Can the California individual and family market survive a 30% forecasted rate increase in 2019?

In a new report released by Covered California they predict rates for individual and family plans could increase by 15% to 30% for 2019 unless the federal government implements changes to stabilize the market. The report highlighted the fact that consumers who receive no ACA subsidy are bearing the brunt of a deteriorating market place beset with uncertainty. It is the loss of these consumers from the individual and family market that could spell drastic rate increases in 2019.

The Covered California report titled The Roller Coaster Continues – The Prospect for Individual Health Insurance Markets Nationally for 2019: Risk Factors, Uncertainty and Potential Benefits of Stabilizing Policies reviews trends and impacts to the 2018 open enrollment period and prospects for significant changes for 2019.

30% Rate Increase With Declining Enrollments

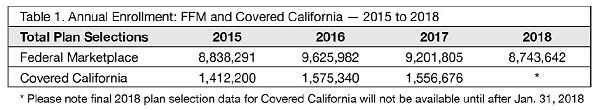

One trend threatening the stability of the individual and family market is the declining enrollment, at least through the Federally Facilitated Marketplace (FFM or Healthcare.gov) and to a lesser extent Covered California through 2017. The report attributes the decline from 9.2 million consumer enrollments in the FFM in 2017 down to 8.7 million enrollments for 2018 due to a shortened enrollment period and less outreach and marketing funding for the 2018 plan year.

Total Enrollments in ACA plans through December 2017.

The Roller Coaster report also assigns some of the enrollment decreases to fewer health plans participating in the ACA exchanges as well as sharp increases in the rates. Part of the rate increases were due to the exchanges including a surcharge on Silver plans in order to fund the cost sharing reduction for the Enhanced Silver Plans. However, consumers who received exchange subsidies were also apt to realize a decrease in their monthly premiums because the subsidy increased as a result of the artificially inflated Silver plans.

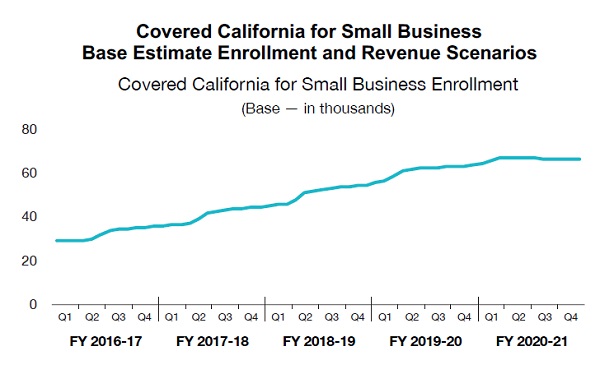

A glaring deficiency in the report is the failure to attribute any decline in enrollments, either on the federal level or at Covered California, to an improving economy. Unemployment is at record low percentages and more people are working for employers who offer group health plans. Covered California’s own small group plans have seen increased enrollment since its inception in 2014 and their budget report estimates continued enrollment growth.

Covered California forecasts increased enrollment in their small group plans which means potentially fewer people in the individual and family plans.

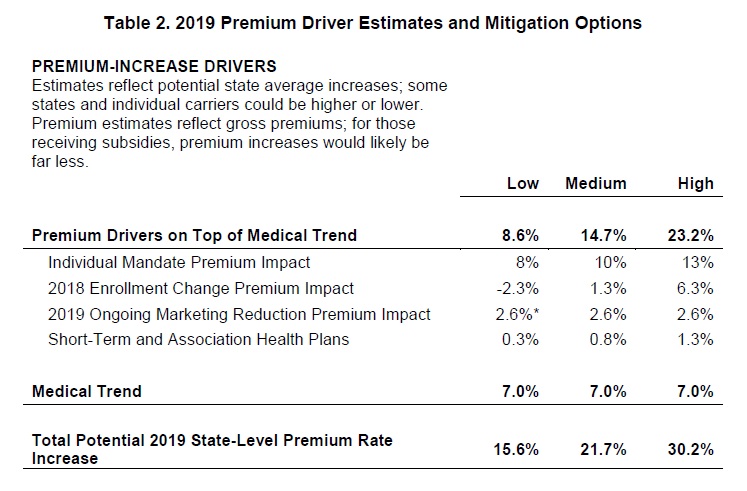

For the future, the Roller Coaster report highlights key areas that will undermine the individual and family market and lead to higher rates.

- Elimination of the individual mandate: shrinks the number of healthy people in the insurance pool and will drive up rates by 8% to 13%.

- Deteriorating Risk From Increased Premiums: healthy people who don’t use insurance are opting out of enrolling because of increased rates. This means the claims by the people left in the pool are divided amongst a small number of people. Rates could increase 6.3% in some states because of this.

- Association Health Plans (AHP) and Short Term Medical (STM) Plans: assuming that AHPs and STMs are expanded in 2019, the Roller Coaster report estimates only a modest increase to premiums for 2019. This is predicated on the assumption that the individuals leaving the individual and family market are 25% less costly than the average person to insure.

- Medical Trend Cost: based on national averages rates will need to increase 7% to keep pace with rising medical care costs.

Premium Driver Estimates for 2019 individual and family plans from the Roller Coaster report.

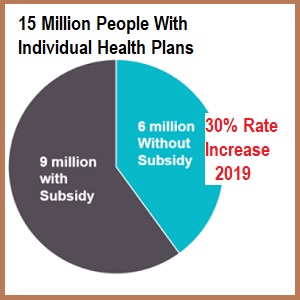

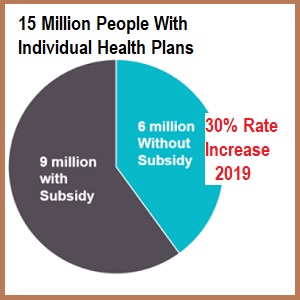

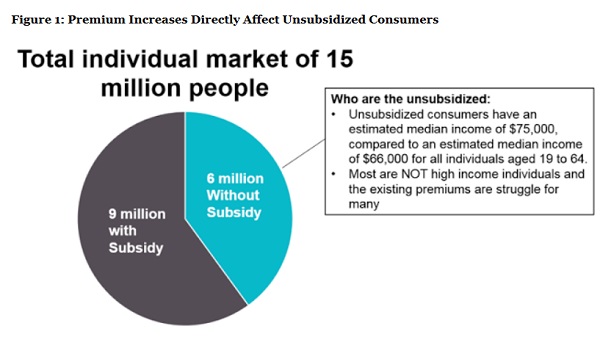

It is estimated that of the 15 million individuals who are enrolled in the individual and family market for health insurance, 6 million receive no subsidies because they either make too much money or choose not to participate in an ACA exchange. The Roller Coaster report notes that these people who are purchasing ACA compliant health insurance are the households most impacted by the estimated 15% to 30% rate increases for 2019. In the conclusion section, the report states that these off-exchange consumers who receive double-digit premium increases may consider dropping coverage.

6 million people are estimated to be unsubsidized in the individual and family market and most vulnerable to rates increases in the future.

Under Covered California’s worst case scenario, a 45 year old in Southern California, earning $50,000, would have to pay $386 per month for the least expensive Bronze plan. That same person living in Sacramento would have to pay $458 for a Bronze plan. A short term medical plan with a $5,000 deductible will be approximately $225. For a healthy person with no pre-existing conditions saving between $1,900 and $2,800 per year on health insurance will be a strong incentive to leave the ACA compliant health plans of the individual and family market.

Federal Actions To Stabilize Rates

The Roller Coaster report offers several stabilizing actions the federal government can take to minimize 2019 rates. The number one stabilizing affect would be to fund a high-risk pool or reinsurance program. This protects insurance companies if they are hit with health care claims that are substantially higher than forecasted. The reinsurance mitigates losses and encourages carrier participation. Such a reinsurance program could yield a rate reduction of between 9% and 16%. Other actions would be to increase the outreach and marketing budgets to boost enrollment and re-institute the health insurance tax holiday for 2019. These two measures could help reduce rates by 3% to 7%.

The Roller Coast report is about stabilizing the rates, not about finding ways to lower the already excessively high rates. The tone is that those people not receiving the subsidies, by virtue of their income, can afford the current rates. The report acknowledges that people who are eligible for the subsidies are relatively immune from the rate increases because the subsidies will always increase to make their rates affordable.

So why issue a report about rate stabilization if it does not directly affect your core business: subsidizing health insurance for people who are eligible? Covered California is worried about the 6 million people who don’t receive subsidies and will drop out of the market. I believe they have underestimated the impact of Association Health Plan and Short Term Medical plans and the drain those options present to the off-exchange enrollments. If the health plans see serious erosion to their enrollments from off-exchange healthy people, they may close all their individual and family plans in certain counties or the entire state.

It’s not just a matter of stabilizing the rates, the rates need to be lowered for the off-exchange households. I don’t think Covered California has a handle on the level of discontentment from individuals and families who believe the 2018 rates are excessively high and unacceptable. If these families are socked with a 15% to 30% increase, and they are already in the cheapest Bronze plan, look for them to drop coverage altogether and self-insurance or turn to permanently enrolling in Short Term Medical plans. The loss of a significant number of individuals in ACA compliant plans runs the risk of making the whole market collapse, and that is what Covered California is worried about.

See also: Can Covered California Survive Repeal of the Individual Mandate?