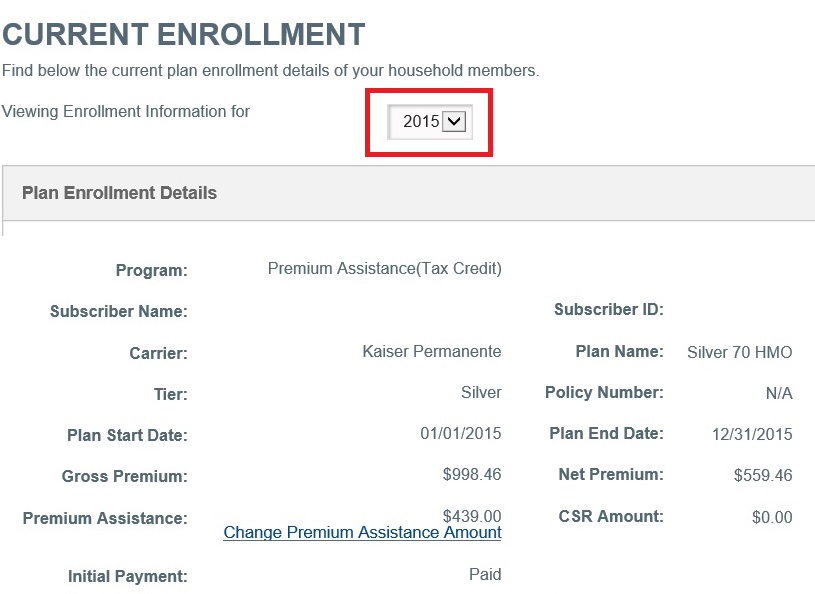

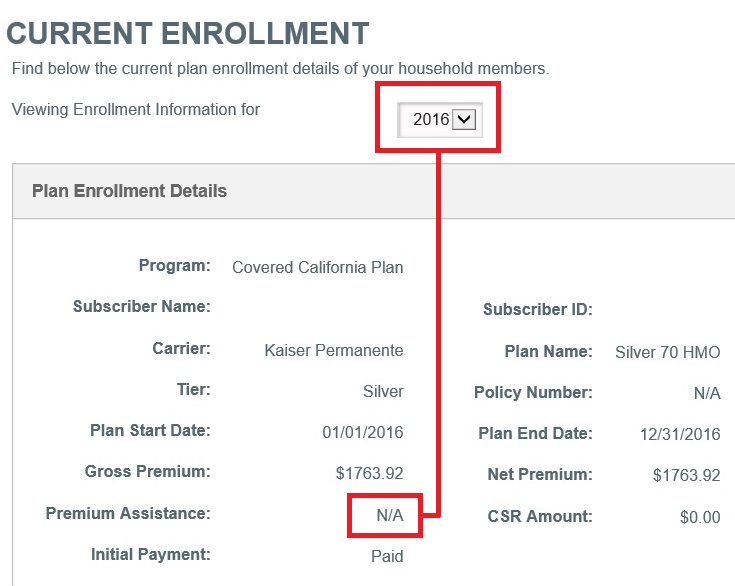

Errors and omissions on some Covered California enrollment will allow the tax credit subsidy to melt away in 2016.

Covered California is cancelling the Advance Premium Tax Credit subsidy that lowers a household’s monthly health insurance premium for 2016 for some consumers. Through Covered California’s automatic renewal process I’ve seen several families’ tax credits disappear for 2016. Without intervention or explanation, many families who had their health insurance automatically renewed may receive a bill for the full premium amount because the tax credit subsidy was eliminated by Covered California.

Tax subsidy lost without consent for verification

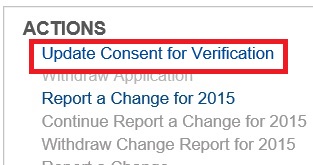

There are several reasons why the household tax credits will melt away in 2016. The first is that the household has not updated their Consent for Verification. Without the consent Covered California will not authorize the tax credit subsidy. But it is not as simple as

The Update Consent for Verification is only recognized when the application goes through the Report a Change function. If consent is not given, the household is ineligible for the tax credit premium assistance.

clicking on the Update Consent for Verification button and selecting the default five year period. This action must be in concert with Reporting a Change to the household. You should Update the Consent and then go through the process of Reporting a Change for 2016 to trigger.

If your health insurance subsidy has been deleted, and you’ve updated your consent for verification, you need to carefully scan your application for any missing information that may trigger an ineligible status for the tax credits.

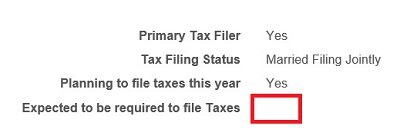

Primary tax filer required to pay taxes?

I’ve had two households where the enrollment question of “Is the Primary Tax Filer expected to be required to file taxes?” has neither a Yes or No radial button highlighted. This question had to be answered originally during the initial application process for the household to have received the tax credits for the last year. Why the Covered California system has mysterious unchecked the Yes response to the question is unknown. But the effect is that individual or family is determined to be ineligible for the tax credits in 2016 if they don’t indicate they will filling their taxes according to Covered California staff.

Affordable employer group coverage condition

One of my clients who had their premium tax credit eliminated for 2016 not only had the Primary Tax Filer Income Tax Return question unchecked, but one of parent’s was flagged for being offered group insurance. There is no dispute that the one parent is enrolled in a group health insurance plan. Technically, if the dependents and spouse are offered coverage and the employee only premium is considered affordable, the rest of the family is ineligible for tax credits through Covered California. You need to review the information and make sure that the group plan is either employee only coverage or the employee only premium amount is greater than 9.5% of the household income.

Review the application for missing data

Had I not caught the loss of tax credits when I was modifying their income they would have received a huge bill in December for the January 2016 premium. At least we can put in the necessary information into the system to keep the family’s tax credit in place for 2016. But the question remains as to why Covered California couldn’t have sent out a short letter noting they received information about the group health insurance and without additional information before December 15th, the family will lose the APTC for 2016.

Mysteriously, this families answer on the requirement to file taxes became blank at renewal time. It had to have been check in the affirmative for the family to have receive the tax credit premium assistance in 2015.

Lack of notification will surprise many families

A quirk in the system is not to be unexpected, but the lack of correspondence about the elimination of the tax credits is a true failure. I could only find eligibility determination letters stating the household would receive no tax credit subsidy if a change to the application had been made. If the enrollment was automatically renewed, and there were issues with the application that prevented the tax credit subsidy from being applied, I could find no letter indicating this fact to the consumer.

Why can’t Covered California send a simple letter?

A simple letter notifying a household that they will not receive a monthly tax credit subsidy in the coming year should be standard operating policy. Covered California had ample time to collude with the health plans to automatically renew members into plans before the plans had even released their plan documents.

A rush to re-enroll consumers

The rush to “re-enroll” households borders on consumer fraud. There were significant changes to the standard benefit design that applied to all the metal tier levels. The Bronze plans received a pharmacy deductible and prescription cost cap. Silver through Platinum plans also received the prescription cost cap and Bronze H.S.A. plans switched from an aggregate deductible to an embedded deductible. The health plans also major changes to their plans. Anthem Blue Cross and Blue Shield dropped their EPO plans and converted them to PPO plans. We also have the new carriers of Oscar and United Healthcare.

Collusion with the carriers?

Covered California sent out letters to scare people into renewing early without encouraging consumers to research the health insurance changes or the new carriers in their market. It almost seemed as if Covered California had struck a deal with the insurance companies to help push consumers into their existing plans before the families had a chance to gather information and make an informed decision. Covered California can rent a big bus and travel the state but they can’t alert consumers with a simple letter that they will be losing the very essence of the existence of Covered California – the health insurance monthly tax credit subsidy.

[wpfilebase tag=file id=744 /]

[wpfilebase tag=file id=736 /]

[wpfilebase tag=file id=1048 /]