Covered California provided some very important training to insurance agents on determining ACA MAGI for clients…twelve months late. The information offered on household income for tax credits should have been offered months ago before we started the first open enrollment. While the maxim of “better late than never” is apropos, content was at times needlessly simplistic, overly complicated and glossed over the real information Certified Insurance Agents want which is entering the income into the CalHEERS program.

Covered California provided some very important training to insurance agents on determining ACA MAGI for clients…twelve months late. The information offered on household income for tax credits should have been offered months ago before we started the first open enrollment. While the maxim of “better late than never” is apropos, content was at times needlessly simplistic, overly complicated and glossed over the real information Certified Insurance Agents want which is entering the income into the CalHEERS program.

Covered California Agent MAGI webinar

The Individual Marketplace: MAGI & APTC webinar held on September 5th is available to be viewed but they have yet to post a PDF of the slide presentation. As with most webinars, I grab screen shots for future reference. Ive put together a PDF of the 37 slides I captured from my computer screen out of a 75 slide presentation.

The topics the webinar and the slides covered are

- Definition of MAGI

- How MAGI is estimated

- Federal Poverty Level for CSR, APTC and Medi-Cal

- Expenses deducted for MAGI

- Income excluded from MAGI

- APTC and tax filing

- Offered Employer health insurance

- Estimating Fair Share

- Estimating household income as percentage of FPL

- Mixed immigration families

- Medi-Cal after APTC eligibility

- Deductions from the MAGI

As a companion, there is a pretty good outline from Covered California developed for CECs on the new income section that allows for start and end dates of employment. You can download this at the end of the post.

ACA Fair Share calculations

Since the webinar didn’t allow for real time questions and answers, the presentation was just different “experts” reading the text of the slides. Consequently, just reading through the power point presentation will be just as good as having attended the webinar, if the entire presentationis ever madeavailable. There is some valuable information concerning how the household income’s modified adjusted gross income is used to determine the Advance Premium Tax Credits. But the calculation of the household’s fair share and calculated APTC was pushed into a fog with a detailed mathematical example. (Those slides I didnt capture because thats what the CalHEERS program does.)

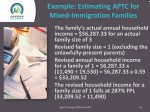

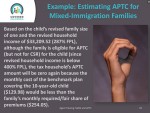

Mixed immigrant family income

Even more complicated was the determination of the fair share and ACA tax credit for families where some household members are entitled to a subsidy by virtue of being lawfully present residents while other members are undocumented immigrants and not entitled to tax credits. What was completely missing in the presentation was how an agent, consumer or Certified Enrollment Counselor enters both the fair of the mixed household of lawful and unlawful residents into the CalHEERS program.

Medi-Cal MAGI eligibility

The presentation did add more background to Medi-Cal eligibility for individuals and families whos MAGI falls below 266%. However, the nuances of federal Medicaid rules, federal poverty lines and immigration status continue to cloud any clear cut determination. For example, some lawfully present non-citizens are eligible for the APTC even if their MAGI is less than the expanded Medi-Cal threshold of 138% of the FPL. But the presentation wasn’t clear on who these immigrants are or how we designate their status to be eligible for tax credits and not Medi-Cal.

But how do we input the numbers?

Because agents, consumers and CECs rely almost exclusively on the CalHEERS program to determine the premium tax assistance, it would have been better to center the presentation on enrollment process and webpages. The presentation almost seems like it was developed as an introduction for policy analysts, computer programmers or members of congress. All agents want to do is properly enroll clients without making 13 phone calls to Covered California for the income rules.

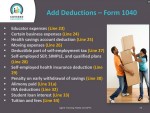

MAGI deductions

They did provide a list of MAGI income and deductions which is good. They also listed which line from the form 1040 tax return we could find this information. Unfortunately, many individuals and families use 1040A and 1040EZ, which have different line numbers for specific income information. A useful tool would be a spreadsheet where agents could just fill in the data from the different tax return lines for the client and have it either subtract or add the various income portions and deductions. This is really important because excluded from federal taxes, social security income and tax-exempt interest, are included in MAGI.

Are you a MAGI expert yet?

Next to the complicated world of health insurance, federal taxes are the next most complicated topic. The Individual Marketplace: MAGI and APTC recording is worthwhile to watch on several levels. The downside is that the presentation is too academic and not focused enough on the realities of entering the MAGI into the Covered California application.

[wpfilebase tag=file id=129 /]