I am guilty of being complacent. Covered California was humming along so well that I was surprised at the number and type of problems Covered California was generating with updating income and calculating subsidies for their members. Essentially, the Covered California online application (CalHEERS) has, in some instances, not been updating subsidies when the income is changed.

While I am sure the number of families affected is small, if not caught and corrected early, these problems create real headaches for enrolled individuals and families.

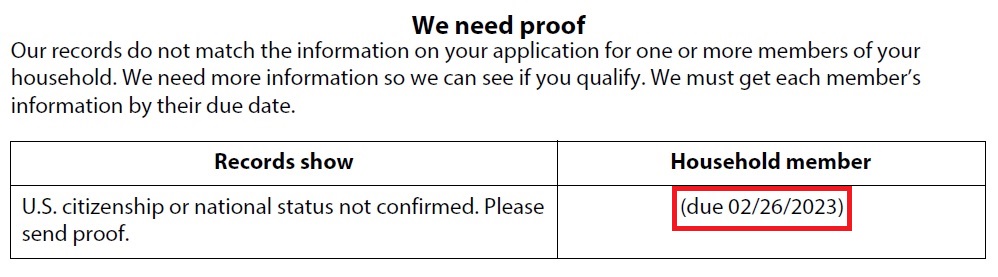

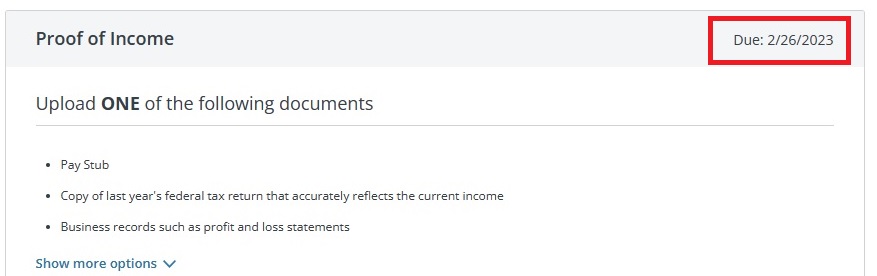

Case 1: Incorrect Verification Request

In September, my client received notification that she may be eligible for Medi-Cal. This was odd because we changed nothing in her account since enrollment in November 2022. At that time, Covered California requested proof of citizenship. She had been enrolled through Covered California for several years and already provided proof of citizenship. Regardless, we complied with the request and uploaded the immigration documents.

After she received the disturbing letter about Medi-Cal, we checked her account and it said she was overdue on the proof of income request. Covered California never sent any letter about requiring proof of income, only citizenship. We increased the income in September and the subsidy did not change. Whenever you make a change to the income, the Enrollment Dashboard will indicate the effective date of the new health plan premium with associated adjusted subsidy.

Within her account it looked as nothing had changed. I corresponded with Covered California about the issue. Their response was to sidestep any direct accountability. They stated that the review of the citizenship triggered an income review and the client was transferred to Medi-Cal. I have never seen where any review of citizenship or income verification tripped the application to be reevaluated as if it was being submitted with a change report. Regardless, Covered California sent out another letter saying she was eligible for the subsidies….but….the subsidy is still being calculated on the old income, it never changed.

Case 2: No Subsidy Change After Income Update

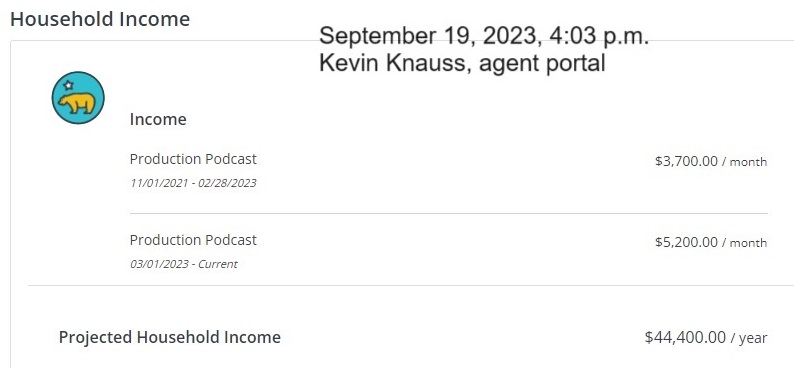

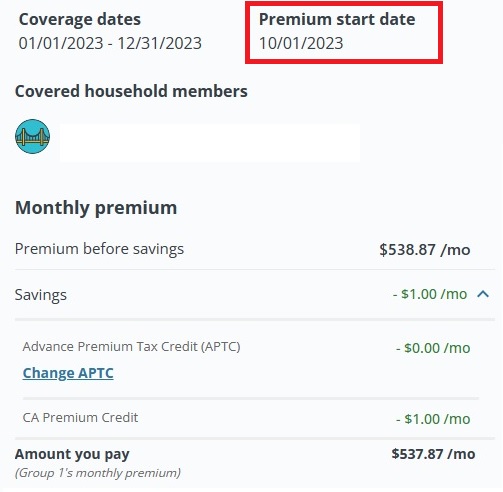

Another client contacted me to update her income in September. It was a substantial income increase and I knew the subsidy would really drop. However, after I reported the change, her subsidy did not change. Just like the previous case, there was no new premium effective date listed on the Enrollment Dashboard.

I thought I did something wrong in reporting the income. When I reviewed the enrollment application, the updated income was listed, but the projected household income reflected the original monthly income. Covered California could also see the two income entries. Some screens displayed the correct household income and others did not.

The problem was escalated and Covered California fixed the issue. On the Enrollment Dashboard the effective date of the new premium was properly displayed and the subsidy had been reduced based on the higher monthly income. How many people and Covered California customer service representatives would not have caught the problem of the subsidy not changing? Without intervention, this client would have had a big excess premium tax credit to repay on her federal tax return.

Case 3: No income, still receiving subsidies

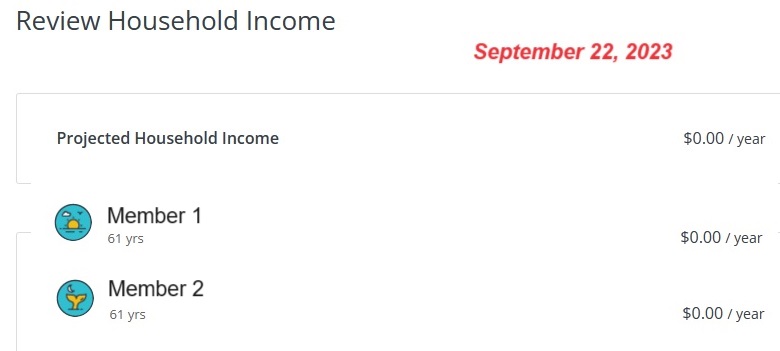

Later in September I received an improbable email that a family had received a letter stating their income was $0. Sure enough, when I checked the account, the income had been wiped out to $0.

The couple, despite having no income entered in the Covered California system, was still receiving $1,517 in monthly subsidy. Normally, when your income is $0 you are automatically flipped to Medi-Cal.

In this case, Orange County Medi-Cal had been in the account earlier in the year. The couple had been determined ineligible for Medi-Cal. Whatever Medi-Cal did, they wiped out the income, but it did not register with the Covered California CalHEERS online application. This case has been escalated in Covered California.

As an aside, I have seen many cases where an individual is deemed eligible for Medi-Cal and the Covered California enrollment is not terminated. The subsidy is reduced to $0 and they receive an invoice from the health plan for the full premium amount. This is confusing because they are in Medi-Cal because of low income. In past years, the county Medi-Cal office would terminate the health plan enrollment, not just erase the subsidy.

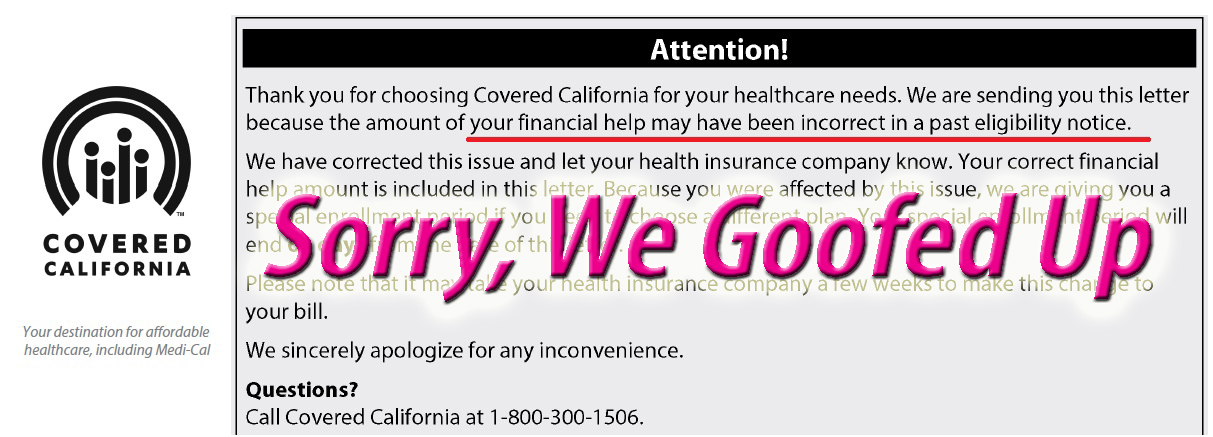

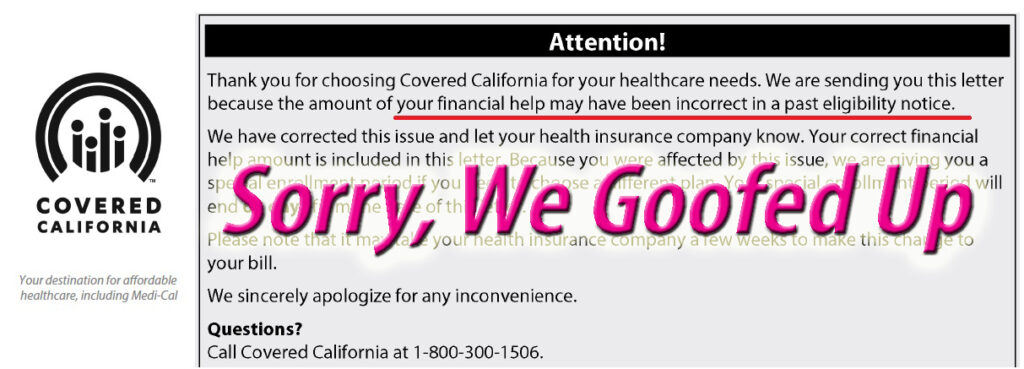

Case 4: We Goofed

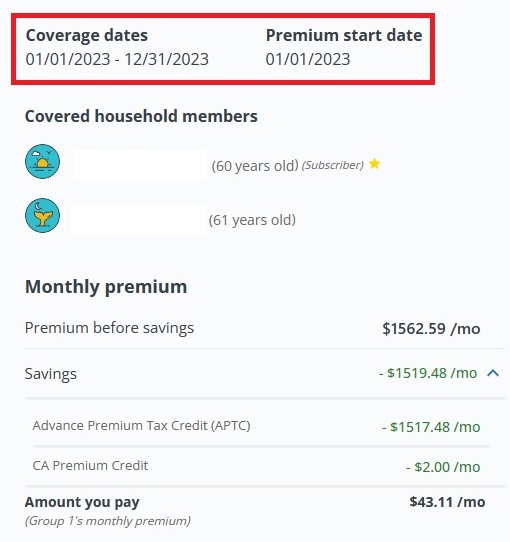

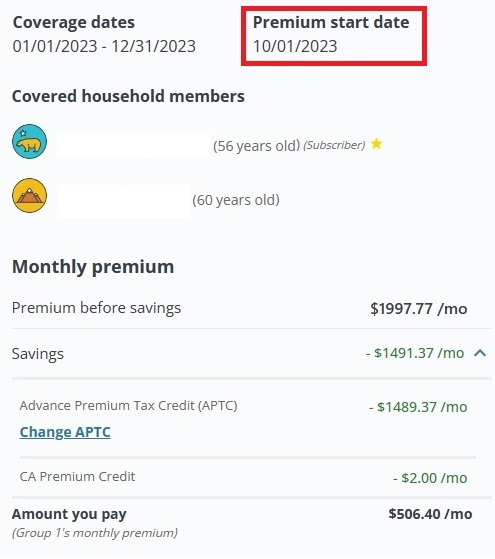

Finally, a client contacted me because Blue Shield informed him that his premium was increasing from $208 to $506. We had not touched the account since May when we did increase the income. The subsidy with that income increase did drop and the monthly premium went from $70 to $208. So, what happened?

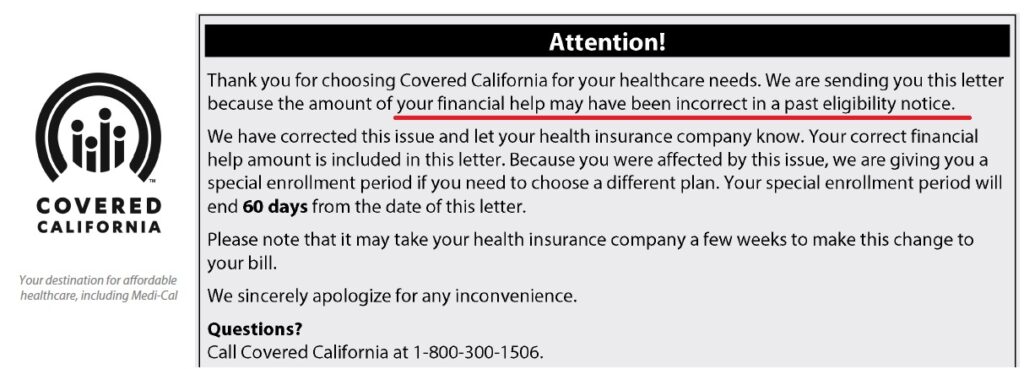

On September 21, Covered California had reviewed the client’s account and realized they were receiving too much monthly subsidy. They sent them a letter stating they made an error and the subsidy would be decreasing. Blue Shield also received the updated lower subsidy amount and sent a letter their member before the Covered California letter was received.

The family did not understand what was going on. Why was their subsidy unilaterally changed by Covered California with no warning? They did not trust Covered California to get the numbers correct. I created a spreadsheet to see if the new subsidy and subsequent totals matched what they were eligible for at the estimated income.

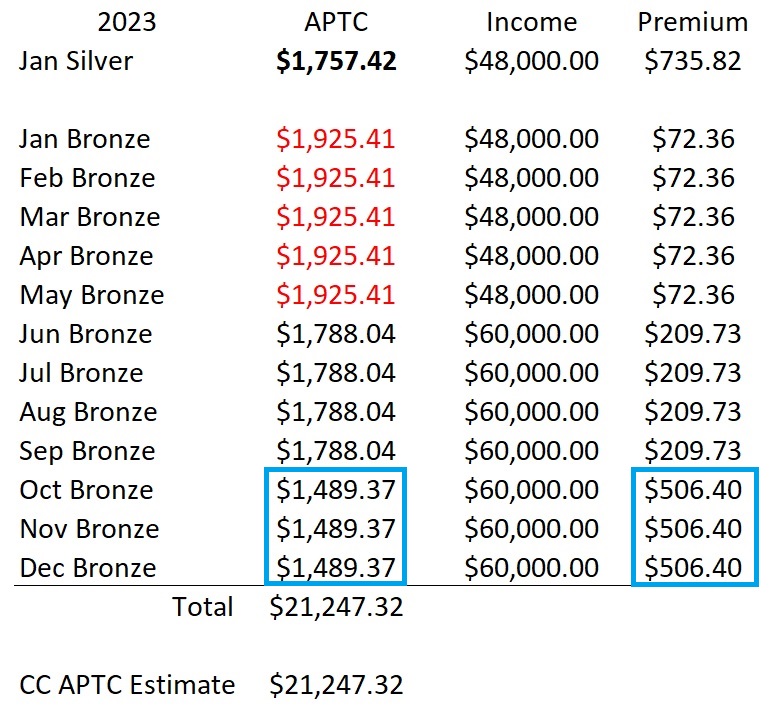

One item that jumped out at me was the lower subsidy for the initial Silver plan for 2023. In November, during Open Enrollment, the family decided to move from a Silver to a Bronze plan. The subsidy should have remained the same. It did not. The subsidy for the Bronze 60 plan for 2023 went from $1,757 to $1,925.

Even when I made the income update in May of 2023, the new subsidy was still higher at $1,788 than the original subsidy amount of $1,757. Obviously, the original subsidy benchmark was wrong from the beginning. Covered California implemented some sort of audit that identified the incorrect subsidy calculation. With the subsidy correction, the total amount of subsidy that will be advanced through December 2023 is equivalent to what the couple is eligible for at the higher $60,000 estimated income.

What does all the income – subsidy mess suggest for Covered California? They obviously have a few bugs in their software. Covered California is as cagey as a health insurance company. They like to keep their mistakes quiet so as not to tarnish their brand.

All you and I can do is to be diligent. Always check dates and potential dollar amounts. I hate to approach Covered California under a constant hint of suspicion that the displayed results are not correct, but they are not leaving us much space to feel confident. We cannot become complacent.