Every Summer Covered California announces the health insurance rates they have negotiated for the next year. For 2022, the headlines heralded a 1.8 percent average weighted rate increase to individual and family health plans. Any rate change announcement is only a mirage for most Covered California members and are meaningless to the final health insurance premium an individual or family pays monthly.

Covered California Rate Announcements Are Meaningless

The ceremonial announcement of health insurance rate changes, usually a modest increase, is meant for the consumption of politicians, elected officials, regulators, special interest groups, and the media. You know, all those people who have group health insurance and are not subject to the vagaries of the ACA subsidy calculation. The reality of what most consumers pay for their health insurance through Covered California is far more complicated than a celebratory press briefing announcing a 1.8 weighted average percent increase.

The L. A. Times splashed a misleading headline about the 2022 rate changes announced by Covered California.

Aside from the fact that the 1.8 is a weighted average, not mentioned in the headline, the health insurance rates will vary by carrier, region, age, the household income, and a few other factors. Covered California needs to included one of those financial investor disclaimers;

Individual results may vary based on the market, your income, and where you live.

If you peruse the announcement – full of statistics – it becomes apparent that any derived weighted average of a rate change is theoretical and not connected to the reality of any individual or family in California.

Age-Base Rate Increase & Universal Rate Changes

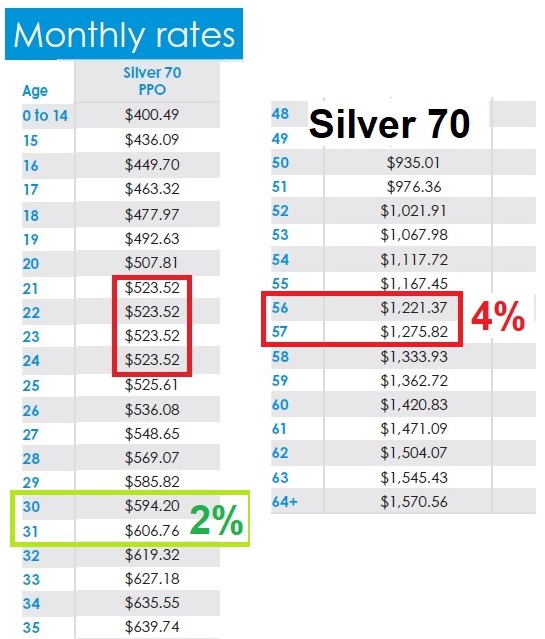

Your health insurance rates can change for two specific reasons. First, you get one year older. For each year increase of age for adults is usually associated with an automatic increase in the rate. Adults in their early 20s may not experience a rate increase based on age. All other ages will see a 1 to 4 percent increase, year over year. This annual age-based increased is baked into all of the carrier’s rate curves from ages 21 to 64. Just getting one year older will increase your rates more than 1.8% for most adults. Congratulations on living another year…here is your rate increase birthday present.

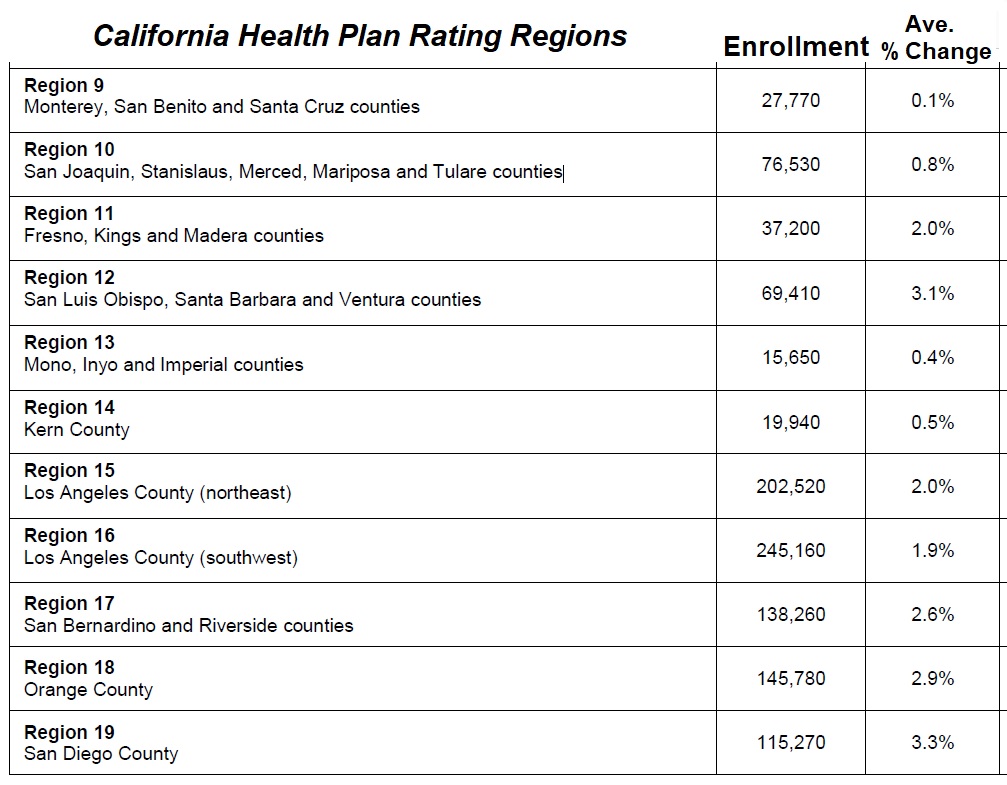

The second change is any blanket rate increase or decrease by the carrier. This is the what Covered California is referring to with their rate announcement. California is broken up into 19 different rating regions, each of which will have a different aggregated rate change based on all of the carriers offering plans in that region.

California’s 19 Different Rating Regions

Region 1 will have rate decrease of 5.7 percent. Only Anthem Blue Cross and Blue Shield of California offer plans in Region 1. Blue Cross offers an EPO plan. Blue Shield offers a PPO and HMO. But we are not told which carrier or what plans are actually decreasing their rates. No specific rates were released and won’t be until sometime this autumn.

Region 19, San Diego County, will have a 3.3 percent increase. Los Angeles, Regions 15 and 16, have rate increases of 2.0 and 1.9 percent respectively. Because Covered California highlights a weighted average, where regions with more enrolled members have a bigger influence than small enrollment regions, the average weighted change comes out to 1.8 percent statewide, heavily influenced by Southern California.

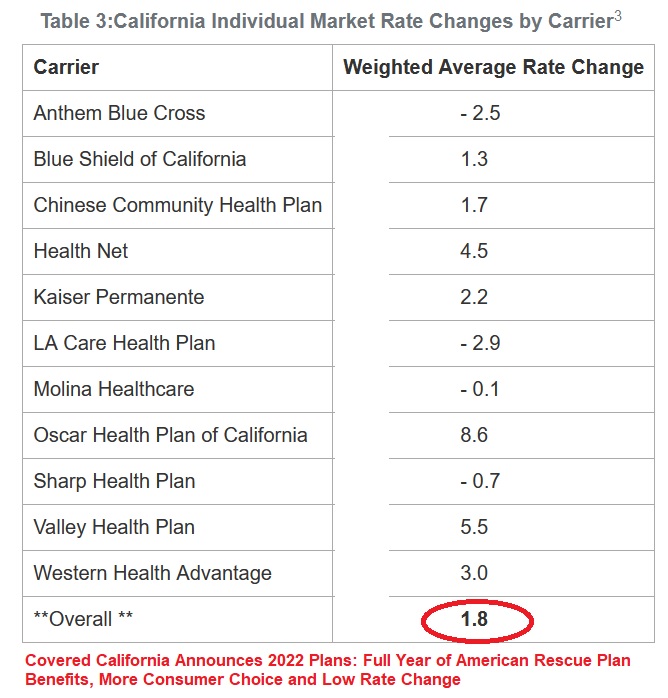

Another Worthless Table of Carrier Weighted Rate Changes

Of course, the meaningless weighted average rate change is comprised of each carrier’s average rate changes.

Anthem Blue Cross, L. A. Care, Molina, and Sharp health plans will all reportedly decrease their rates. All the other carriers will have increases from increases from 1.3 to 8.6 percent. Unfortunately, this is another chart of numbers that has little relevance to most families. First, the rate sheets have not been released. We don’t know if a carrier’s rate changes were for all the regions where they offer plans or just a couple. We don’t know if the rate changes are for all of the metal tier plan offerings (Bronze through Platinum) or if they were concentrated in just a couple of metal tiers. Finally, some of the carriers have multiple plan types: EPO, HMO, and PPO. A carrier may have jacked up the PPO rates and lowered the HMO rates.

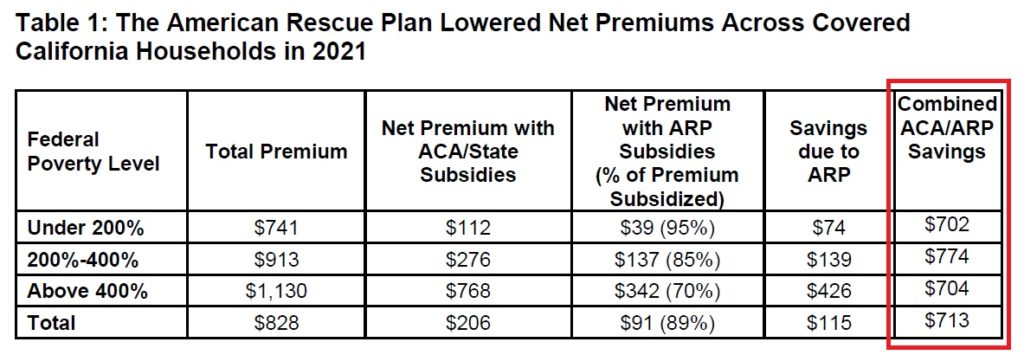

Because over 95% of Covered California members get a subsidy, any rate increase has little impact. The household income has a larger role in determining the monthly health insurance premium the individual or family pays. Covered California even included a table of average household subsidy for 2021 by income based on the federal poverty level.

The American Rescue Plan really punched up the monthly subsidy for families. It swamped any rate increases because of age or a carrier blanket increase. The unemployment subsidy benefit further increased the subsidies for those households who received unemployment insurance in 2021. It is this group, those receiving the unemployment subsidy benefit, who will have the biggest sticker shock in 2022. That extra subsidy amount will evaporate and many families will see their premiums jump from just a few dollars per month back up to a couple of hundred dollars per month in 2022. For these families, they won’t see the ballyhooed 1.8 percent weighted average increase, but a rate increase over 1,000 percent.

Just Shop and Save, Said the Animated Reptile

We must remember Covered California is a dot-com (coveredca.com), a commercial operation. They are in the business of selling insurance and making themself look as favorable as possible. However, for years they have included a column in the regional rate changes table called Shop and switch. Supposedly, some consumers can switch health plans to the lowest cost health plan in their metal tier.

The image that comes to mind is the advertisement where some animal tells the viewer to switch and save on auto insurance. Health insurance is not car insurance. People, often times, have specific doctors they want to see and facilities they want to be treated at. To switch health plans can mean losing all of your doctors and having to drive all across town to get health care. I find it rather insulting that Covered California has taken such a cavalier approach to health insurance and insinuates that consumers are rather dumb when they select their health plans.

In summation, the annual Covered California announcement about the next year’s health insurance rates, without actually providing the rates, means nothing to consumers in Covered California. The announcement is meant to burnish their image with elected officials, regulators, and special interest groups.