down to 138.1 percent FPL, increasing the subsidy – that special subsidy vanishes for 2022. If the household income is over 150 percent of the federal poverty level, the subsidy will decrease in 2022, dramatically as the household income increases. That means, for some people who were paying $1 for a Silver plan, the monthly premium will jump up significantly.

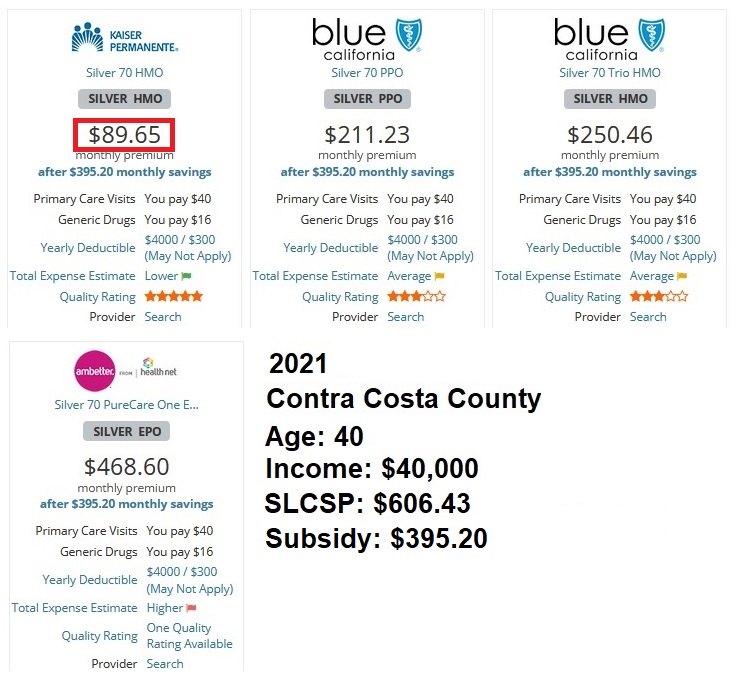

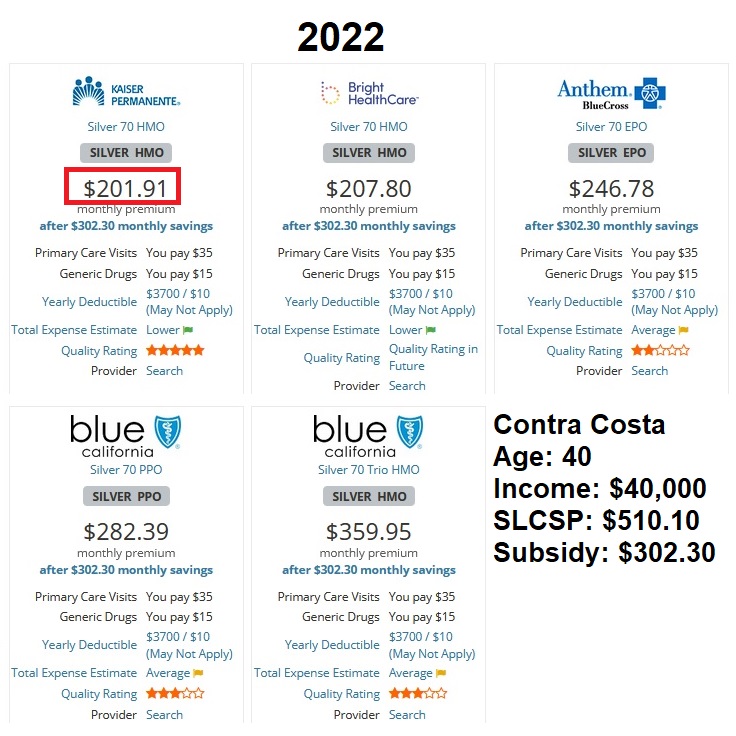

The lower subsidy will also impact consumers in less expensive plans. A 40 year old, with a $40,000 income, in a Kaiser plan in Contra Costa County will see the monthly premiums double.

A 40-year-old earning $40,000 in Contra Costa County would pay $89.65 for a Kaiser Silver plan in 2021.

In 2022, a 40-year-old at $40,000, will see the Kaiser Silver plan in Contra Costa County increase to $201.91, double the premium from 2021.

Covered California always touts that consumers can save money if they switch to a lower priced plan. Well, if lower priced plans don’t have your doctors in-network, then it really isn’t health insurance. And while Covered California heralds an overall low-rate increase of 1.8 percent for 2022, the residents of Contra Costa County may find that congratulatory announcement hollow as they face a minimum 15 percent monthly increase.

2022 Bright IFP