Covered California has updated their income eligibility table for 2022 to reflect the higher federal poverty levels. They have also announced a few new Qualifying Life Events that can trigger a Special Enrollment Period to purchase a health plan outside of the Open Enrollment Period that ended on January 31.

Higher Income Covered California Amounts

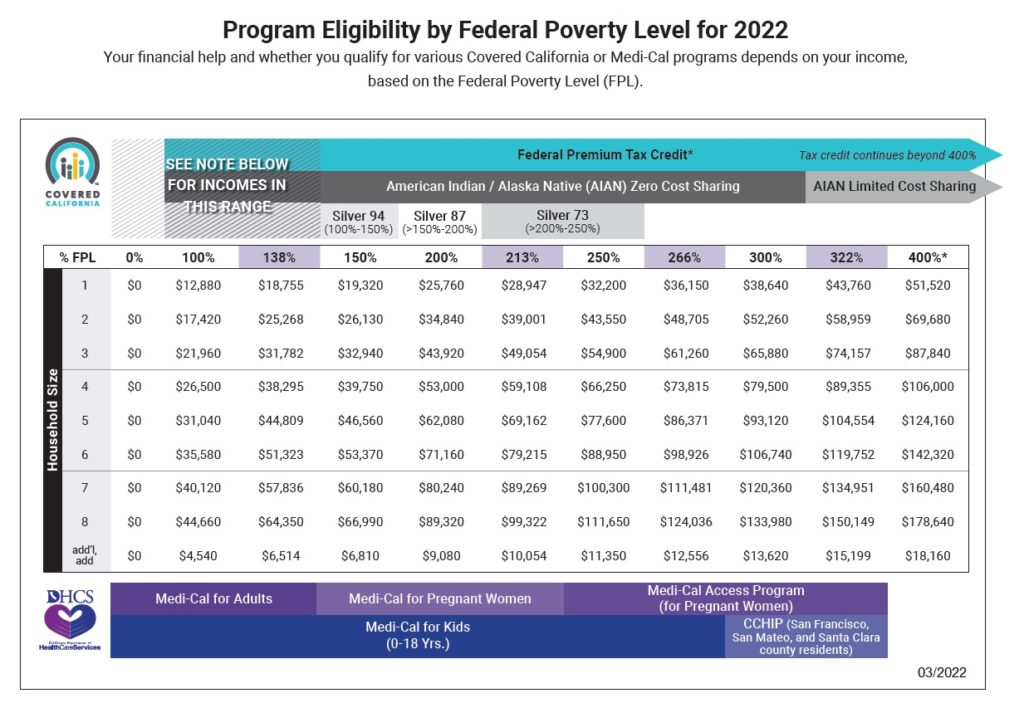

The minimum annual income in order to become eligible for the Covered California health insurance subsidies for a single adult is $18,756 for 2022. That is $980 higher than the minimum annual income for 2021, approximately a 6 percent increase. The minimum amount for 2 adults is $25,269 annual income. Estimated income amounts below 138 percent of the federal poverty level on the Covered California application will make the household eligible for Medi-Cal.

The annual household income for 1 parent and 1 child (2-person household) is $48,706 in order for the child to be eligible for Covered California subsidies and a private health plan. Household incomes below 266 percent of the federal poverty level, in most counties, will make dependents 18 years old and younger, eligible for Medi-Cal.

If a family enrolled or renewed Covered California coverage for 2022 during the Open Enrollment Period, they entered the exchange under the 2021 income table. However, if they make a change to their application and their estimated income is under the higher 2022 income dollar amounts for the Advance Premium Tax Credit subsidy, the dependents and adults may be determined eligible for Medi-Cal.

New Qualifying Life Events for Enrollment

Covered California has added a couple of Qualifying Life Events that qualify for a Special Enrollment Period.

Paid Penalty for Not Having Health Coverage

This QLE may apply if the consumer or their dependents paid the Individual Shared Responsibility Penalty to the Franchise Tax Board (FTB) due to not having Minimum Essential Coverage (MEC) for the previous tax year. Consumers who may qualify are those who have already filed their 2021 taxes and paid at least a part of the Individual Shared Responsibility Penalty to the Franchise Tax Board in the past 60 days. Note: This is different than in previous years, in that “just learned of penalty” does not qualify.

Less than 150 percent of the federal poverty level

For 2022, if the expected income is less than 150 percent of the federal poverty level, but greater than 138 percent (Medi-Cal eligibility), the individual or family can apply for health insurance through Covered California. The instructions note using the “None of the above” QLE from the drop-down menu when applying.

Pandemic (COVID-19)/Public Health Emergency

This QLE is in effect if there is a declared national public health emergency, or if there is a declared state of emergency due to a pandemic at the national or state level. A national public health emergency currently exists, as proclaimed by the Health and Human Services Agency. This is for any California resident, who otherwise qualifies, while there is a declared state of emergency for a pandemic or public health emergency.

There are many Qualifying Life Events that make an individual or family eligible for a Special Enrollment Period and the subsidies through Covered California. If someone has lost health coverage from the separation of a job or divorce, they can use the “Lost or will lose health coverage” QLE. Medi-Cal enrollment is available at anytime during the year. There are no specific enrollment periods for Medi-Cal. You can apply for Medi-Cal through the Covered California application at any time.