Covered California has touted that the average state wide rate increase for 2020 is a low 0.8%. What they failed to mention was that the deductibles for the Silver 70 and Enhanced Silver plans 73, and 87 were increased between 60% to 115% over 2019 plans. In addition, the maximum-out-of-pocket annual amount increased by a minimum of 3% on most metal tier plans.

Approximately 55% of the 1.4 million households in Covered California are enrolled in a Silver plan. About 25% of the enrollments are in Bronze plans, and the rest of the households are scattered between Minimum Coverage, Gold and Platinum plans. Consequently, the large increase in the Silver plan deductibles will hit the majority of Covered California enrollments, and off-exchange consumers, the hardest.

Silver Plan Deductibles Jump For 2020

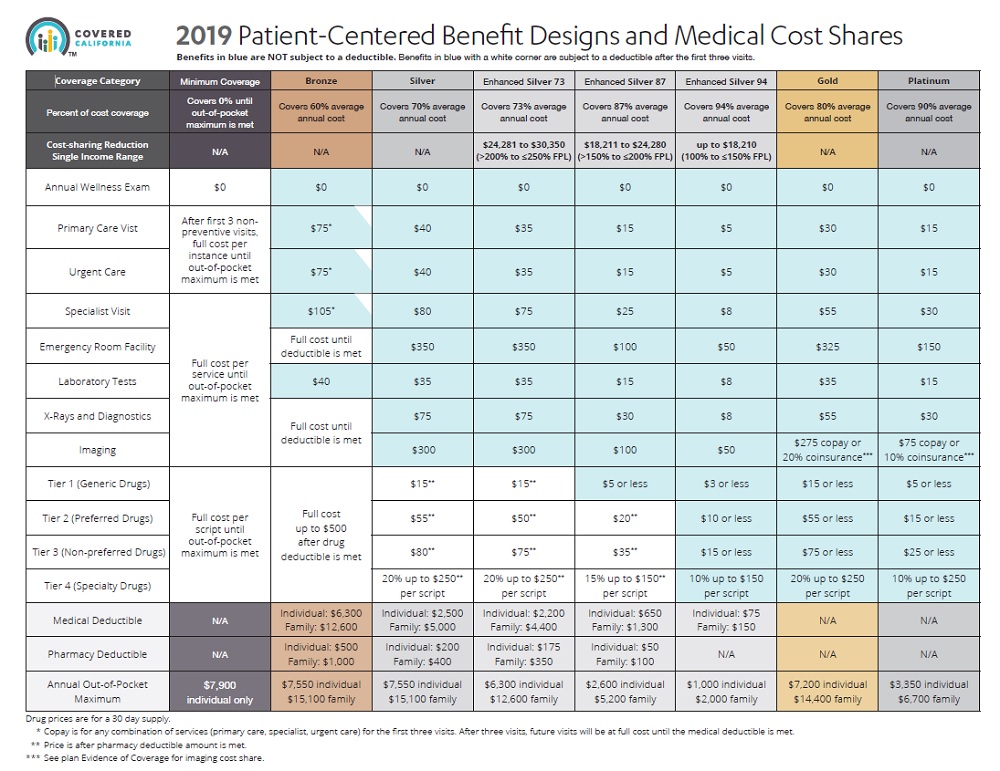

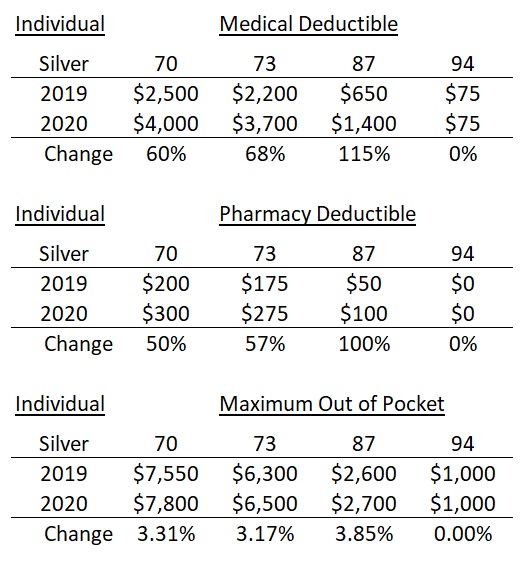

I was surprised by the 60% increase in the Silver 70 medical deductible from $2,500 in 2019, to $4,000 in 2020. The Silver 73 plan increased 68% from $2,200 to $3,700 and the Silver 87 went from $650 to $1,400 – a 115% increase. Covered California did not touch the Silver 94 consumer cost-sharing structure. Any savings from a stable monthly premium or realized decreased from the federal or state subsidy in the monthly health insurance bill, could be quickly wiped out if the consumer has to meet the higher deductible amounts.

The Covered California Patient-Centered Benefit Design matrix is fairly easy to read and understand. But not all of the covered benefits are listed, such as; what health care services are subject to the medical deductible? Those would include: facility fee for in-patient hospitalization, physician or surgeon fees for in-patient hospitalization, out-patient surgery costs, skilled nursing, and durable medical equipment. Some high cost imaging services may also be subject to the medical deductible.

Covered California Pharmacy Deductible Increases for 2020

There was also an increase in the pharmacy deductible for most plans. Before a health plan member can get the plan copayment for the designated drug tiers, they will have to move through a higher pharmacy deductible in 2020 for most Silver plans as well. These pharmacy deductibles have been increased by 50% to 100%.

Finally, the maximum-out-of-pocket amount has increased for the Silver plans between 3.3% and 3.85%. This represents an increase from $100 to $250, depending on the metal tier design. The maximum-out-of-pocket amount represents all the dollar costs the health plan member is responsible for including deductibles, copayments, and coinsurance for both medical services and pharmacy drugs. Once the maximum-out-of-pocket is met, the health plan pays for all covered services from in-network providers.

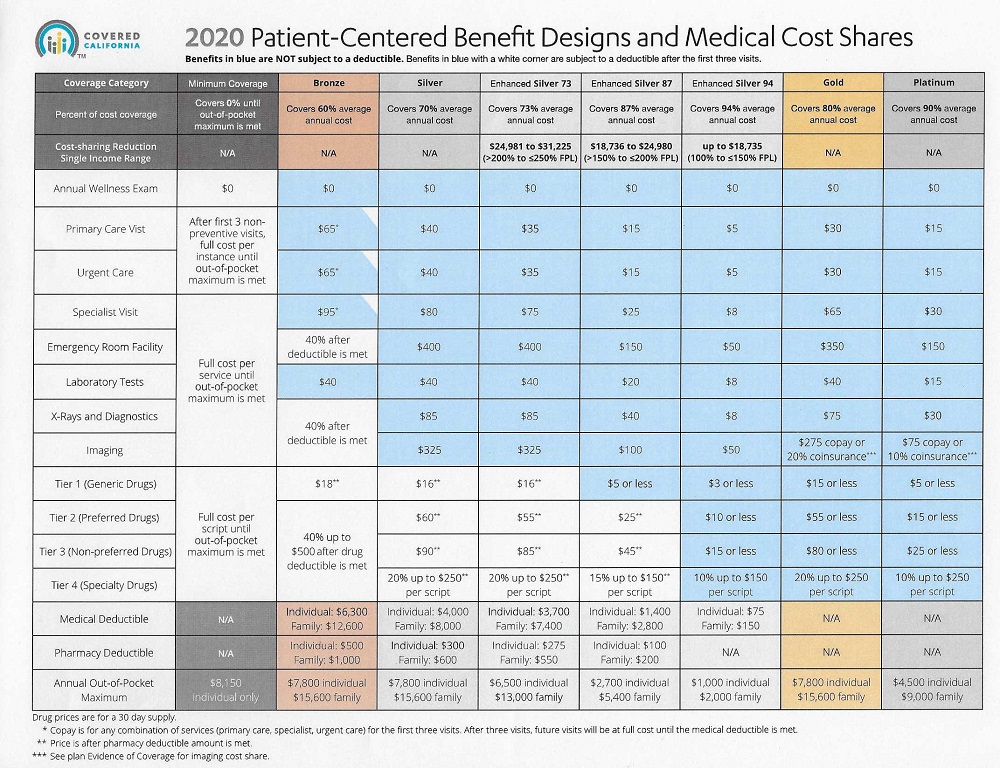

While most of the copayments for medical services remained the same or increased slightly by $5, the emergency room facility copayment increased by $50 for Silver 70, 73, and 87. The new ER copayment for the Silver 70 and 73 will be $400, and Silver 87 will be $150. While these are not big increases, every dollar shouldered by the consumer is a dollar the health plans don’t have to pay out.

When it comes to calculating health insurance premium rates, two of the biggest drivers are the deductible and maximum-out-of-pocket (MOOP) annual dollar amount. A higher deductible and MOOP means the health plan will potentially have to pay or cost-share a smaller amount for medical claims on behalf of the consumer. When the consumer has to pay more of the health care services, the health plans don’t have to charge as much. If the health plan members will be shouldering more of their health care expenses in 2020 under Covered California plans, the insurance companies aren’t under as much pressure to raise their rates.

The Platinum plans had a major spike in the maximum-out-of-pocket dollar amount. They jumped from $3,350 in 2019 to $4,500 for 2020, an increase of 34%. The Gold plans also had an increase in the maximum-out-of-pocket amount of 8.3%, from $7,200 up to $7,800. The Gold plan’s maximum-out-of-pocket amount is now the same as Silver 70 and Bronze 60.

Bronze Plan 100% Coinsurance Changed

While the Bronze 60 plan had a 3.3% increase in the maximum-out-of-pocket amount, the deductible remains the same for 2020 at $6,300. Consumers in Bronze plans will see the strange ‘100% coinsurance after the deductible is met’ condition being erased. In essence, under the 2019 Bronze structure, there was no reduction in member cost-sharing after the medical deductible was met. Which left many people wondering why there was even a stated medical deductible to begin with.

For 2020, once the Bronze deductible plan has been met for the covered benefits of Emergency Room Facility, X-Rays, diagnostics, and imaging, the plan member will go into 40% coinsurance until they meet their maximum-out-of-pocket amount. There will also be 40% coinsurance on prescription medications, tiers 2 – 4, once the pharmacy deductible of $500 is met. Bronze copayments have been reduced by $10 for the first 3 visits, any combination, for Primary Care Visits, Urgent Care, and Specialist Visits.

Off-Exchange plans, or health plans purchased directly from the health insurance companies, that mirror the Covered California metal tier plans will have the same benefit and cost-sharing structure as those offered by Covered California.

Covered California has highlighted the fact that the new California penalty for not having health insurance coupled with the new California subsidy for middle income households up to 600% of the federal poverty income level, helped reduce overall rate increases. There is no reason to doubt this assessment. But it is hard to spin the reality that for Covered California’s most popular Silver plans, most of the deductibles have jumped significantly. This in turn means many Californians will have to pay more for health care services in 2020.

Podcast