The most difficult, time consuming, and confusing part of the Covered California application is the crazy income section. In an effort to help consumers estimate their income, Covered California added all sorts of different categories and sections, which creates a rat’s maze where agents and consumers get lost. In reality, the IRS doesn’t care how you characterize your income on the Covered California application. The IRS and FTB only care about one number: your Modified Adjusted Gross Income.

As many people enrolled in Covered California have found out, the folks at Covered California will not talk about taxes. Most consumers have also learned the dirty little secret about the federal and state subsidies for health insurance; it’s all about your tax return. The Internal Revenue Service (IRS) and the California Franchises Tax Board (FTB) don’t care how you estimated your income to Covered California to become eligible for the monthly subsidies. They only care about the final income number (MAGI) that entitles you to a subsidy.

The IRS and FTB don’t care if you made all of your taxable income in January or December, in one month, or spread out over 12 months of the year. They don’t care if your taxable income came from W-2 employment, self-employed Schedule C, K-1, dividends, capital gains, interest on savings, or any other financial transaction that created a taxable event. They only care about comparing the Advance Premium Tax Credit subsidies you received from Covered California with your FINAL Modified Adjusted Gross Income and the tax credit subsidy you are eligible for at that dollar amount.

Calculation of MAGI IRS Form 8962

Modified AGI. For purposes of the PTC, modified AGI is the AGI on your tax return plus certain income that is not subject to tax (foreign earned income, tax-exempt interest, and the portion of social security benefits that is not taxable). Use Worksheet 1-1 and Worksheet 1-2 to determine your modified AGI.

Instructions for Form 8962

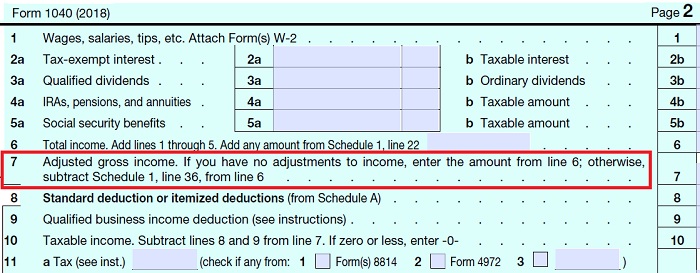

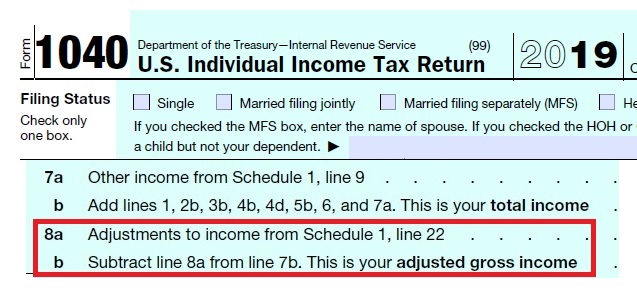

Adjusted Gross Income (line 7 of 2018 IRS 1040)

- Adjusted Gross Income (line 7 of 2018 IRS 1040)

- Plus: Social Security Retirement or Disability Benefits

- Plus: Tax Exempt Interest

- Plus: Foreign Earned Income

- Equals = Modified Adjusted Gross Income

The Adjusted Gross Income is the money you earned before any taxes are withheld from your paycheck or before you make your quarterly IRS self-employed tax payments. Your AGI is NOT your taxable income. Your taxable income is the AGI reduced by standard, business, or itemized deductions within the federal and state income tax returns. Those reductions to your AGI do not affect the income you are estimating for Covered California subsidies. The AGI is then modified or increased by the addition of certain Social Security benefits, tax exempt interest (usually from instruments like municipal bonds), and foreign earned income to get the Modified Adjusted Gross Income.

The Covered California application throws all of the income and deduction streams into their income section. Every category, income, or deduction section comes from the IRS. The Covered California income section duplicates your IRS tax return and the calculation of the AGI and MAGI. If you are a tax preparer, this all makes perfect sense. If you let a professional prepare your tax return or you use a tax preparation software to figure out your federal and state taxes, the Covered California income section seems really complicated.

The benefit of using the Covered California income section as designed, with discreet entries for various income and deduction streams, allows you to make adjustments to just those entries during the year. For example, if you had a specific entry for interest income, and it changed in the middle of year, you could adjust that monthly dollar amount. This relieves you from having to recalculate one monthly income amount to capture the previous and current interest income stream. The Covered California system will automatically do it for you.

The complicated part of the Covered California income section is that some entries go to determining your AGI, while others are for the modified portion of the MAGI like Social Security and tax-exempt interest. In addition, the assumption in the Covered California income section is that you are starting from ground zero. You are not simply entering your AGI, but the section is designed to estimate the AGI.

For instance, the income section has the consumer enter their self-employment income. But in a different section, they ask for business expenses. The taxable self-employment income from IRS Schedule C is gross revenue – business expenses. There are two potential problems. First, a consumer enters their gross self-employed revenue and doesn’t enter their business expenses. This makes their estimated income too high. Second, the consumer enters the net revenue for the business (gross revenue – expenses), but then enters the business expenses again under the deduction section for business expenses, artificially deflating the income.

One approach to entering income and deduction information into the Covered California income section is to base it on your last federal income tax return. Then if the final annual household income amount in Covered California closely approximates your AGI + Social Security + Interest + Foreign Earned Income = MAGI, you know you are on the right track. You can then make adjustments to those entries to reflect the income estimate for the enrollment year.

Alternately, some consumers will just make one entry of income that captures or accurately reflects their estimate for the MAGI. There is nothing wrong with this. For many households, the AGI is the MAGI. The tax preparer has already crunched the numbers to determine the AGI. Why add the element of a potential error in the income by trying to recreate the AGI by filling out the Covered California income section?

Lowering The MAGI

There are several deductions a taxpayer gets to take that directly lower their AGI, and thus, the MAGI. The three entries most applicable for many consumers in Covered California are a contribution to retirement plan like an IRA, Health Savings Account contribution, and the deduction for self-employed health insurance premiums.

Many individuals and families won’t factor in an IRA contribution in the Covered California income section because they are not sure if they will make a contribution or not, and if they do, how large it will be. However, if the household income is getting close to the 400% of the federal poverty level*, or actually exceeds it, then the taxpayer can make a contribution at the last minute to lower the AGI. Contributions to a Health Savings Account will also lower the AGI; but the taxpayer must have a High Deductible Health Plan (HDHP) for this to be a valid deduction.

*If the household income exceeds 400% of the FPL by $1, all the subsidies from Covered California during the year must be repaid to the IRS.

Finally, self-employed individuals can deduct the portion of their health insurance premiums they actually paid to the health plan. If the individual or family is not receiving a large subsidy, this can equal thousands of dollars for the year. There is one calculation glitch with this deduction, it creates a circular reference to the AGI via Form 8962 the premium tax credit reconciliation. In short, the self-employed health insurance deduction lowers the AGI that feeds into Form 8962. When the AGI or MAGI changes on the Form 8962, it changes the subsidy amount. If the subsidy goes down, the taxpayer can claim a larger deduction for the self-employed health insurance deduction, which in turn, lowers the AGI and the circular reference repeats itself. The IRS knows about the circular reference and has instruction on how to deal with it.

Income of Investments

One question I often receive is that the individual or family’s income is made up solely of investment income that fluctuates and may not be realized until the end of the year. In these situations, you would characterize the income as an annual amount. Covered California will then slice up the amount into twelve equal increments for a monthly income.

The income section is very date sensitive. Covered California screens for Medi-Cal eligibility based on monthly income, not annual income. Therefore, it is very important that the month in which you apply – not necessarily the month the health plan is to start – has a monthly income over the Medi-Cal threshold. If you apply in November for a plan start date of January 1, and you indicate all your investment and retirement income starts in January, the system will determine you have NO current monthly income and deem you Medi-Cal eligible.

Net Operating Loss Carryover

The 2017 Tax Cuts and Jobs Act changed the way taxpayers can apply past business losses on future tax returns. However, many taxpayers have net operating losses that can still be carried forward on their federal tax returns, effectively wiping out their AGI. In order to be eligible for the Premium Tax Credits through Covered California, you must have a MAGI greater than 138% of the federal poverty level for the household size.

Individuals and families must estimate their next year’s income for the purposes of receiving the Premium Tax Credit during the year to lower the health insurance premium. As a consumer entering into Covered California you can estimate your income however you like. Covered California may request verification of your income.

If the individual or family knows that their net operating loss carryover will drop their AGI to zero in the next year, are they eligible for the Premium Tax Credits? From my perspective, the household is not eligible for the subsidy because there is a high probability that their MAGI will not be high enough to qualify. This is an obvious flaw in the Affordable Care Act that denies families assistance based on a prior income loss. The net operating loss carryover also reduces the liability for federal income taxes. One might argue that since the family may not pay any federal income tax, that is a subsidy to help pay for the health insurance.

The one thing I am certain of is that design of the Affordable Care Act made sweeping simplified generalizations about the nature and diversity of household income. There is a substantial portion of our population who don’t have traditional W-2 income. And many of these families also have 1099, self-employed, investment, retirement, and business loss income that flows into their AGI. Consequently, one of the most difficult parts of the Covered California application is the income section. It is a maze and families are wise to take their time and do some tax planning and forecasting for the next year so as to avoid being hit with a large IRS repayment of the subsidies they received from Covered California.

Covered California Countable Sources of Income

Countable_Sources_Income 2020 Covered California

2020 guide to countable sources of income from Covered California for the Modified Adjusted Gross Income based on revised federal income tax form 1040 for 2019.

2018

- Underpayment_Penalty_Calculation_form_2210

- Underpayment_Penalty_Instructions_form_2210

- 1040_Form_2018

- 1040gi_Instructions_2018

- 1040 Schedule 1 Form

- 1040 Schedule 2 Form

- 1040 Schedule 5 Form

- Schedule C_f1040sc_2018

- Schedule C Instructions_i1040sc_2018

- 8962 Form Premium Tax Credit_2018

- 8962 Instructions Premium Tax Credit

- Publication 974_2017

- HSA IRS Maximum Contributions Plan Design

- House 2017 Tax Cut Bill 115hrpt409

- Senate House Conference 2017 Tax Cut Bill115hrpt466

- Law change affects moving, mileage and travel expenses _IRS

- Deduction for Qualified Business Income Sec 199A FAQs_IRS

- Qualified Business Income Deduction IRS reg-107892-18

- Section 199A Calculating Wages W-2