Covered California consumers will receive not only a 1095A statement for 2020, they will also receive the new Franchise Tax Board (FTB) 3895 statement. The FTB 3895 will report any California premium assistance paid to the household’s health insurance plan and will also verify enrollment in Minimum Essential Coverage to avoid the new California individual mandate penalty. It is important not to confuse the two statements and erroneously report data to the incorrect taxing authority.

Estimated reading time: 5 minutes

1095A and FTB 3895 Report Different Subsidy Information

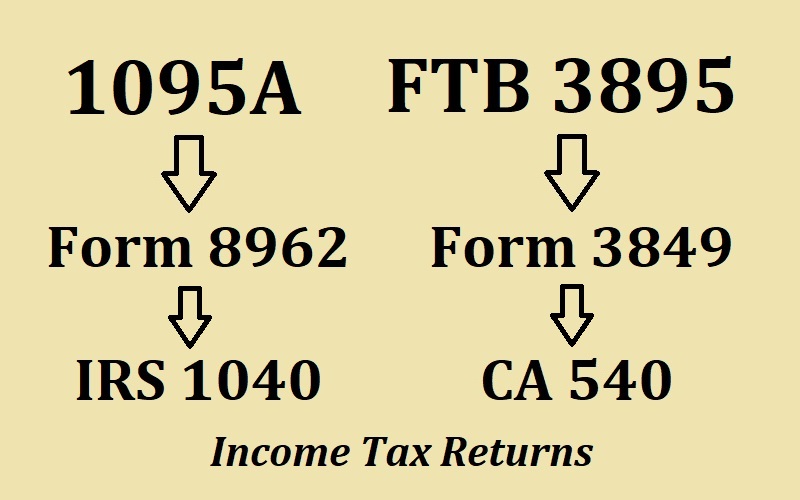

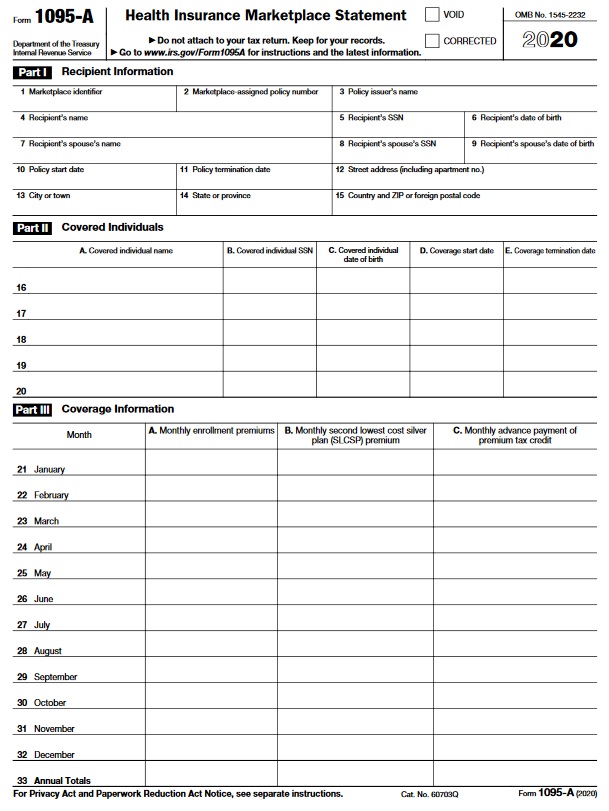

The 1095A statement of Advance Premium Tax Credits is used to report federal health insurance subsidies on your federal 1040 income tax return. The data from the 1095A is transferred to federal form 8962 Premium Tax Credit reconciliation. The final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either Schedule 2 or 3 of the federal 1040 tax return.

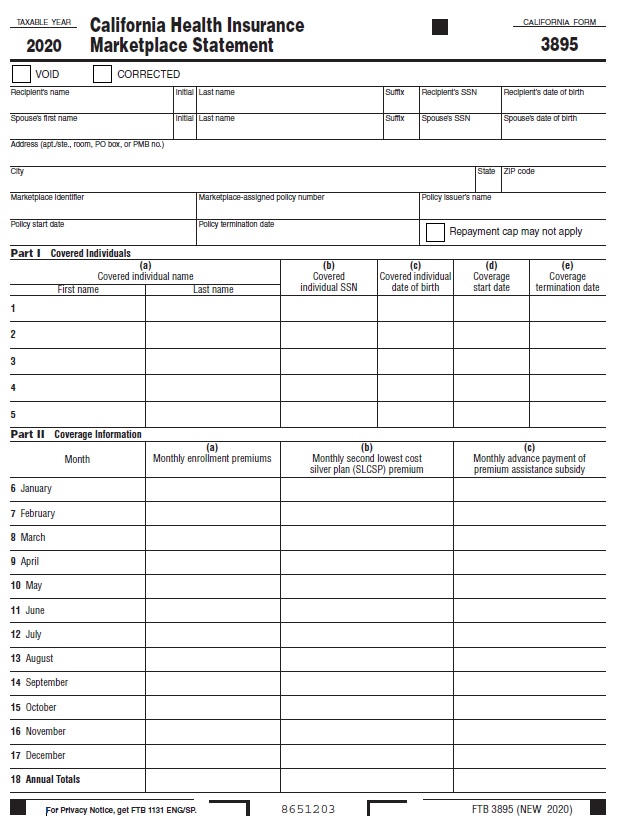

The new California Franchise Tax Board (FTB) 3895 is a close mirror image of the federal 1095A. The FTB 3895 statement reports important data regarding your health insurance through Covered California such as the monthly premiums, Second Lowest Cost Silver Plan, and how much Covered California paid to your health insurance company to lower your premiums.

The subsidy the State of California paid to your health plan, reported on FTB 3895, is different from the federal subsidy on the 1095A.

The new California subsidy was implemented in 2020. Covered California refers to it as the California Premium Subsidy. The Franchise Tax Board calls it the Premium Assistance Subsidy (PAS). When the subsidy was distributed to your health plan on a monthly basis, the FTB refers to it as the Advance Premium Assistance Subsidy (APAS.)

California FTB 3895 health insurance subsidy statement.

1095-A federal health insurance subsidy statement.

The 2020 California Premium Assistance Subsidy is reconciled similar to the federal subsidy. Information from the FTB 3895 statement is transferred to form 3849 to be reconciled with your final income amount and household size. The result, either a repayment of the California subsidy or additional tax credit, is then entered on your California 540 income tax return.

FTB 3895 Data To Avoid California Individual Mandate Penalty

Another important function of the FTB 3895 is that it reports the months in which you and your household members were enrolled in Minimum Essential Coverage (MEC.) For 2020, California has an individual mandate penalty for lack of MEC health insurance. FTB 3895 shows the months you had health insurance and are not subject to the penalty.

In an odd twist for 2020, some individuals may be subject to a penalty before they enrolled in MEC during the Special Enrollment Period with the qualifying event of the Covid-19 emergency. Additionally, they may also have to repay some of the APAS they received if their final California income falls between 138 and 200 percent of the federal poverty level. Unlike the federal subsidy, California does not offer a subsidy to household incomes below 200 percent of the federal poverty level.

Since most tax payers will use the help of a professional tax preparer or an online computer tax program, reconciling the two subsidies with the final taxable incomes will be relatively easy. However, because California has a different income eligibility range for the subsidies than the federal ACA program, some tax payers may have to repay subsidies to one or the other tax agencies.

For example, the federal subsidy only extends to incomes up to 400 percent of the federal poverty level, while California offers subsidies up to 600 percent. If a household received federal subsidies with an estimated income of 380 percent of the federal poverty level, but their final income number was 450 percent, they must repay all of the federal subsidy. They may get California subsidy, but it may not cover all of the federal subsidy that needs to be repaid. Additionally, depending on the rate of the Second Lowest Cost Silver Plan, the household may not get any California Premium Assistance Subsidy.

Most households should have no issues reconciling their federal and State income tax with the subsidy statements. Self-employed individuals who can deduct their health insurance premiums from their federal Adjusted Gross Income should pay particular attention to the calculations. There may be situations where the loss or gain of the California Premium Assistance Subsidy could change what they paid for their health insurance and in turn could force an adjustment to the federal Adjusted Gross Income.

1095A_FTB3895

- 540 Form 2020

- 1095A Notice

- 1095x Form Definition

- 3849 California Subsidy Reconciliation form 2020

- 3849-instructions 2020

- 3895 FTB CA Notice

- 3895 FTB CA Quick_Guide

- 3895 FTB Form 2020

- 3895 FTB Statement instructions-covered-ca 2020

- 3895 FTB Statement instructions-recipient 2020

- 3895b-MEC Penalty Reporting 1095B_pub 2020

- 3895c-MEC Penalty Reporting 1095C_pub 2020

As of January 12th, not all of the final California tax forms had been released. As the final versions are made available, they will be added to the folder.