Through the power of the internet, many consumers searching for Covered California get baited to websites and then switched to insurance products that are not creditable health plans. While the advertising is not illegal, the lack of disclosure on the part of agents is unscrupulous. Consumers are enrolled into low-cost indemnity plans and health care sharing ministries that fall short of real health insurance.

Baiting Covered California Consumers and switching them to fake insurance

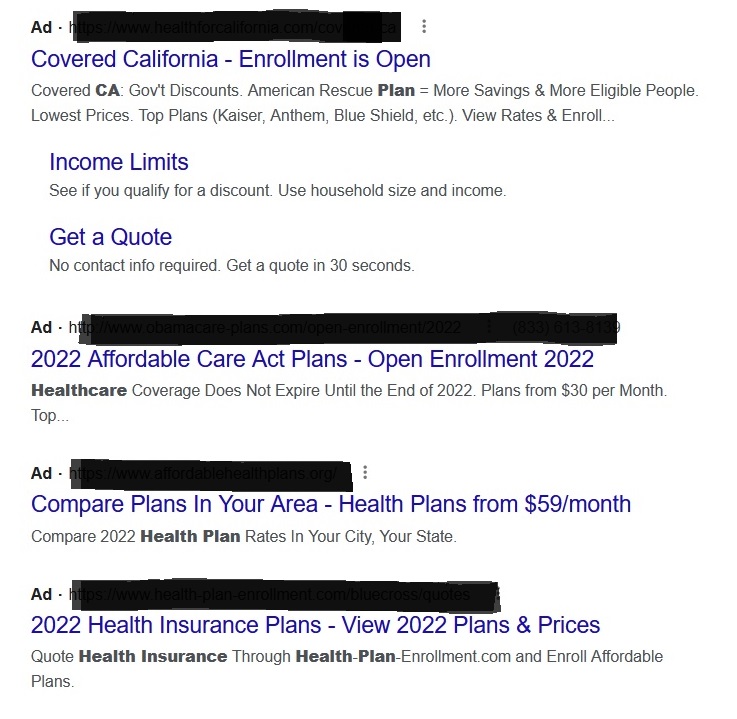

In performing an internet search for California Health Insurance, the top four results on the first page promised affordable health insurance, but none of them were Covered California. The top result even stated Covered California in the title, leading people to believe it is the official Covered California website, it isn’t.

Most of the links will take you to insurance agencies that can enroll you in a Covered California health plan. Unfortunately, some of the agents push indemnity and health care sharing ministry plans, not Covered California. Why do they do this? The commissions are higher for these plans. Once the consumer is enrolled in some of these plans, and subsequently want to terminate the coverage because they realize they did not enroll in real a real health plan, there is no support from the agency or the carrier.

The products being sold are legal and can work for some individuals and families if they understand how the plan or program work. An indemnity plan pays you for covered health care expenses such as a doctor’s office visit or hospitalization. The problem is there are numerous conditions for being reimbursed and the monetary benefit can be limited. While an indemnity plan can help defray the cost of a broken leg, if you need long term and expensive treatment, there can be no benefits.

The health care sharing ministry programs are not insurance. Like the indemnity plans, they have low monthly premiums and big promises of coverage. The health care sharing programs will usually not cover pre-existing conditions, have a cap on benefit dollars, and other exclusions and limitations wrapped around religious principles. The health care sharing programs can work for people, if the consumer is fully aware of all the details, limitations, and exclusions.

Neither the indemnity plans nor the health care sharing programs are offered by Covered California. Additionally, enrollment into those plans does not meet the criteria for creditable health insurance in order to avoid California’s individual mandate penalty for lack of coverage.

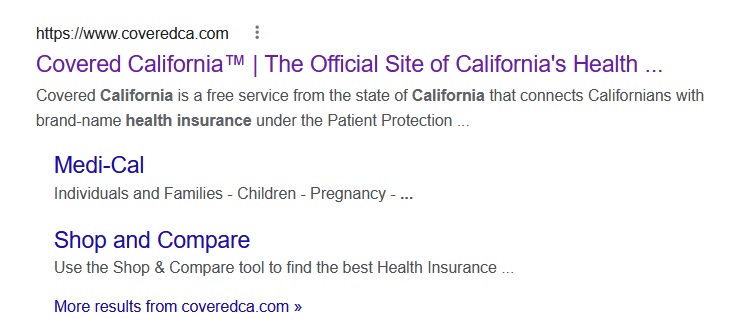

The official Covered California website is usually listed on the first page of most internet searches. The marketing failure is that Medi-Cal listed in the expanded search result. Most people are not looking for Medi-Cal, so they avoid clicking on the coveredca.com URL link. However, the Covered California Shop and Compare website is the best resource for comparing plans where you live, even if you are not eligible for a subsidy.

You don’t have to enroll in a health plan through Covered California, but you can find the plans that are offered in your zip code region and then go directly to the carrier’s website to enroll. (Note: Sutter Health Plus health plans and Health Net Full PPO health plans are not offered on Covered California, but are legitimate health insurance.) Searching the carrier’s enrollment has the same problems as searching for Covered California. The best advice is to make sure the carrier’s name or acronym is part of the URL to take you to the official website.

https://www.anthem.com/ca Anthem Blue Cross

https://www.blueshieldca.com/ Blue Shield of California

https://healthy.kaiserpermanente.org/northern-california/front-door Kaiser

https://cchphealthplan.com/ Chinese Community Health Plan

Steps to protect yourself from fake insurance tactics

Enrolling in health insurance can be complicated because each person has unique health care requirements. How do you protect yourself from bait and switch tactics?

- Don’t fill out an online form to be contacted later. That information is usually sold to other agent’s and you will be inundated with phone calls.

- If you have contacted a local insurance agency for assistance, get the agent’s health insurance license number. It should be on the website.

- Ask if the agent is a Certified Covered California Agent. Certified agents can sell Covered California and the same plans direct from the carriers.

- If the agent pitches another product, ask if the health plan or program is considered creditable health insurance.

- Ask the agent if they are appointed with all the carriers offered in your region. If they are not appointed with the carrier’s health plans, they may try to steer you to a health plan or program they are appointed with.

- If the agent says there is a one-time processing or underwriting fee, that’s a red flag. There should never be any extra fees for enrolling in health insurance through Covered California or directly with the health plan.

- Have the agent check to see if your doctors and hospitals are in-network with the health plan.

- Have the agent check to see if your prescription medications are covered.

- If you have unanswered concerns about the health insurance, ask that screen images of the enrollment be emailed to you for review before you make binder payments.

- If you believe you qualify for the subsidies through Covered California, create a Covered California account. Then when you find a health insurance agent you are comfortable with to assist you with the application, delegate the agent to your account. In this manner, you can review everything the agent has entered into your account and the final eligibility results.

- If an agent starts an application for you, when it is submitted the agent will see an access code. Ask for the access code so you can create a Covered California account and link it to the application.