Covered California Silver plans are artificially inflated and you can’t buy a lower priced plan outside of open enrollment even if your income increases.

In an odd twist, the effort by Covered California to help low income consumers ends up penalizing individuals and families whose income increases during the year. Covered California allowed the health insurance companies to raise their rates for plans sold only through Covered California in order to fund reduced cost-sharing amounts for low income households. But if the household income increases, and the monthly tax credit subsidy goes away, the family can’t buy a less expensive Silver plan off-exchange. They are stuck with the artificially inflated rates.

Silver Plan Rates Inflated To Help Low Income Households

This all started when the Trump administration decided to eliminate paying for enhanced Silver plans reduced cost-sharing benefits. The federal government had been making payments to the health plans to offer enhanced Silver plans (73, 87, & 94) that had lower deductibles, coinsurance, and copayments to low income households between 138% and 250% or the federal poverty level. To make up for the loss of funding, Covered California let health plans increase their rates in order to collect more premium dollars to subsidize the enhanced Silver plans. In addition, Covered California let the health insurance company’s offer an almost identical Silver plan off-exchange at a lower monthly rate.

For individuals and families receiving a hefty monthly tax credit subsidy from Covered California the artificially high Silver plan rates had very little impact on their monthly bill. For consumers who would never receive a tax credit subsidy from Covered California, they were instructed to purchase their health insurance off-exchange, directly from the health insurance company, in order to get the lower Silver plan rate. (Bronze, Gold, and Platinum standard benefit designed qualified health plans have the same rate on- or off-exchange.)

Increased Household Income Forces Consumers To Pay Inflated Silver Plan Rates

What was not considered is the impact of an individual’s or family’s increased wages during the year. I have been working with consumers whose income has increased. They no longer qualify for the enhanced Silver plan and in some instances no longer receive any monthly tax credit because their income is too high. This means they are paying the full artificially inflated Covered California Silver plan rate.

A change of income in the Covered California system allows the consumer to change plans. By design, a family must change metal tier plans if their income increases and they are no longer eligible for an enhanced Silver plan. The change of income is a unique Covered California qualifying life event that triggers a special enrollment period. However, a change of income is not recognized by health insurance companies’ off-exchange as a qualifying life event for a special enrollment period.

If an individual or family has a change of income – increase or decrease – that change of income is not a qualifying life event to either buy insurance through Covered California or directly with a health insurance company outside of the open enrollment period. If a family has the good fortunate to have their household income increase because of a better job, more hours, or a promotion, and they are in a Silver plan, and want to keep the Silver plan, they are stuck paying the artificially high rates. The Covered California Silver plans can be priced 7% to 20% higher than the off exchange rates.

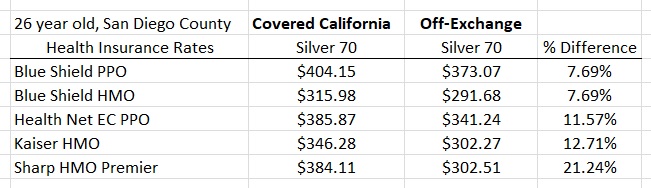

Silver plan rates in San Diego for a 26 year old can be 20% less expensive than Covered California. Some consumers are stuck if they initially enrolled with Covered California.

In short, Covered California consumers are penalized for having the good fortune of their household income’s increase. To add another layer of insult, if the consumer makes over 400% of the federal poverty level, they have to repay all the monthly tax credit subsidies they received during the year and pay for an artificially inflated Silver plan rate. Ouch!