The American Rescue Plan, also known as the 2021 Federal Stimulus Package, made numerous changes to the health insurance subsidies dispensed by Covered California. The health insurance Premium Tax Credit subsidies will not arbitrarily stop based on income, the subsidies will be more generous throughout the income range, households who receive unemployment benefits in 2021 will have a special subsidy calculation, and repayment of excess Premium Tax Credits from 2020 has been suspended.

American Rescue Plan Lowers Household Contributions – Increases Subsidies

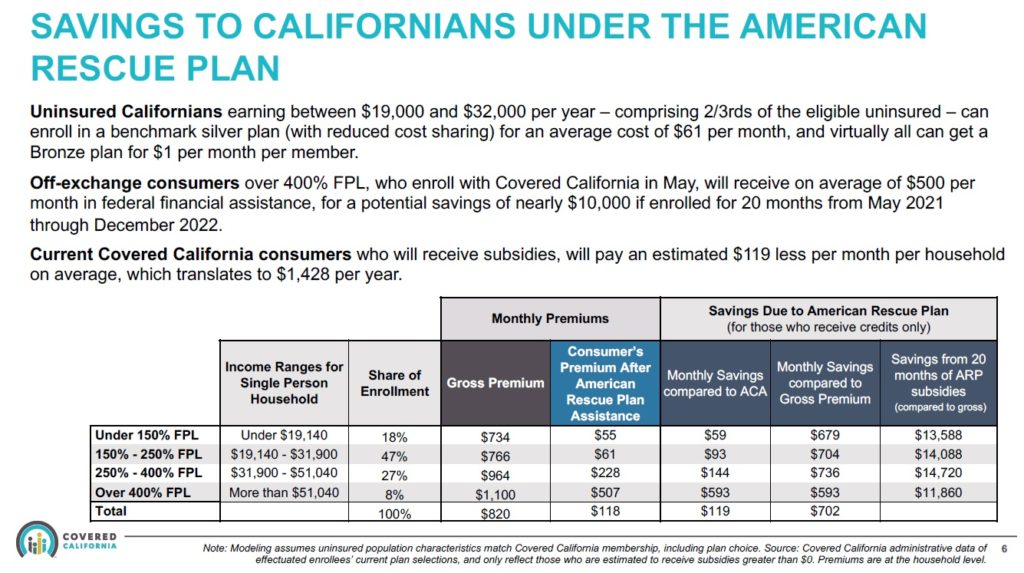

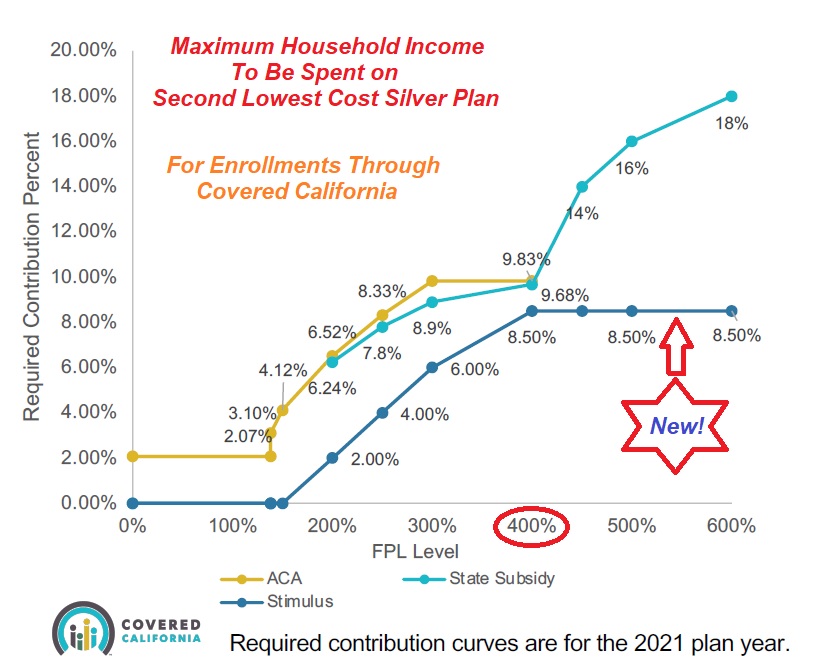

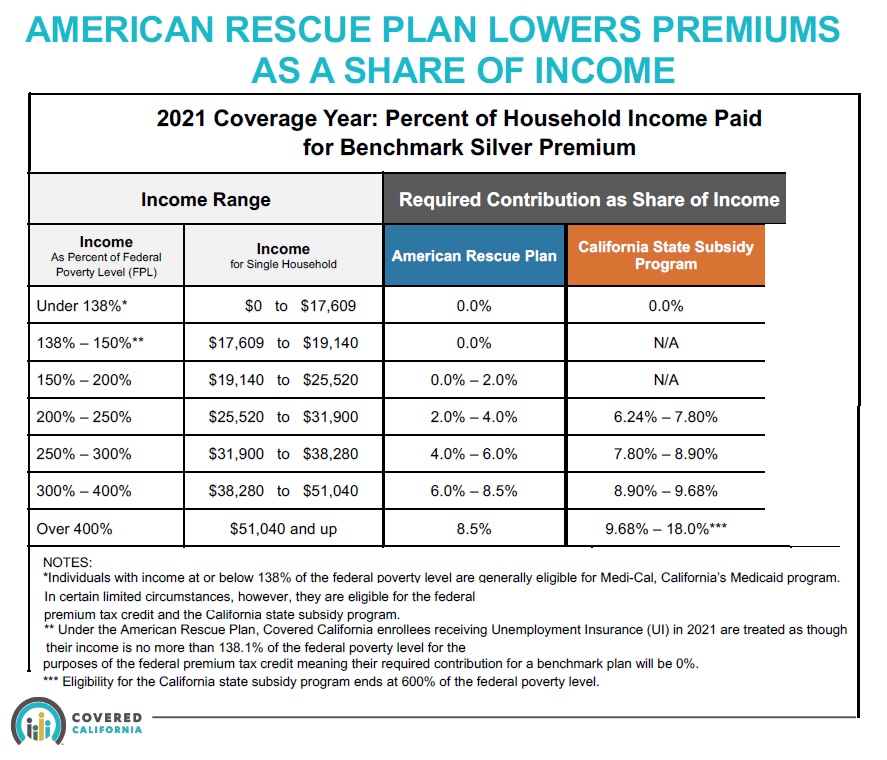

Most substantially, there are lower household income contributions for health insurance costs. This translates into higher monthly subsidies to reduce the cost of health insurance. Under the American Rescue Plan, the percentage of household income that is expected to be contributed to paying for health insurance has decreased. Since the cost of health insurance has not decreased, this means the subsidies must be larger in order to bring the monthly premium payments within the prescribed contribution percentages for the household.

First, California still has expanded Medi-Cal. Adults whose income is under 138 percent of the federal poverty level for their household size are still Medi-Cal eligible. Children under 19 years of age in a household whose income is under 266 percent of the federal poverty level (FPL) are still Medi-Cal eligible.

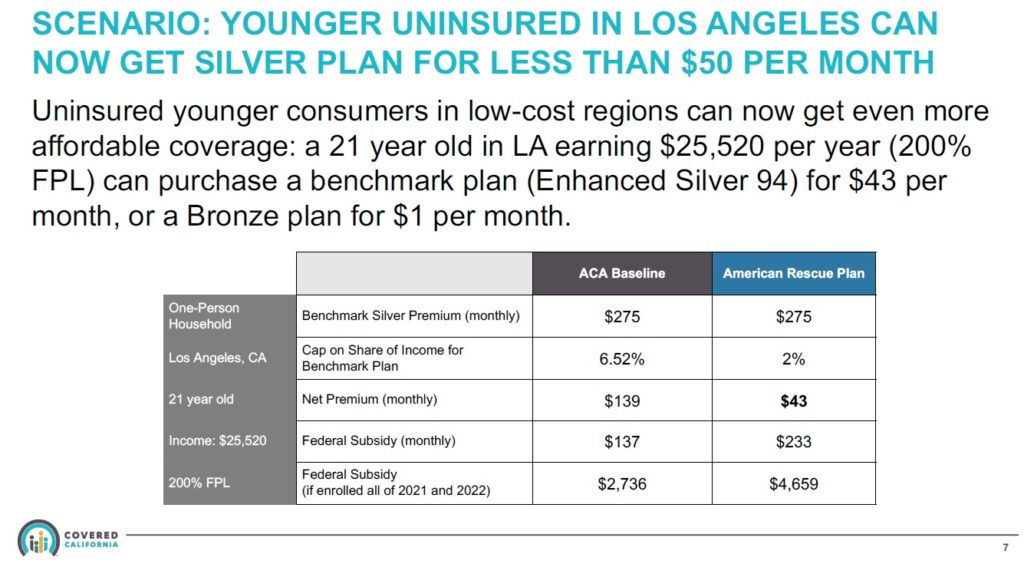

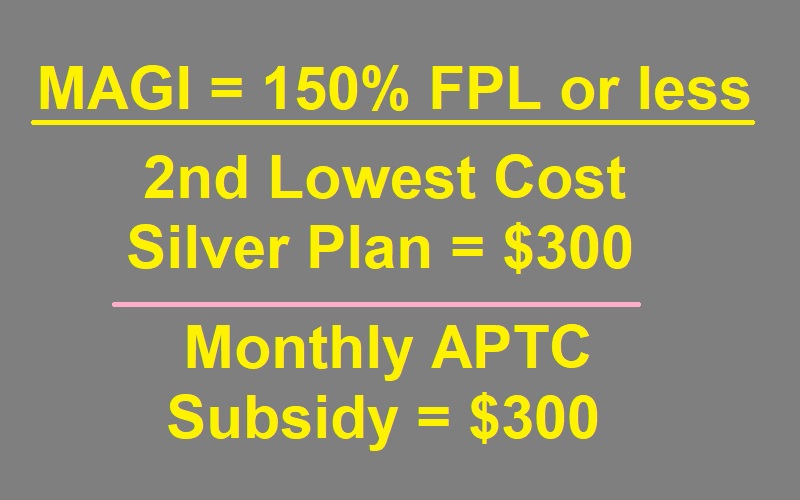

Second, the original ACA subsidies formula will be replaced by the new American Rescue Plan (Stimulus) percentages. This means that for a household at 150 percent of the FPL, the new Advance Premium Tax Credit (APTC) subsidy will be equal to the dollar amount of the Second Lowest Silver Plan. If the monthly cost of the Second Lowest Cost Silver plan for an individual is $300 per month, and the individual’s Modified Adjusted Gross Income is at or below 150 percent of the FPL, the monthly APTC subsidy will be $300. The consumer can spend that $300 on any plan within Covered California. It is not limited to the Silver plans.

The subsidy equals the amount of the Silver plan because under the new household income contribution curve an individual earning 150 percent of less of the FPL should not have to make a contribution to their health insurance premiums. Note: Covered California has assessed a $1 fee even if the subsidy is greater than the rate of the health plan.

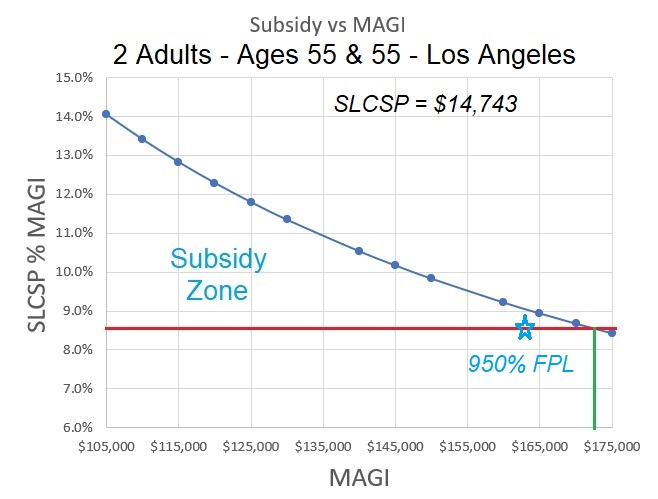

No Income Cap for Subsidies

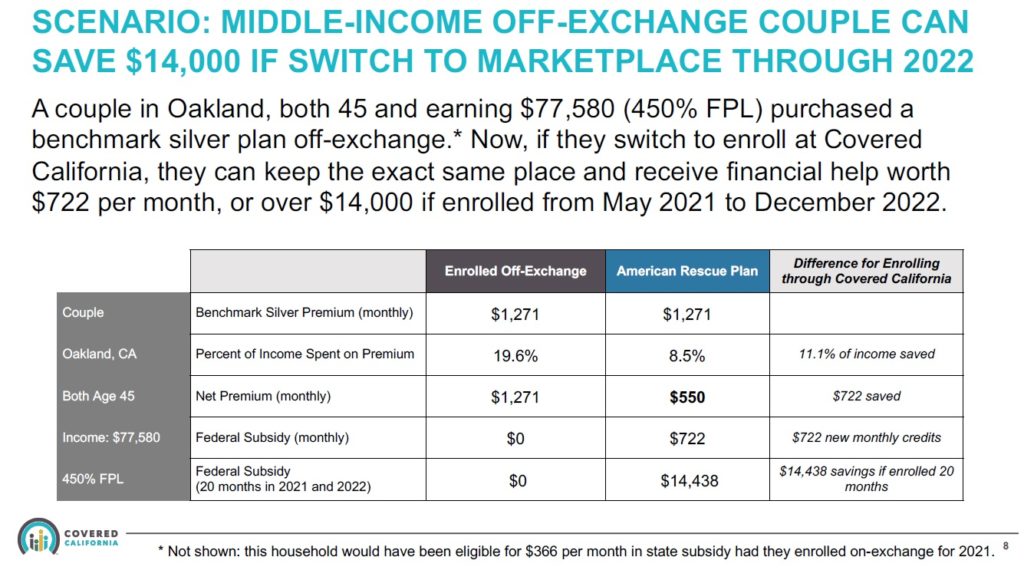

The household contribution percentages progressively increase until they reach 8.5 percent when the Modified Adjusted Gross Income is at 400 percent of the FPL. There is no cap on the household income in order to receive the federal Premium Tax Credit subsidy. As long as the Second Lowest Cost Silver Plan exceeds 8.5 percent of the household income, there will be a subsidy to lower the cost.

Third, the California Premium Assistance Subsidy (State Subsidy) will be overtaken by the more generous federal subsidies under the American Rescue Plan. As of May 2021, Covered California will transition all of their existing consumers over to the new federal subsidy formula, which will make the California subsidy disappear.

Covered California has said that when they transition consumers to the new subsidy formula, they will aggregate the higher subsidy amounts the consumer did not receive in the first four months of 2021 and spread that amount over the remaining months of the year. Covered California is working with the Franchise Tax Board on how to handle the California Premium Assistance Subsidy that consumers received, but is no longer applicable.

Implications for health plans

Because the subsidies will be larger, many Covered California consumers may want to move from a Bronze plan to a Silver or higher-level plan. As long as you stay with the same carrier and plan type (Blue Cross Bronze EPO to Blue Cross Silver EPO, Kaiser Silver HMO to Kaiser Gold HMO, etc.) all of the accumulated deductible and maximum out-of-pocket amounts will transfer. If you switch from a PPO plan to an HMO plan, or if you completely change carriers (Blue Shield to Health Net) the dollar amounts you have accumulated will not transfer.

Covered California is working with the different carriers to help consumers in off-exchange plans transition to a Covered California with subsidies and have the accumulated deductible and maximum out-of-pocket amounts follow the plan member. All of this is a work in progress and it may not apply to some carriers. Consult your health plan or agent for specific details.

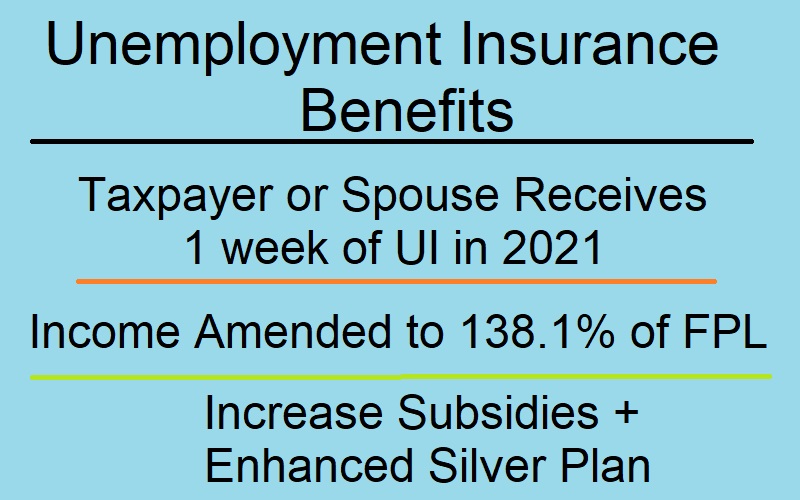

Unemployment Benefits

A provision of the American Rescue Plan is that if the primary tax filer or the spouse is approved for unemployment insurance benefits for one or more weeks in 2021, the household MAGI will be capped at 138.1 percent of the FPL. The household may have been at 300 percent of the FPL, but Covered California will amend the MAGI to reflect 138.1 percent of the FPL. This would mean that the adults will not be determined eligible for Medi-Cal, which is an income under 138 percent. The lower income means the household will see larger subsidies and be eligible for the enhanced Silver 94 plan with reduced cost-sharing reductions.

What has not been addressed is if by triggering the unemployment insurance benefit provision that lowers the income, will dependents under 19 years old become automatically eligible for Medi-Cal, which happens when household income is under 266 percent of the FPL. However, the unemployment insurance benefit provision will not be implemented into the Covered California online account and application system until the summer of 2021.

Suspended Federal Excess APTC Subsidy Repayment

The American Rescue Plan suspends the repayment of any excess Premium Tax Credit subsidy that may be owed for 2020 by virtue of having a final MAGI higher than originally estimated. This is big for consumers who received a federal subsidy based on a Covered California MAGI of under 400 percent for 2020. When the taxpayer went to file their taxes, the MAGI was over 400 percent, possibly because of unemployment benefits, and that triggered the repayment of ALL of the subsidies paid out in 2020. This provision suspends that repayment. See: Excess 2020 Health Insurance Subsidy Suspended

- The American Rescue Plan only modifies the Affordable Care Act through 2022.

- Covered California will be updating their website and application on April 12th with the new information.

- There is a special enrollment period at Covered California for enrollment into a health plan with subsidies from April 12th through the end of December 2021.

- The unemployment insurance benefit trigger will not be implemented in Covered California until the summer of 2021.