Under the American Rescue Plan, an individual who received unemployment insurance benefits for one week in 2021 is eligible for a subsidy boost through Covered California. To receive the boost in subsidy, and lower health insurance premiums, Covered California enrolled individuals and families must report they received unemployment insurance benefits on the income section of the Covered California application.

Covered California will begin processing the extra subsidy increase for applications that indicate unemployment benefits on June 21, 2021. The unemployment insurance benefit could have been for just one week in January. The household income will be taken down to 138.1 percent of the federal poverty level, regardless of the income estimated by the consumer. The 138.1 percent income level will prevent adults from being automatically determined eligible for Medi-Cal. The new subsidy will be based on the lower income and applied to the health insurance premium.

Unemployment Subsidy Boost Triggers Silver 94 Eligibility

The lowered income will make the household members eligible for the enhanced Silver 94 metal tier plans. Enhanced Silver plans have lower deductibles, copayments, coinsurance, and maximum out-of-pocket amounts. Consumers not in a Silver plan can change metal tier plans to Silver in order to receive the enhanced Silver benefits. For example, if a consumer is in a Bronze, Gold, or Platinum plan, they will receive the extra subsidy, but not the Silver 94 benefits. The consumer must change plans to Silver and they will receive the enhance Silver 94 cost-sharing reduction.

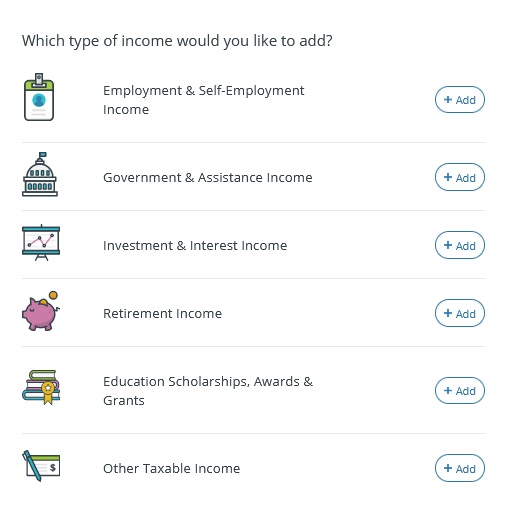

To update your income section to reflect any unemployment benefits you have received, you can call Covered California, contact your agent to make the change, or perform the task yourself. From your Covered California account, select the blue link that states report a change. Flip through the pages until you get to the income section and select Add for the person who received the unemployment benefits.

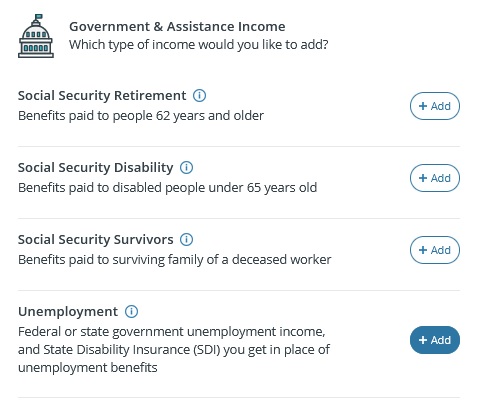

Select the Government and Assistance income type.

On the next screen select Unemployment

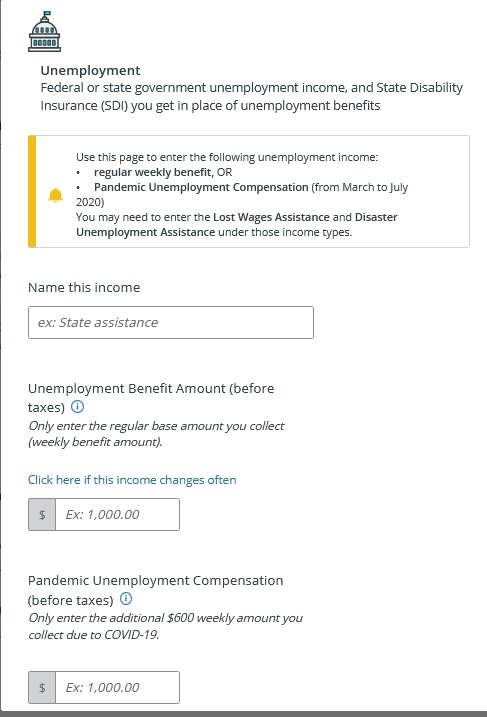

Finally, on the third screen, you will be able to input all the specifics of the employment insurance amounts, start and end dates. When you are done, recheck your monthly amounts and annual amounts. The income section is very date sensitive.

Covered California Unemployment Benefit Unknowns

There are a few particulars that Covered California has not elaborated upon. There has been no mention if dependents, under the age of 19, will be determined eligible for Medi-Cal when Covered California automatically applies the new and lower income amount at 138.1 percent of the federal poverty level for the household size. In general, dependents are Medi-Cal eligible when the household income is under 266 percent of the federal poverty levels. We are not sure if you can take this extra subsidy when you file your income tax return if it was not reported through the exchange like Covered California.

While this is an automated redetermination of accounts who have unemployment listed in the income section, there has been no guidance on updating the income section after the automatic updates. In other words, will households who report the unemployment in July or August still receive the boost to the subsidy? The extra unemployment subsidy is a fairly technical and temporary adjustment to the CalHEERS Covered California application. I expect there will be some glitches or bugs with such a complicated software update as this.