Marketing Matters report fails to recognized the increased customer service agents are providing to Covered California members.

Covered California has released a report detailing how their marketing efforts have helped boost enrollment in health insurance and lowered overall costs. The report Marketing Matters: Lessons From California to Promote Stability and Lower Costs in National and State Individual Insurance Market is a very well researched and documented study about Covered California’s experience. What the report fails to detail is the level of increased consumer service from both Covered California and health insurance agents because of the relative complexity of enrolling in health insurance through Covered California to be eligible for the Advance Premium Tax Credits.

Marketing Helps Agents, But Doesn’t Lower Their Costs

Covered California invests heavily in marketing to educate consumers about the value of health insurance in protecting their income and assets from unreasonably high and unexpected health care costs associated with not having health insurance. Covered California spent $122 million on marketing in 2017 and will spend a minimum of $111 million for the 2018 enrollment period. Marketing represents approximately one-third of Covered California’s budget.

The report determines that the heavy investment in marketing has helped drive healthier consumers into the health insurance market thereby stabilizing rates for all consumers on- and off- the exchange. Covered California is funded currently by a 4% fee assessed on the participating health plans of each enrolled consumer’s total monthly premium amount. Consequently, Covered California has a vested interest in enrolling as many individuals and families through their exchange as possible to meet their budget numbers.

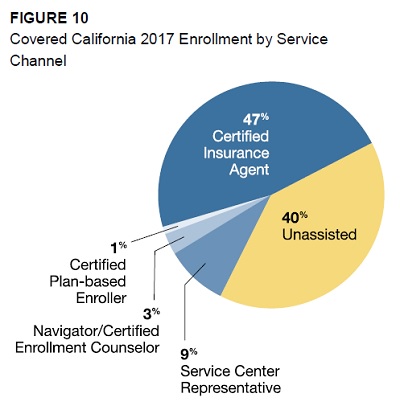

Agents Enroll 47%

The Marketing Matters report noted that the single largest marketing channel for enrollments is Certified Insurance Agents who account for approximately 47% of all Covered California enrollments. Before the Affordable Care Act, the marketing and acquisition costs for the individual and family market were higher than they are today with guarantee issue health insurance. A large portion of the acquisition cost was from the medical underwriting staff that had to screen applicants for pre-existing conditions through health questions and medical information. Marketing costs were higher because the insurance companies paid higher commissions to the agents for their efforts to market the plans and go through the extensive medical questionnaire with the prospective members.

It was estimated that pre-ACA the acquisition cost was 7.6 percent of the premium. Agents, before the ACA, were paid an average of 6.3 percent commission on the total monthly premium amount. Since the ACA, the underwriting cost associated with acquiring new enrollments has dropped dramatically. While the health plans no longer have to screen for pre-existing conditions, there still remains the costs of validating qualifying events for individuals and families who enroll in health insurance outside of open enrollment during a special enrollment period.

Certified Insurance Agents help enroll 47% of Covered California members in health insurance.

Reduced Agent Commission, Increased Customer Service

Marketing costs for the health plans has also dropped dramatically in the form of reduced agent commissions.

While overall enrollment, including enrollment done through agents, has increased dramatically, agent commissions on a per-case basis have dropped significantly and a larger percentage of enrollment is not subject to commissions. Commissions in California have dropped from 6.3 percent of total individual market premium pre-Affordable Care Act to about 1.5 percent in 2017 (inclusive of on- and off-exchange commissions). Marketing Matter, page 34

Commissions to agents are the same regardless of whether the individual or family enrolled through Covered California or directly with the health plan off-exchange.

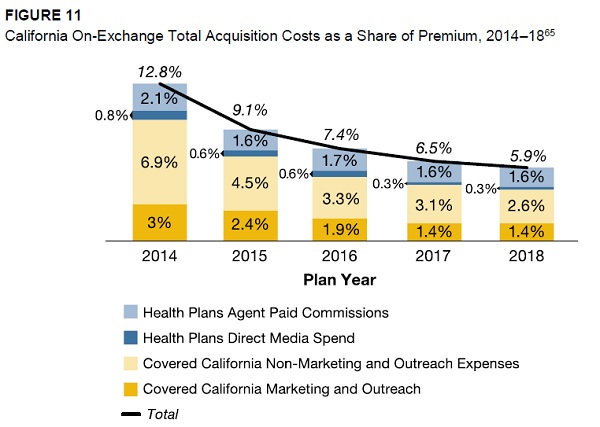

Figure 11 from Marketing Matters illustrates how the marketing and acquisition costs to the health plans have decreased since Covered California began in 2014.

Marketing costs for insurance companies has gone down along with agent commissions since Covered California launched.

The report notes that while agent commission percentages have decreased, the total commission amounts paid to all agents has increased because of the higher enrollment numbers.

What Marketing Matters does not address is the costs to health insurance agents. The underlying assumption of the report is that even though the commission percentage decreased, agents made up for the loss revenue with more individuals and families enrolled under them. They are only considering the revenue side and not the expense part of running a business.

Application, Immigration, Income, Taxes, Changes

Agents no longer have to review tedious underwriting questions with clients since the ACA began. Now, agents participating in Covered California must review the Covered California application with clients. Not only must they be familiar with health insurance in general, they must be experts in the Covered California application and all of the federal requirements for eligibility for the monthly tax credit assistance. This includes immigration status, immigration documents, what qualifies for income under the Modified Adjusted Gross Income rules, and what happens if household members are deemed eligible for Medi-Cal. Proper assistance also includes understanding how the Advance Premium Tax Credits (APTC) work when the household receives their 1095-As from Covered California and subsequently have to file their taxes using IRS Form 8962 to determine if they have to pay back any of the APTC. Then there are the additional services of researching doctors and hospitals to make sure they are in the health plan’s provider network.

Because Covered California members must report income and household changes within 30 days, agents constantly work with clients to report changes to income, household members, and change their health plans throughout the year. On top of these duties specific to Covered California enrollment, agents must continue to supply support to clients who have billing and authorization issues with their health plans.

While Covered California may have decreased the marketing costs agents incurred before the ACA, it has dramatically increased the customer service and maintenance costs to the agents. The potential customer service costs associated with the ACA have double, if not tripled, to agents under Covered California. Each client represents a potential cost of customer service time during the year. Just as Covered California must maintain a customer service call center, agents are the customer service call center for their clients. In a sense, agents are reducing the costs to Covered California by servicing members through their Covered California agent portal. Covered California is earning a 4% fee on the monthly premium while agents are earning 1.6% commission on the same premium. And they are providing additional service to members by helping them with health plan problems that Covered California won’t touch.

Education Before Enrollment

I believe an underlying assumption that the Marketing Matters report makes that health insurance must be sold is incorrect.

Health insurance needs to be sold. Consumers need to be convinced to spend their discretionary income on coverage. Page 5

You may have to sell the benefit of health insurance to a marginal percentage of consumers that are healthy and otherwise see no need to spend their money on it. But part of the marketing emphasis is on education. When an individual or family contacts an agent about health insurance through Covered California, they have already determined they want coverage. The crucial piece of information they need is if they can afford it. No amount of selling will convince anyone to spend their money on an insurance product they can’t afford.

By assuming that Covered California is one big selling machine, the report also paints agents as little more than clerks at a supermarket. Agents do more than just ring up the consumer’s purchase and then watch them take their goods out the door. Agents, just like Covered California customer service representatives, are available all year to help with reporting changes to Covered California and assist with health plan problems. Some agents have complained that Covered California helps enroll the easy cases and the agents must work with individuals and families who have more complicated households, immigration issues, and income questions that require more time.

One of the single largest changes to the individual and family health insurance sector is that Covered California is now the primary marketing agent for health insurance. The marketing costs have been shifted from the insurance companies to Covered California. Overall, that is probably a good change. Marketing Matters fails to account for the time agents spend handling Covered California issues. Every call to an agent is a call not made to Covered California helping them keep their staffing levels low.

I completely agree that marketing is a central element as to why Covered California has been more successful than other exchanges. But I also believe that part of the costs of servicing these new individuals and families has been shifted to agents and the report does not recognize it. I am not saying that agents were over-paid before the ACA and are now under-paid since Covered California launched. I would like to see Covered California work to make the commission structure more uniform between the health plans – they can vary wildly- so agents are compensated more evenly regardless of the complexity of the enrollment.

CoveredCA_Marketing_Matters_9-17

Marketing Matter: Lessons from California to promote stability and lower costs in National and state individual insurance markets.