Covered California and the IRS have been encouraging individuals and families that have purchased health insurance through the state or federal exchange to update their household income whenever there is a change. The simple act of reporting this change of income through Covered California is considered a qualifying event for a Special Enrollment Period. Once the income has been changed and submitted, the consumer is requested to enroll in a health plan. This re-enrollment has caused confusion among consumers and agents alike as all they wanted to do was update the income and keep the Advance Premium Tax Credits adjusted properly.

Income change triggers new health plan selection

Because household income is tied to the federal poverty line (FPL), even relatively small changes to wages or self-employment income can push a family into or out of Medi-Cal. In the scenario where the household income increases above 138% of the FPL, it would be considered an appropriate qualifying event to allow the selection of a private health plan with tax credits now that the household was no longer eligible for Medi-Cal.

Income change may result in Medi-Cal

Conversely, a decrease in household income may make the children or the whole family eligible for Medi-Cal if the income dips below 138% of the FPL. If this were the case, the family will not have the ability to select the same or new health plan because they would no longer be eligible for the tax credits. Not reporting the change to household income could make the family liable for the repayment of excess tax credits. But it remains to be seen how the IRS will handle such cases with their new ACA tax credit reporting forms. (See: IRS releases draft ACA tax credit reporting forms)

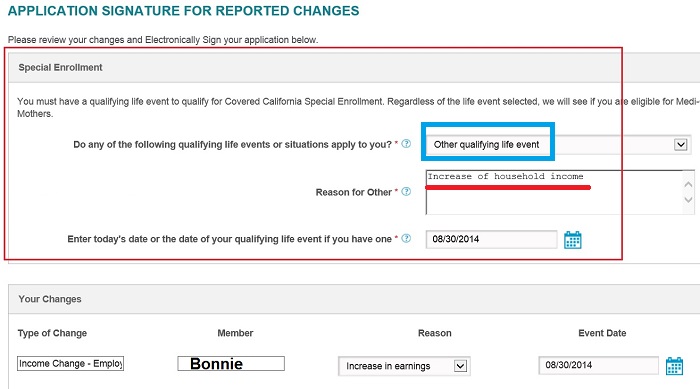

Income change is a qualifying event for Special Enrollment Period

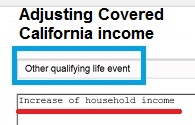

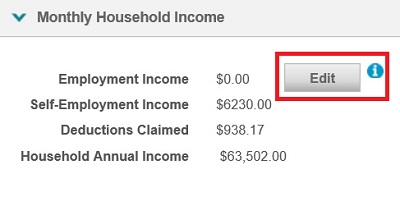

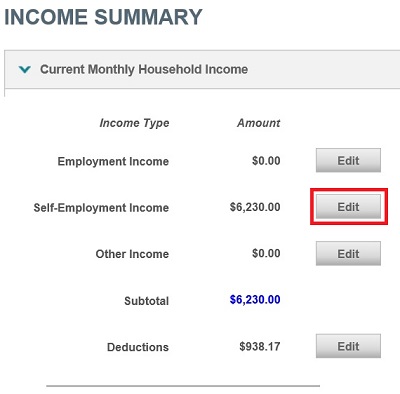

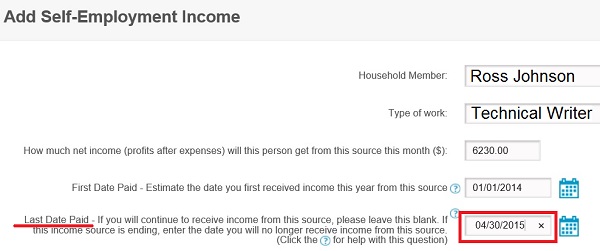

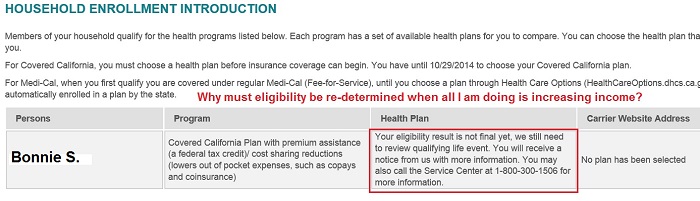

When you do report the change to household income you will be asked to specify the qualifying event for the Special Enrollment Period. For a simple income change you’ll want to select “Other Qualifying Event” from the drop down menu. You can then add a note as to the reason for the increase or decrease of income. Once you submit the changes you’ll be greeted with the enrollment eligibility page. Under the Health Plan box it will notify you that your eligibility is pending review.

Other qualifying event must be selected to report a change to income.

“Other Events” must be reviewed

The downside to having to select “Other Qualifying Event” to report a change of income is that it triggers the event to be reviewed. Consequently, you won’t be able to select a new or your current plan until it has been reviewed and approved by Covered California. The review is supposed to take no more than 72 hours. This means you have to log back into your account later in the week to select a health plan. The other option is to call Covered California after you have made the change and ask them to review it and flip the switch of approval so you can enroll in a health plan.

You can’t stay in your current health plan until your qualifying event has be approved.

Don’t forget to re-enroll

Once Covered California determines that you are just following their advice to regularly update your income, you’ll get the “Continue to Health Plan” button. You can then select the same health plan or change to a different carrier or metal tier level (Bronze, Silver, Gold or Platinum). Even if you are currently in a health plan through Covered California you’ll want to re-select a health plan. If you don’t select a health plan after making the income, changes your current health plan will be dropped at the end of the current month if the income change is reported before the 15th or the end of the following month if the change is entered after the 15th of the month.

Keep your current health plan or switch, just by changing your income.

Confusing path to reporting a small change to income

While I understand the hoops and hurdles for reporting an income change if it allows someone to move into a private plan with tax credits, Covered California has set up the program in such a way to discourage families from updating their incomes. In the worst case scenario, a family might forget to re-enroll in a health plan after reporting a change to income and then they would be without health insurance.

Download notices

Here are some of the letters you may receive about updating and verifying your income with document on how to upload verification.

[wpfilebase tag=browser id=31 /]

[wpfilebase tag=file id=149 /]