Covered California is studying how President Trump’s plans for repeal and replacement of the ACA might impact their enrollment and health insurance premium rates.

Covered California is a business entity that relies on revenue generated by health insurance enrollments to pay their bills. President Trump’s promise to repeal and replace the Affordable Care Act (ACA) puts Covered California’s existence in jeopardy. Covered California has been studying how different changes to the ACA will impact their ability to meet their projected budget and offer affordable health insurance to consumers. At the Covered California January Board meeting they released six reports they commissioned that studied consumer attitudes toward health insurance and potential changes to the ACA.

Covered California Receives No Federal Or State Funding

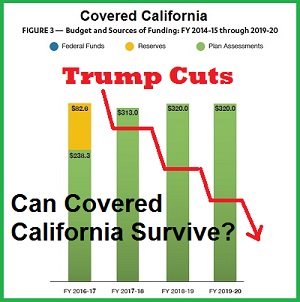

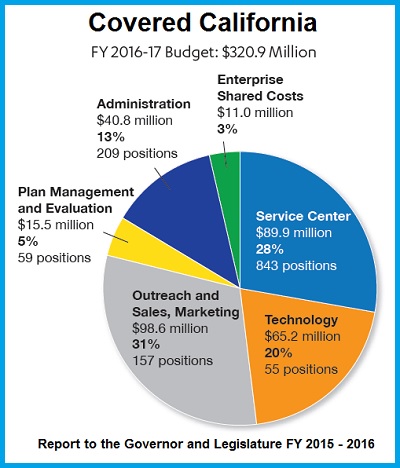

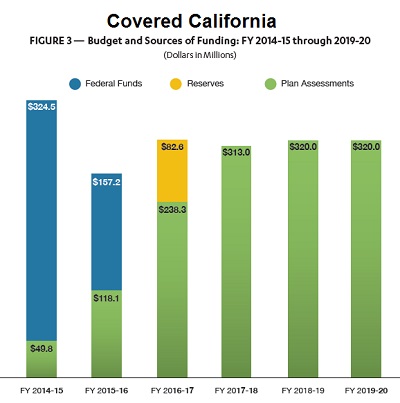

Covered California is funded by a 4% commission or assessment on the total premium amount of each individual enrolled in health insurance purchased through Covered California. For fiscal year 2016 – 2017, Covered California received no state or federal funding. They have preserved a portion of their original federal grant to establish a California Marketplace Exchange for ACA plans that has carried over into FY 2016 – 2017. In Covered California’s Report to the Governor and the Legislature for Fiscal Year 2015 – 2016, they noted, “Covered California projects that it will achieve a balance between revenues and expenditures in FY 2017-18.”

Covered California Budget pie chart for Fiscal Year 2016-17 that shows where there 4% health plan assessment revenue is spent on administration and program activities.

Covered California Funded By 4% Assessment On Health Plans

The Covered California budget was developed based on the ACA remaining intact with potentially only minor modifications. In other words, Covered California is predicting modest enrollment gains over the next several years. With the election of President Trump and the promise to repeal the ACA, no one is certain what the enrollment will be in future years. In its report to the Governor and Legislature, Covered California noted,

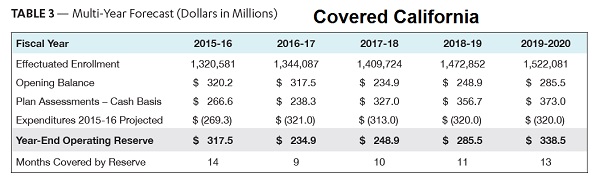

In addition to the $321 million budget in FY 2016-17, the forecast assumes budgets of between $313 million and $320 million for FY 2017-18 through FY 2019-20, and is designed to balance revenues and expenditures by FY 2017-18. The plan will provide a nine-month operating reserve throughout FY 2016-17 with a fiscal year end position of more than $230 million. Covered California does not expect its fiscal year-end reserve level to be less than nine months at any time throughout the outlook. The forecast reflects modest increases in operating expenses over the next few fiscal years to allow programs to maintain service levels necessary to maintain and expand membership.

Loss of Cost Sharing Reduction Payments

Before the ACA is even repealed and replaced, Covered California must grapple with potential sink hole of the loss of the Cost Sharing Reductions (CSRs). The U.S. House of Representative Republican members filed a lawsuit in 2014 complaining that there was no direct authorization for the federal government to pay health plans for the CSRs. The CSRs are the Enhanced Silver plans (73, 87, and 94) awarded to consumers with household income below 250% of the federal poverty level. The CSRs take the form of reduced plan deductibles, office visit copayments, coinsurance, and lower maximum out-of-pocket amounts. The judge hearing the case concurred that there was no proper authorization and ordered a halt to the payments. The Obama administration appealed the decision and the order was put on hold pending appeal. The Trump administration has not indicated if they will continue the appeal or move to let the order stand.

Covered California is facing the prospect that the CSR funding may be terminated in 2017. This could lead thousands of people to drop coverage if the consumer sees no value in a health plan where they can’t afford to pay for services. The sentiment was reinforced in consumer research study Covered California commissioned right after the 2016 presidential election. While Covered California was generally seen in a favorable light by consumers, people voiced skepticism about the whole concept of health insurance. As one focus group participant put it,

“Why should I be paying $300 a month if I am healthy?” – Covered California Sentiment Research

Covered California bar chart showing budget totals and how much of the revenue was derived from federal funds and future 4% health plan assessments.

In an effort to get ahead of the CSR termination curve, Covered California commissioned research on the consequences of CSR funds vanishing. The report Evaluating the Potential Consequences of Terminating Direct Federal Cost-Sharing Reductions (CSR) Funding focused on shifting the costs for the CSR funding across all Silver plans. In other words, increasing the premiums of all Silver plans to cover the costs of the CSR for consumers who were awarded the Enhanced Silver plans.

Evaluating the Potential Consequences of Terminating Direct Federal Cost-Sharing Reduction (CSR) Funding

- If Enhanced Silver Plans remain in effect, but the federal funding to the health plans is eliminated because of the lawsuit, health plans may be forced to raise premium rates to continue with the CSR for households with incomes below 250%.

- The study concluded a 16.6% increase in Silver plan premiums would be necessary to cover CSR funding. On exchange plan members would not realize any real increase in monthly premium because there would most likely be a corresponding increase in the Advance Premium Tax Credit (APTC) amount based on the Second Lowest Cost Silver Plan (SLCSP) formula for calculating the subsidies.

- Because the APTC increases, plan members with Bronze, Gold and Platinum plans would see a net decrease in premiums after the new SLCSP APTC adjustment is calculated.

- The study concluded that approximately 6% of Silver plan members would change to a Bronze plan because the lower net premium after the new APTC was applied.

- After premiums were adjusted to maintain the CSR – increasing the SLCSP and APTC – the study concluded that total APTC would increase by $976 million. This is greater than the estimated $750 million being spent by the federal government to subsidize the Enhanced Silver Cost Sharing Reductions currently.

Covered California Can Force Premium Increases To Pay For CSRs

Covered California probably would not necessarily be opposed to increasing the rates, especially when the APTC would cover most of the rate increase for the consumer. When the premium rates go up, Covered California makes money. Covered California assesses the health plans 4% on the total premium amount. So if Silver plans increase by an average of $65 per month, Covered California realizes a revenue increase of $2.60. And since the concentration of the enrollment is in the Silver plans, approximately 60%, Covered California can’t lose even if the premium increases decrease enrollment slightly.

Off-exchange standard benefit design plans would increase by 16.6% because the health plans must mirror the rate of the on-exchange plan to their off-exchange members. The increase was estimated to translate into a $65 per month premium rate increase for off-exchange Silver plans. This would lead to approximate 18% of off-exchange Silver plan members changing to Bronze plans that have a lower monthly premium according to the study.

Appendix: Consequences of Terminating CSR

An alternate scenario to keep the Enhance Silver plan Cost Sharing Reductions was to spread the cost over all the metal tier level plans, not just the Silver plans. The study determined that all metal tier plans would have to be increased by 11.3%.

- For plan purchased through Covered California, the increased APTC would offset any increase in premiums for consumers. In addition, the APTC paid out to consumers would be $687 million which is less than the current $750 million currently being spent for the CSR plan reductions.

- Because the premium increase would be a percentage of the base premium amount, Gold and Platinum plans would have the largest net dollar amount increase. The study concluded that enrollment in off-exchange Gold and Platinum plans would decrease by 2%, Silver enrollment would remain the same, and Bronze plan enrollments would increase by 1.5% as consumers switch plans to maintain premium levels within their budget comfort zones.

- The Appendix report concluded that 1% of consumers whose income was over 400% of the federal poverty level, and not eligible for the Premium Tax Credits, would leave the health insurance market. However, it was noted that up to 3% of off-exchange plan members could exit the market place for health insurance. For on-exchange consumers the enrollment would decrease by 0.5%.

Consumer and Market Implications of ACA Repeal without Viable Replacement

Funding elimination for the CSR Enhanced Silver plans would most likely lead to health plans leaving the market or seeking higher mid-year premium rate increases was the conclusion of another study commissioned by Covered California.

Funding Changes for Cost Sharing Reduction (“CSR”) Subsidies Need Clear Timeframe and Recognition of Potentially Higher Federal Spending. If direct federal funding of CSR’s were eliminated for all or part of 2017, many health plans would likely decide to immediately withdraw from the individual market or seek mid-year rate increases that would be substantial. While with early notice, health plans could build the cost of CSR into their premium pricing for the Silver products for 2018, the impact on enrollment, tier selection and on federal spending needs analysis. While health plans could build CSR into their premium pricing, recent analysis commissioned by Covered California found that such a change would result in approximately 29 percent higher cost to the federal government. – Consumer and Market Implications of ACA Repeal without Viable Replacement

Review of Potential Policy Changes to ACA

Another document released by Covered California is a synopsis of major policy proposals to the ACA from different initiatives, some of which have been introduced into congress. One item not addressed that I could ascertain is if the Marketplace Exchange such as Healthcare.gov and Covered California would still have a role in offering health insurance to consumers. The primary purpose of the exchanges is to determine the eligibility of a consumer to receive the Premium Tax Credits. Consumers can only receive the APTC or reconcile the Premium Tax Credit on their federal taxes if they purchase health insurance through the exchange.

Some people have argued that as long as an individual enrolls in a qualified health plan, either on or off the exchange, they should be eligible for any Premium Tax Credit the federal government may offer. Just like other tax credits, the Premium Tax Credit is reconciled when the consumer files their federal tax return. If the consumer is not taking the monthly APTC, where the exchange forwards a portion of the estimated Premium Tax Credit to the health plan to lower the insurance bill, then they should be able to claim the Premium Tax Credit on their federal tax return without having to purchase the health plan through the exchange.

Mulit-Year Forecast of Covered California Budgets based on estimated enrollment and revenue from health plan assessments of 4%.

Since Covered California receives its funding through the sales of health insurance to consumers, if individuals and families don’t have to purchase from Covered California, they may see their revenue drop. Consumers moving outside of Covered California to purchase insurance coupled with a potential loss of the CSR funding and current levels of the APTC, could have negative implications for Covered California’s budget. So far, Covered California under the leadership of Executive Director Peter Lee, has remained a solid, fiscally sound enterprise. The leadership at Covered California, as demonstrated in their latest release of publications and studies, is trying to prepare for an uncertain future under President Trump and that is commendable.

[wpfilebase tag=file id=2101 /]

[wpfilebase tag=file id=2100 /]

[wpfilebase tag=file id=2098 /]

[wpfilebase tag=file id=2102 /]

[wpfilebase tag=file id=2103 /]

[wpfilebase tag=file id=2099 /]