Covered California allows Blue Shield to impose a 44% rate in in Northern California.

Covered California has released the preliminary health insurance rates for 2016 conveniently avoiding telling some consumers that they will see a 30% to 44% increase in their monthly rates. While Covered California was massaging the statistics to promote a statewide weighted average increase of only 4%, consumers enrolled in some Blue Shield plans in Northern California will experience a 44% rate increase according to Covered California’s regional rate summary.

- [wpfilebase tag=fileurl id=761 linktext=’CoveredCA-2016 Plan Rates Preliminary Booklet’ /]

California is 19 separate rating regions

Under the ACA, Covered California broke the state up into nineteen different rating regions. (Covered California Rating Region Map). This has allowed the health insurance companies to modify their health plans by region, if they offered coverage at all, to maximize their profits. Essentially, California is nineteen different states when it comes to health insurance. But Covered California wants to portray the state as one big happy Obamacare success story. They side step the tough questions about the narrow provider networks, lack of plan competition, and nasty rate hikes for some consumers.

Glossy marketing material buries the facts

A review of the preliminary 2016 rate increases reveals a clever marketing piece that uses pretty graphics and jargon to obscure some unpalatable facts. Basically, many Northern California regions and counties will see double-digit rate increases for 2016. Blue Shield seems to be the worst of the bunch with rate increases routinely hitting the upper 20% to 44% range. This was after Blue Shield’s modest rate increases of approximately 6% for 2015. Perhaps the new contracts with Sutter and University of California hospitals are showing up in their new rates. See all the rate increases by region by plan at the end of the post.

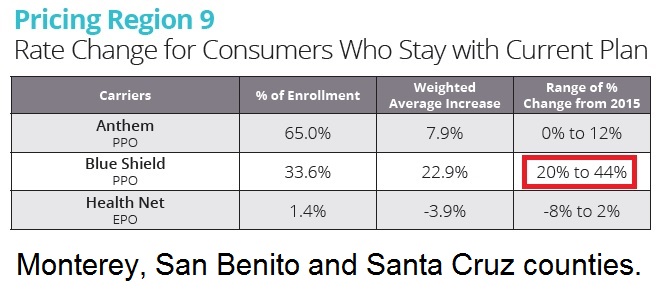

Region 9, Montery, San Benito, and Santa Cruz counties will see a 44% rate increase on some Blue Shield health plans for 2016.

Do Northern California families matter?

For those people who report on Covered California and Obamacare, but don’t actually have to participate in it because they have employer sponsored health insurance, they are all too happy to promote the Covered California marketing spin of a modest 4% rate increase for individual and family plans. But let me tell you, the family in Chico, California that gets a 29% rate increase on their Blue Shield plan really doesn’t care that a family L.A. may have seen their Blue Shield rates drop. Just like politics, all rate increases are local.

Weighted average waters down the impact

By applying a weighted average to the rate increases Covered California seeks to ameliorate the overall negative publicity associated with some families receiving double-digit rate hikes. Covered California also likes to point out that consumers can just switch to a lower price plan. But if the family’s doctor is only in-network for the plan that just had a 30% rate increase, what options does the family really have? We have to remember that these rates are the same for consumers who purchase their health insurance off-exchange or directly from the carrier. (Five paths to health insurance in California)

Covered California marketing for the health insurance companies

The Covered California preliminary rate plan booklet could pass as a slick marketing brochure for Covered California and the health insurance companies. The glowing descriptions of the different health plans could, and probably was, written by the health plans themselves. Covered California should just allow the health insurance companies to advertise in their literature because the information is very one-sided. Covered California doesn’t approve the rates. They are reviewed by either the Department of Managed Health Care or Department of Insurance. But if they are going to take the credit for a low weighted average rate increase, they need to take the blame for outrageous rate spikes for 2016.

Look over there!

In addition to the preliminary rates announcement, Covered California also released “Beyond the Rates – Promoting Quality Care” flyer. This marketing piece enumerates the numerous ways Covered California and the health plans are working to improve the quality of health care. The flyer states,

Covered California holds health insurance companies accountable through their contracts, which include financial incentives and penalties, with the goal of achieving the larger mission of health reform: better quality, better health and lower costs through the following methods.

But they give no statistics or evidence if any health plan has received a monetary incentive or been penalized for not meeting contractual performance goals. The marketing flyer helps to take the consumer’s gaze from the premium increases.

Where’s Medi-Cal?

Completely absent from any of the marketing material for Covered California is any mention of Medi-Cal. Whereas Covered California used to tout their “No Wrong Door” approach to enrolling people in either a private health plan with tax credits or Medi-Cal, they now want to distance themselves from the nightmare so many people face with the Medi-Cal bureaucracy. Covered California also fails to mention that the health plans pay them a fee every month for each person that enrolls through the Covered California enrollment system.

Just explain the premium rate hikes

It’s wonderful that some Californian’s will see their health insurance premiums decrease in 2016. However, it is slightly disingenuous to proclaim a low overall statewide average rate increase, for the sake of national publicity, when some consumers will face increases of 30% to 44%. Covered California, in collaboration with the health plans, should have to explain why some regions and health plans in California were having their premiums increased by over 20% when inflation is under 3%. Covered California wants to be seen as the low price leader just like Walmart. And just like Walmart, they won’t advertise those pesky price increases.

- [wpfilebase tag=fileurl id=762 linktext=’Covered California Good Rates-fact Sheet’ /]

- [wpfilebase tag=fileurl id=760 linktext=’Beyond The Rates-fact sheet’ /]

2016 rate increases by region and health plan

The following information was pulled from the Covered California 2016 preliminary rate booklet. The rate increase percentage next to the Region is the weighted average. “A weighted average is the average of values which are scaled by importance. The weighted average of values is the sum of weights times values divided by the sum of the weights.” In other words, if their are more consumers in a Bronze plan which had a lower overall increase in rates than consumers in the Gold plans that had high rate increase, the weighted average would be lowered because there were so many more people in the Bronze plan relative to the Gold plan.

Next to each carrier is a range of for their respective health plans offered in the region. For example, health plan ABC may increase their Bronze plans by 1%, Silver plans by 5%, Gold plans by 3%, and Platinum plans by 9%. The range would then be 1% – 9%.

| Region 1 | 10.6% |

| 22 Nor. Cal counties | |

| Anthem | 2% to 15% |

| Blue Shield | 8% to 29% |

| Kaiser | 2% to 7% |

| Region 2 | 6.6% |

| North Bay counties | |

| Anthem | -2% to 10% |

| Blue Shield | 10% to 31% |

| Health Net | 6% to 4% |

| Kaiser | 2% to 6% |

| WHA | 2% to 6% |

| Region 3 | 8.2% |

| El Dorado, Placer, Sacramento, Yolo counties | |

| Anthem | 2% to 14% |

| Anthem | 9% to 10% |

| Blue Shield | 9% to 30% |

| Kaiser | 2% to 7% |

| WHA | 3% to 4% |

| Region 4 | 3.4% |

| San Francisco | |

| Anthem | 1% to 13% |

| Blue Shield | 3% to 16% |

| CCHP | 3% to 3% |

| Health Net | 2% to 8% |

| Kaiser | 2% to 7% |

| Region 5 | 5.4% |

| Contra Costa county | |

| Anthem | 1% to 10% |

| Blue Shield | 3% to 23% |

| Health Net | -7% to 3% |

| Kaiser | 2% to 7% |

| Region 6 | 6.3% |

| Alameda County | |

| Anthem | 2% to 15% |

| Blue Shield | 2% to 22% |

| Kaiser | 2% to 7% |

| Region 7 | 7% |

| Santa Clara county | |

| Anthem PPO | 1% – 11% |

| Anthem HMO | 14% |

| Blue Shield | 8% to 29% |

| Health Net | 4% to 6% |

| Kaiser | 2% to 7% |

| Valley HP | 0% to 4% |

| Region 8 | 6.6% |

| San Mateo county | |

| Anthem | 4% to 8% |

| Blue Shield | 10% to 32% |

| CCHP | 3% to 3% |

| Health Net | 2% to 13% |

| Kaiser | 2% to 7% |

| Region 9 | 12.8% |

| Monterey, San Benito, Santa Cruz | |

| Anthem | 0% to 12% |

| Blue Shield | 20% to 44% |

| Health Net | -8% to 2% |

| Region 10 | 9.8% |

| San Joaquin, Stanislaus, Merced, Mariposa, Tulare | |

| Anthem | 2% to 14% |

| Blue Shield | 10% to 14% |

| Health Net | 0% to 11% |

| Kaiser | 2% to 7% |

| Region 11 | 3.3% |

| Fresno, Kings, Madera | |

| Anthem PPO | 1% to 11% |

| Anthem HMO | 8% to 10% |

| Blue Shield | 2% to 3% |

| Kaiser | 2% to 7% |

| Region 12 | 4.4% |

| San Luis Obispo, Santa Barbara, Ventura | |

| Anthem | 15 to 13% |

| Blue Shield | -4% 15% |

| Kaiser | 2% to 7% |

| Region 13 | -.5% |

| Mono, Inyo, Imperial | |

| Anthem | -8% to 4% |

| Blue Shield | -3% to 16% |

| Kaiser | 2% to 7% |

| Region 14 | 4.30% |

| Kern county | |

| Anthem | 0% to 12% |

| Blue Shield | -3% to 16% |

| Health Net | 21% to 6% |

| Kaiser | -2% to 2% |

| Region 15 | -.2% |

| Northeast Los Angeles county | |

| Anthem PPO | -13% to -3% |

| Anthem HMO | 6% |

| Blue Shield | -9% to 8% |

| Health Net | -5% to 8% |

| Kaiser | 1% to 6% |

| L.A. Care | -4% to 5% |

| Molina | -3% to -1% |

| Region 16 | 2.5% |

| Anthem PPO | -11% to 0% |

| Anthem HMO | 2% to 3% |

| Blue Shield | 3% to 23% |

| Health Net | -4% to 6% |

| Kaiser | 1% to 6% |

| L.A. Care | -4% to 5% |

| Molina | -10% to -8% |

| Region 17 | 1% |

| San Bernardino, Riverside | |

| Anthem PPO | -4% to 8% |

| Anthem HMO | 3% |

| Blue Shield | -3% to 16% |

| Health Net | 0% to 3% |

| Kaiser | 2% to 7% |

| Molina | -7% to -5% |

| Region 18 | 1.8% |

| Orange county | |

| Anthem PPO | -10% to 1% |

| Anthem HMO | 4% to 5% |

| Blue Shield | -2% to 17% |

| Health Net | -7% to 8% |

| Kaiser | 2% to 7% |

| Region 19 | 2.8% |

| San Diego county | |

| Anthem PPO | 0% to 12% |

| Anthem HMO | 7% to 8% |

| Blue Shield | 0% to 19% |

| Health Net | -7% to 2% |

| Kaiser | 2% to 7% |

| Molina | -10% to -8% |

| Sharp 2 | -3% to 1% |

| Sharp 1 | -1% to 1% |