Covered California consumers receiving letters they are not eligible for the monthly tax credit subsidy or denied altogether, AFTER the family had already renewed or enrolled for 2017

Some Covered California consumers are receiving confusing letters stating they are either not eligible for health insurance or will be awarded no monthly tax credits for 2017. These letters are arriving after consumers have already successfully renewed their coverage or just enrolled for 2017 health insurance. The letters seem to be automatically generated in error as the consumer’s account still show enrollment with tax credits.

Letters of No Subsidy and Denial

Many families are shocked to open a letter from Covered California informing they are not eligible for health insurance or they will be receiving no Advance Premium Tax Credit (APTC) monthly subsidy to lower their health insurance premium. The letters of denial come after a Covered California letter informing them have successfully enrolled and are entitled to the APTC. The consumer’s account still shows they are enrolled and eligible for the monthly tax credit. So what is going on?

Covered California Notice CCOE100 After Renewal

Covered California Eligibility

You qualify for health and dental insurance with premium assistance (a federal tax credit) through Covered California. This was based on your household income of $33,599.96 for the year ($2,800.00 a month). This is the income you said you expected to get for the year you want coverage. You qualify for up to $.00 per month in premium assistance to help pay for your health insurance coverage. Premium assistance cannot be used to help pay for dental insurance coverage. However, you do not qualify for cost-sharing reductions (lower co-payments and deductibles) because:

Your household income is above the limits for these programs. This was based on your household income of $33,599.96 for the year ($2,800.00 a month).

To help pay the monthly health insurance premiums for your household, you qualify for monthly premium assistance up to $.00.

The income amounts for this household are correct. The conclusions the Covered California CCOE100 notice represents are incorrect. The income is clearly within the guidelines. On page two, the letter gives additional explanations.

What to do next

The special enrollment period only lasts for 60 days after the event occurred. If you qualify for a special enrollment period, it will end 01/21/2017.

PLEASE NOTE: Call the Service Center immediately if your special enrollment period will end before we should finish reviewing your case. A representative will be able to help you.

The income of $2,800 per month is over the Medi-Cal limit for one individual. Since the consumer met all the conditions for receiving the APTC, there is no apparent reason for the denial of the tax credit. When you read further, this application was being reviewed for eligibility under the Special Enrollment Period conditions. But this household was already a Covered California member for 2016 and was just renewing coverage for 2017.

Covered California Notice CCOE100 After New Enrollment

Covered California Eligibility

You do not qualify for health insurance through Covered California, premium assistance (a federal tax credit) or cost-sharing reductions (lower co-payments and deductibles) because:

You do not qualify for health or dental insurance through Covered California because we got your application after the enrollment period ended. You may re-apply if your situation changes. Or you may re-apply in the next enrollment period. If you believe you qualify for a special enrollment period based on your situation, please call the Service Center at 1-800-300-1506.

Thank You…You Are Denied

This family had just received a Thank You letter from Covered California telling them they qualified for health insurance and would be receiving a monthly tax credit. The next letter, dated that same day as the Thank You, notifies them they are not eligible for Covered California…Special Enrollment. Unfortunately, most consumers are unaware of what a special enrollment is. They only read they are now denied after being enrolled. This family wasn’t applying for a special enrollment. But the system was screening the application as if it was or could be a special enrollment situation.

Transaction Summary

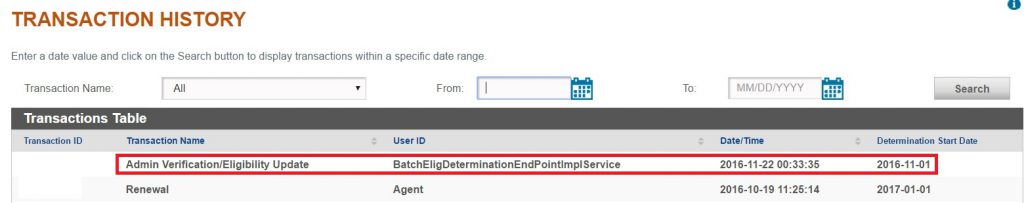

Of the consumer accounts I checked who had received these erroneous denial letters, there was a similar entry in the transaction history.

Admin Verification/Eligibility Update BatchEligDeterminationEndPointImpIService

Covered California CalHEERS automated review of application after the renewal. Note the determination Start Date is November 1, 2016, which probably indicates that the system was reviewing for a Special Enrollment Period, not the 2017 year.

This would seem to indicate an automated review of the account. Also notice the determination start date is for November 1, 2016, while the renewal is for 2017. The CalHEERS may have been determining eligibility for a special enrollment period. But why? Perhaps a value changed while doing the renewal or the new enrollment that automatically triggers a SEP review.

The CalHEERS (California Healthcare Eligibility, Enrollment, and Retention System) is a complicated piece of software. It must check a variety of conditions to determine if an individual or family is eligible for health insurance, Medi-Cal, Enhanced Silver Plans, etc. Many of these functions are triggered at the time of the application and some seem to be reviewed after the application has been submitted.

CalHEERS is always screening for different situations. For example, even though a family is applying for 2017 coverage, if they don’t include monthly income for 2016, at the time they are filling out the application, the household will be determined eligible for Medi-Cal. Why? Because CalHEERS is programmed to determine Medi-Cal eligibility on monthly income and this was not suspended for open enrollment. Consequently, families with plenty of income have been dropped into Medi-Cal because they didn’t enter any current 2016 income. See: Medi-Cal Takes Over Covered California

If you do receive one of the CCOE100 letters of denial after receiving a Thank You letter of enrollment, check the text to see if it mentions special enrollment. If it does, it probably has been generated erroneously by CalHEERS. Also check your enrollment summary to make sure you are still enrolled in your health plan with the monthly tax credit. There are valid reasons why the monthly subsidy may be deleted such as not filing a 2015 tax return or Covered California did not receive verification documents for income or immigration status. Covered California has generated lots of phone calls to its agent and consumer service centers because of poorly worded automated denial letters.