The health plan benefits and member cost sharing are the same for each metal tier level regardless of the insurance company. In other words, regardless of which carrier you select, a Silver 70 health plan will have the same benefit design whether you enroll with Blue Shield, Kaiser, Health Net, or some other carrier. Even the off-exchange Silver 70 plans will mirror the Covered California design.

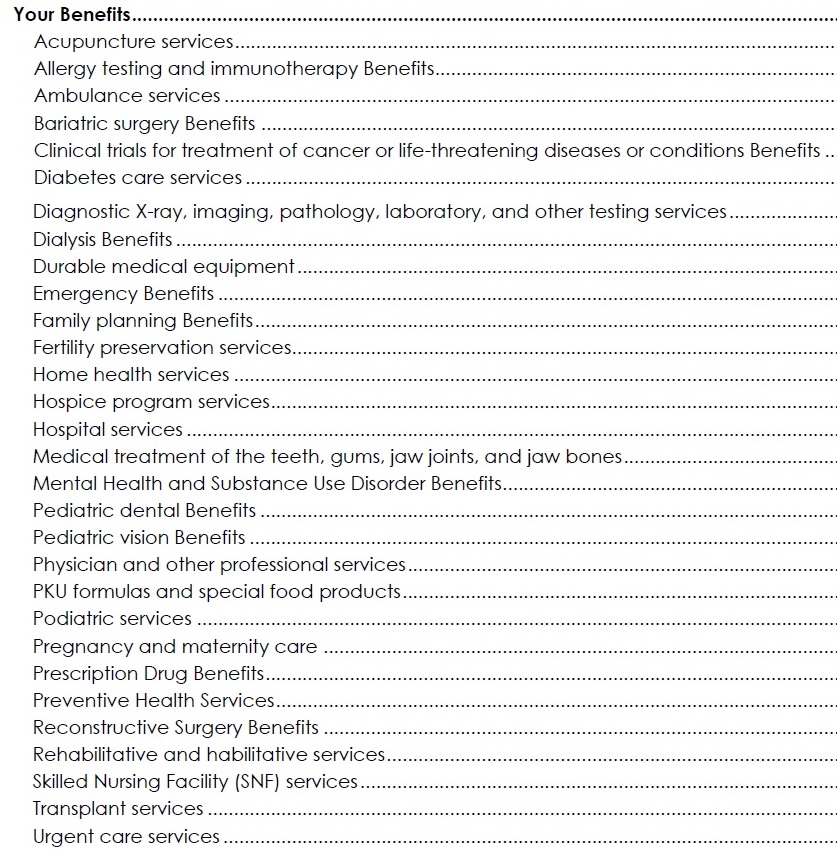

Essential Health Benefits Covered In All Plans

Covered California has taken some of the guesswork out of selecting a plan by allowing only standard benefit design health plans on the market place exchange. First, all plans must cover the same health care services from routine office visits, maternity, to mental health services. You will not find plans that are lower cost because they do not cover maternity or cap the benefits for cancer treatment.

Second, the member cost-sharing for medical services is the same within the metal tiers irrespective of the carrier. This means that a Bronze 60 has the same member cost sharing structure between all the different carriers offering Bronze 60 health plans. Regardless of whether the plan is an EPO, PPO, or HMO, the maximum out-of-pocket amount for a Bronze 60 plan is $8,200 for an individual in 2023.

Unlike other states, California does not allow multiple designs with various ancillary benefits on the exchange. Health plans are difficult enough to compare with some Silver plans having different deductibles, copayments, or extra benefits like dental coverage. While the variety can be nice, it can become impossible to make an informed decision. Do you enroll in the plan with a high deductible but with dental benefits or the plan with lower copayments and no dental coverage?

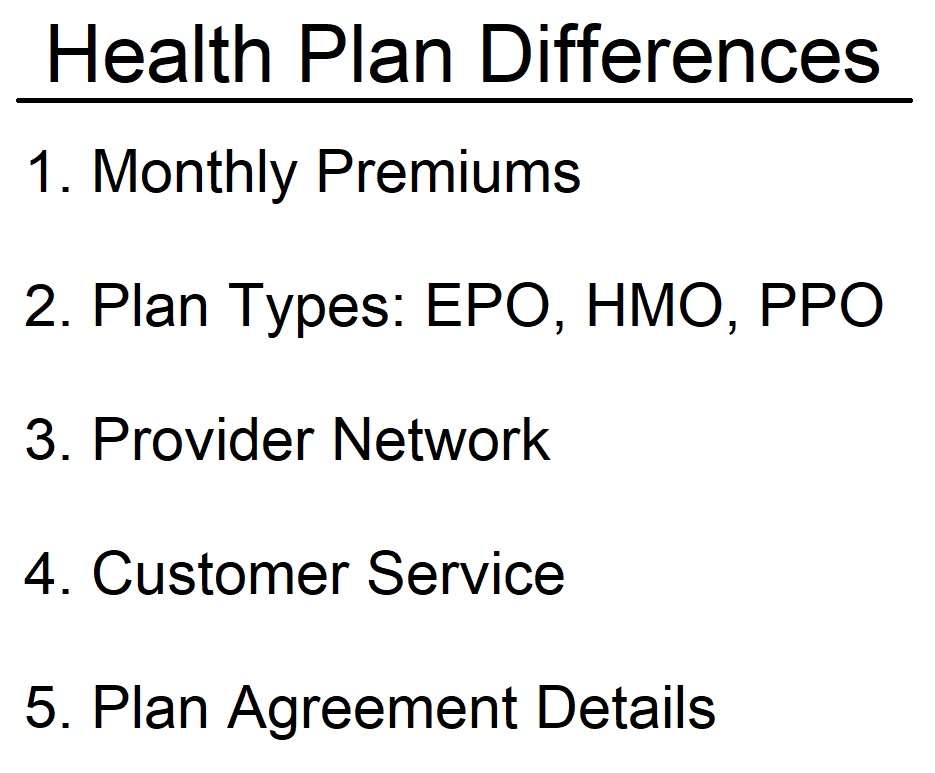

Health Plans Differ On Plan Type, Providers, Customer Service, Small Details

The health plans have enough differences within their administration to make them distinctive from one another. The first step is to determine which metal tier best meets your health care needs or that of your family. Remember, with Covered California, different family members can be enrolled in different metal tier plans AND with different carriers. You can have a Bronze with Kaiser while your spouse enrolls in a Gold plan with Oscar.

The real difference between the plans are the monthly rate, type of health plan (EPO, HMO, or PPO), provider network, customer service, and the details of the plan agreement. Everyone will prioritize these different elements according to what is most important to them. For some people, they are willing to pay more in order to get some of their preferred doctors in-network.

Monthly Premium Rate. The rates for the health plans are directly related to the contracts they have with medical providers (doctors, hospitals, labs, etc.) and the expected utilization of health care services in a specific region. Regardless of the monthly premium, you know that a Silver 70, from whatever health plan you select, will only have $8,750 maximum out-of-pocket for an individual.

Health Plan Type EPO, HMO, PPO. The health plan type is probably the largest distinction between the health plans. With the HMO design, you need a Primary Care Physician to refer you to most specialist and there is no out-of-network coverage. EPO plan types have no out-of-network coverage, but you can self-refer to most doctors in the network. PPO plan types usually offer the largest provider network, with no Primary Care Physician requirements, and potential coverage for out-of-network services once an out-of-network deductible is met.

Provider Network. The number and variety of providers in a network can be very important for some people. All health plans must meet minimum requirements for network hospitals, primary care doctors, and specialists. There will always be a specialist for a specific medical condition within the network of providers regardless of whether the plan is an EPO, HMO, or PPO. Some plans will have more providers than others, which can help reduce the wait time for an appointment. Of course, only certain health plans will have some of the more popular hospitals in-network.

Customer Service. Some health plans have better customer service than others. Customer service encompasses billing, paying claims, explaining health care charges, handling problems, changing the primary care physician designation, etc. Some health plans push members to use mobile phone applications to answer questions while other plans maintain properly staffed member service departments. Perhaps the least reliable indicator of customer service are the quality star ratings assigned to the health plan by Covered California. The ratings, based on a sample member population, seemed to be heavily influenced by individual biases. For each 2 star rated plan I can find people who had an excellent experience with the health plan. Similarly, there are people who have negative interactions with 4 and 5 star rated plans.

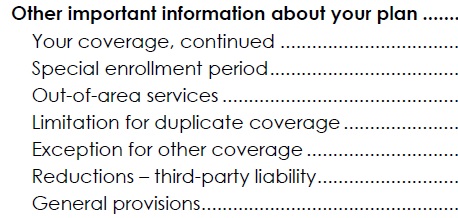

Plan Agreement. Also known as the Evidence of Coverage, the plan agreement or contract spells out how most of the routine health care services are covered. The agreement for EPO and HMO plans will state that no out-of-network services are covered. For PPO plans the agreement will note the out-of-network deductible. There can also be little interesting benefits and exclusions listed such as if you need health care services out of California and how those claims will be processed.

No Plan Exclude Any Essential Health Service

Even though all of the standard benefit metal tier health plan designs are mirrored between carriers, there can be profound differences between the health plans. What you don’t have to worry about is that a Gold 80 plan having a significantly different cost-sharing structure between health plans. You don’t have to worry that a Bronze plan won’t cover maternity compared to a Silver plan. All the covered benefits are the same. The big differences between the health plans lie in the monthly rate, the type, provider network, customer service, and details in the plan agreement.