You can split family members into different health plans and metal tier levels to save money.

Whether you buy health insurance through Covered California or off-exchange, if you have family, you can cut your health insurance premiums by splitting the family members into different health plans. While you may sacrifice some of the benefits of a family plan such as lower household deductible and maximum out-of-pocket amount, the monthly savings could bring welcome relief to high health insurance premiums.

Every family is unique when it comes to individual family member’s use of health care services. Some people may have health challenges that demand frequent trips to the doctor’s office or lab, while other family members rarely go to a doctor. The default selection is that everyone in the family is on the same plan with the health plan selection chosen to support the higher users of health care services.

Having all the family members on one health plan has also gotten more expensive as the rates or children between 15 and 20-year-old jumped up 50% for 2018.

Off-Exchange Separate Family Member Plan Enrollment

If a family buys their health insurance off-exchange, directly with a health insurance company, they will need to complete separate applications. This means that if the parents want a Gold plan for the kids and a Silver plan for themselves, they will have to complete two separate applications. This will also generate two different monthly invoices from the health plan. While this can be a hassle, it may be worth it to save a couple hundred dollars per month.

Families don’t all have to be with the same carrier either. Some parents have chosen a PPO plan for their children because certain doctors who are treating their children are in-network with the PPO plan. The parents then choose a less expensive HMO plan for themselves. It could be that a family member needs surgery during the next year. That person might opt for a Gold or Platinum plan to reduce out-of-pocket expenses while the other family members hang out in the Bronze or Silver metal tier level.

Splitting Up Family Members in Covered California

Covered California has made it relatively easy to split or group different family members into different plans. However, if the household has already been automatically renewed into a plan for 2018, the steps for splitting the family apart get a little more complicated.

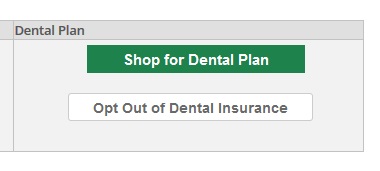

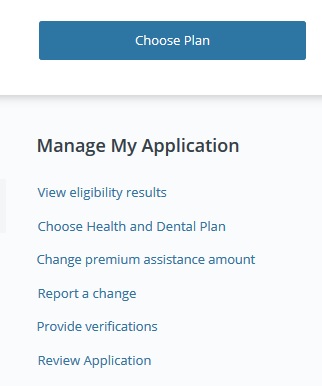

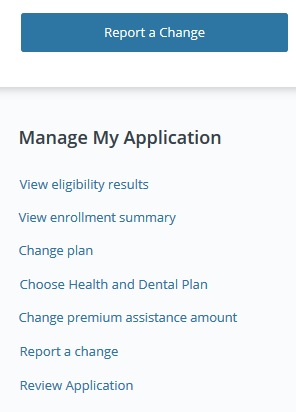

If a family has already been automatically renewed into a health plan, but they want to change the selection, there is a button for that. It is called the Change Plans button. But you say you don’t see the Change Plan button? Thank Covered California for that bit of marketing magic. If you log into your account and scroll down to the Manage My Application column of links, and there is no Change Plans link, you probably have not either selected a dental plan or opted out the offering.

The Change plan button will be visible once a dental plan has either been selected or the household has opted out of dental insurance.

Before the health plan can be changed, before the Change Plans link is visible and active, a consumer must either enroll in a dental plan or opt out of the dental plan insurance. Once you have made that dental selection, the Change Plan link becomes active. But there is still one more hurdle to jump over in Covered California.

If you have been automatically renewed, before you can split up family members, you will need to terminate the 2018 enrollment. Terminating the 2018 enrollment can be tricky. If you are in doubt, work with your agent or have Covered California do it for you. You will be able to change plans for the whole family without a complete 2018 enrollment termination, but the Covered California system will not give you the option to split up the family members unless the 2018 enrollment is wiped out.

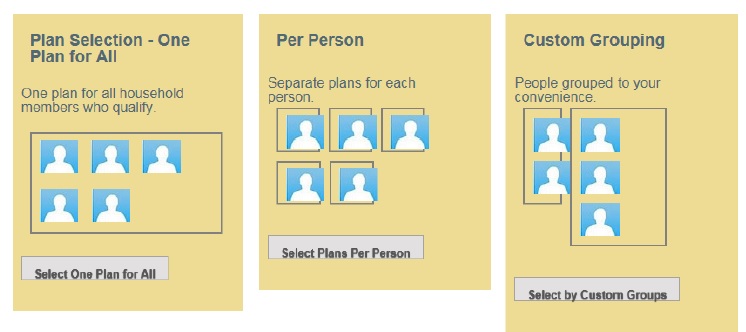

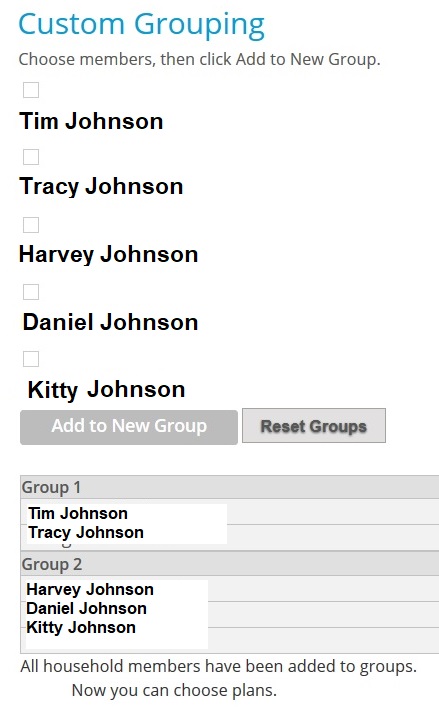

Select Custom Grouping to split up family members into different plans.

Once the account has been completely reset, no 2018 enrollment, Covered California will allow you to enroll each family member in a completely separate health plan, or group family members into separate plans. They don’t have to be with the same carrier.

You check mark each household member you want is a particular group to be enrolled in the same health plan, but different from the other group members.

Once you have selected the health plans for each household member or set up the groups, you will have to enroll and confirm the enrollment for each individual or group.

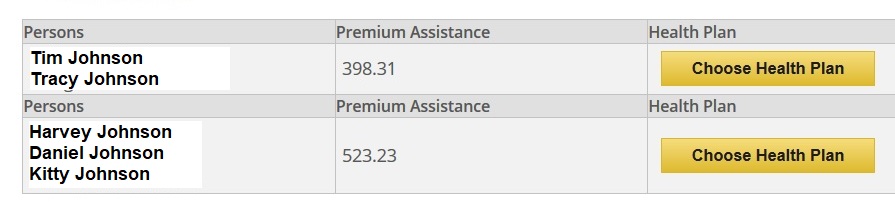

Once the groups has been established, the Covered California system will tell you the premium assistance for each group and then you can make a plan selection. You must enroll each group separately.