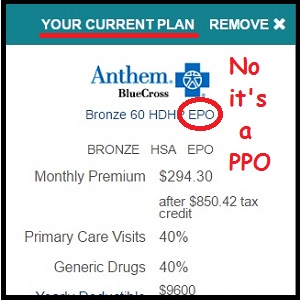

No, the current plan is not an EPO, it’s a PPO from Anthem Blue Cross. Is Covered California labeling misleading to consumers who renew their coverage for 2017?

Anthem Blue Cross is terminating many of their 2016 PPO and Tiered PPO plans across different regions of California. They are being replaced with an EPO version in 2017. Covered California has misleading information placed on the consumer’s accounts that the new EPO is the same as the old PPO plans.

Anthem Blue Cross Change from PPO to EPO

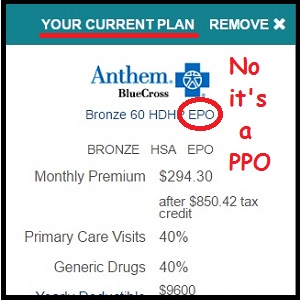

Even though Anthem Blue Cross sent out letters to their current members about the change from a PPO to EPO plan, that information is nowhere to be found on the Covered California website. When a consumer goes to renew their current Anthem Blue Cross health plan for 2017, the Covered California website indicates they are already enrolled in a EPO plan. That is misleading and wrong.

Anthem Blue Cross letter to Covered California consumers notes the plan is changing from a PPO to EPO. But Covered California never alerts its members of this fact.

Is Covered California Misleading Consumers?

In late October and early November when Covered California allowed consumers to renew their plans, the Anthem Blue Cross PPO plan was shown as no longer being available. I saw the display on several of my Covered California clients when I was taking them through the renewal process. As of November 7th, when I went to renew a client who was enrolled in an Anthem Blue Cross PPO Plan that was converting to EPO, the closed plan page was no longer being displayed. (I wish I had grabbed a screen shot of it before it disappeared.)

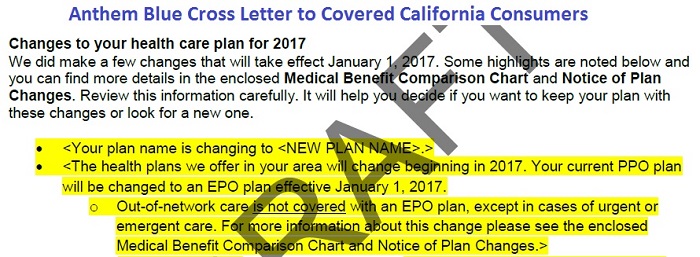

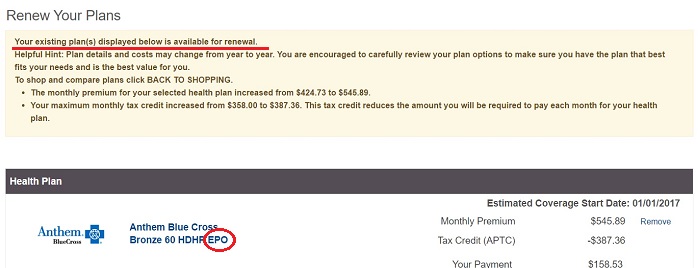

Now, after the consumer goes through the renewal process, Covered California says, “Your existing plan displayed below is available for renewal.”

Covered California renewal page states the existing plan, listed as an EPO, is available for renewal. The member’s existing plan is a PPO.

If a consumer goes shopping for a new plan, Covered California displays the Anthem Blue Cross EPO plan and labels it, “Your Current Plan”

Covered California displays the member’s current plan as an EPO. It can’t be because Anthem Blue Cross offered no EPOs in that region. It was a PPO, which has been switched to an EPO.

Both of these characterizations are wrong. Anthem offered no EPO plans to individuals and families through Covered California in 2016. Therefore it cannot be the consumer’s existing or current plan.

The most significant change from a switch from the PPO to EPO plan is the removal of out-of-network coverage. For the Tiered PPO plans, the Tier 2 hospitals are also being dropped from in-network coverage. Covered California, in a webinar* on the new 2017 health plans noted that because of new regulations, Anthem Blue Cross could no longer offer a Tiered PPO health plan. While that accounts for removal of the tiered hospital coinsurance structure in the plans, it does not justify removing out-of-network coverage and switching the to a EPO plan design.

Some regulatory agencies will argue that the removal of a significant benefit element such as out-of-network coverage does not translate into the EPO plans being a new offering. In other words, removing the out-of-network coverage is no different than modifying the plan with a higher deductible or lower copayment benefits. But if new Anthem Blue Cross EPO plans are the same as the old PPO plans, why did Anthem change the contract or model number of the plans. Because the new EPO plans have new contract numbers, and the PPO plans are no longer being offered in certain regions, doesn’t that mean the old PPO plans have been terminated?

Technically, if a plan is terminated, the member gets a 60 day Special Enrollment Period (SEP). Members of Blue Shield Grandfathered plans that are being terminated on December 31, 2016, are being given a SEP. This means former members have until February 28, 2017, to select a different plan if they don’t like the health plan Blue Shield migrated them into upon the termination of their grandfathered plan. Without the SEP, consumers must make a plan change by the end of open enrollment, which is January 31, 2017.

Lots of people are angry at the Anthem Blue Cross switch from a PPO to EPO plan design. Consumer Watchdog has filed a class action lawsuit on their behalf.

NATURE OF THE ACTION

-

Anthem is engaged in a “bait and switch” scheme designed to significantly downgrade health coverage to its members while increasing the price. Urgent action by this Court is necessary to protect California consumers as the “Open Enrollment Period” for securing health plan coverage for 2017 begins on November 1, 2016….

-

Anthem’s latest marketing ploy is based on its hard-earned experience. The last time Anthem cancelled members’ coverage and replaced it with less comprehensive health plans, members revolted and Anthem lost customers. This time around, Anthem is not telling customers that their coverage is being cancelled. Instead, Anthem is representing that though customers’ coverage will “change” as of January 1, 2017, “you’ll be automatically re-enrolled in similar coverage.” This is in reality, a fraud. Customers are being transitioned from coverage that provides comprehensive coverage for doctors and hospitals that are not participating in Anthem’s provider network, to coverage that provides no out-of-network care whatsoever. This change leaves customers potentially facing thousands of dollars or more in medical bills that would have been covered under their existing plan.

November 15th, Judge allows Anthem to continue sales of stripped-down insurance policies

It’s unfortunate that Covered California is acting in a manner that furthers the consumer deception of the changes to the Anthem Blue Cross PPO and Tiered PPO plans. They should be neutral when it comes to any significant plan changes and plan termination. I understand that Covered California wants to prevent any loss or gap of coverage for an individual or family because they can’t be renewed into plan that is no longer being offered. This would be the case for thousands of consumers who just rely on Covered California to automatically renew their coverage each year.

As an agent, I fret over renewing consumers into health plans that they may not fully understand or where the providers or benefits have significantly changed. It is never a pleasant phone call when a client calls to complain that their health plan no longer covers certain doctors or a benefit has significantly changes. At least I can answer those questions and provide some guidance or options. Covered California can’t provide any answers. Covered California representatives won’t do a provider search for a member or compare health plans for a consumer. That is left up to agents, if the consumer is working with an agent.

I can see Covered California’s dilemma to automatically renew a member in the EPO or force the consumer to make a selection. I probably would opt to renew the member. However, Covered California could be more transparent with its description of the new EPO plan from Anthem Blue Cross. They are not the member’s current or existing health plan. The Covered California website should notify the consumers that the EPO plans have changed and their benefits have been diminished. That’s the least an agency can do that professes to be a consumer advocate.

*August 18, 2016, Covered California 2017 Health and Dental Plan Benefits webinar, minute marker 4:46

https://youtu.be/qTq2ioLwL-s

[wpfilebase tag=file id=1606 /]

Anthem Blue Cross Letter to On-Exchange Consumers

[wpfilebase tag=file id=1843 /]

Consumer Watchdog Lawsuit Against Anthem Blue Cross

[wpfilebase tag=file id=1842 /]