There are more dental plans on the market than there are teeth in your mouth. Are any of them worth the money? I did a modest cost-benefit comparison of three Delta Dental plans marketed to individuals and families for a hypothetical 5-year period. While all the plans would save an adult money, the premium differential made some plans more attractive than others.

Across the spectrum of dental plans, most employer group dental insurance plans are better than the individual and family plans when you compare cost to benefits. Employer group plans usually have lower premiums and better benefits compared to individual and family plans. In this post I look at three different Delta Dental PPO plans available in 2020 to individuals and families. I selected Delta Dental because they have different plans in separate marketing channels making comparison shopping confusing.

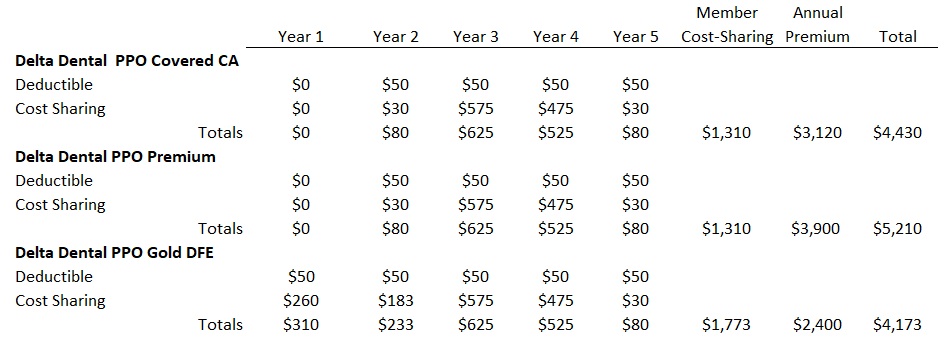

Delta Dental PPO Plan Cost Comparison

From the variety of different Delta Dental plans, I selected those that were most similar. Delta Dental has two different dental networks, the PPO and the Premier network. All these plans use the less expensive PPO network. One of the big drivers of dental insurance is the maximum annual dollar benefit the plan will pay on behalf of a member. Two of the plans have $1,500 maximums and the third has a $1,000 maximum. The rates are based on a Sacramento County residency and may vary depending on your location.

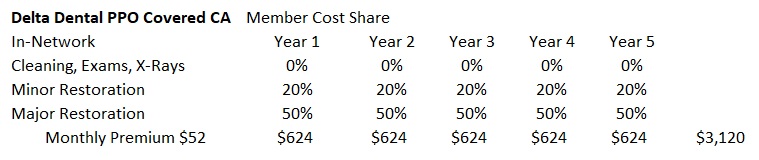

The first Delta Dental PPO plan is offered through Covered California. You must be enrolled in a Covered California health plan in order to enroll in this plan. It has a $50 deductible, $1,500 max. benefit, and a six-month waiting period before Delta Dental will pay any of the costs of the dental services, excluding cleanings, exams, and x-rays. If you have a minor restorative service, like having a cavity filled, before the six-month waiting period, you pay the full negotiated rate for the service. After the waiting period the plan cost sharing becomes effective.

After the six-month waiting period, and after the $50 deductible, you will pay 20% of the contracted rate for minor restoration and 50% for major dental work. Preventive services such as cleanings, x-rays, and exams have an immediate 0% member cost-sharing. The adult monthly premium is $52 and each child is $32.

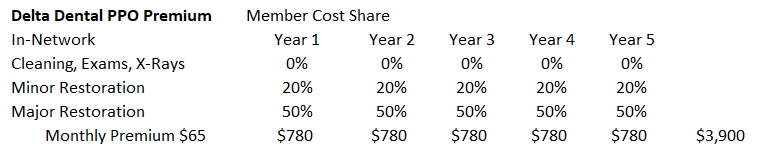

The second Delta Dental plan (PPO Premium) is offered directly from Delta Dental to individuals and families. Anyone can enroll, you don’t have to have health insurance or be in Covered California. It is virtually a mirror image of the PPO plan offered through Covered California: $50 deductible, $1,500 max. benefit, six-month waiting period, same cost-sharing percentages. The significant differences are the rates. Adults are $65 per month and $42 for children.

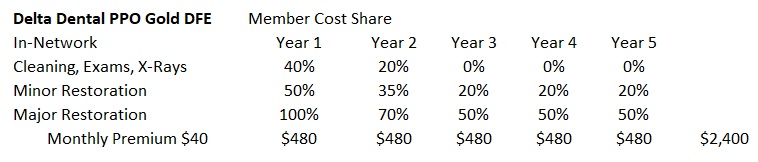

The third marketing channel Delta Dental uses is Dental For Everyone run by the Morgan White Group. The Dental for Everyone plans are structured differently in that members are rewarded for persistency. In other words, the longer you have the plan, the lower the member cost-sharing becomes. The benefit to this structure is lower premiums. The downside is potentially higher out-of-pockets costs for dental services in the early years.

The Dental For Everyone Delta Dental Gold PPO plan has a $50 deductible, $1,000 maximum benefits, a six-month waiting period for minor restoration and twelve-month waiting period for major restoration. The cost-sharing, at year 3, matches the other Delta Dental plans. In year 1, member cost-sharing is 40% for preventative, 50% for minor, and 100% of major restorative work. In year 2, member cost-sharing is 20% for preventive, 35% for minor, and 70% of major restorative dental services. The monthly adult premium is $40. An adult plus one other member is $71.86 per month. The family monthly rate is $104.44.

But how does the varying waiting periods and cost-sharing percentages actually play out under real world conditions. Just because the Dental For Everyone rates are lower, that doesn’t mean it will save money when compared to one of the other Delta Dental plans. I compared the average monthly premiums for one adult over five years and different dental services over the course of the time period.

Dental Services and Costs

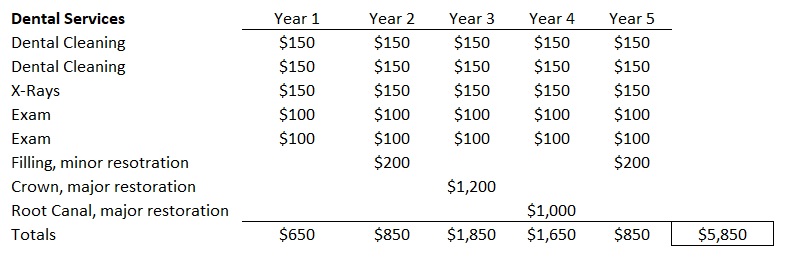

I applied the stated deductible and cost-sharing to the various services outlined in the summary of benefits of each plan. For the costs of those services I tried to find average prices that would be similar to contracted rates. The contracted rate is the dollar amount for the service the dental office has agreed to accept from the dental plan. The contracted or negotiated rates, like the premiums, can be different in different regions of the state.

I assumed that the dental plan member would receive two cleanings and exams per year with one set of x-rays. In year 2 the plan member had a cavity filled. In year 3 the person needed a crown and year 4 a root canal. In year 5 another cavity was fixed.

Under this scenario, when the member cost-sharing plus premiums are added together, the Delta Dental Gold plan was the least expensive. The plan costs were exactly the same for years 3, 4, and 5. It was the monthly premium that made the big difference. The Delta Dental Gold plan had a lower premium, and assuming all plans would inflate at the same rate, it will remain lower for the remainder of the enrollment.

Dental Insurance 5 Year Cost Projections

Other dental service scenarios could yield a different result. For instance, if plan member had both a root canal and crown in the same year. Under the Delta Dental Gold plan, the maximum benefit is $1,000, potentially leaving approximately $1,000 not covered by the plan. The Delta Dental through Covered California and Delta Dental Premium have a $1,500 maximum benefit, resulting in a lower $500 uncovered cost to the plan member.

However, even if the plan member had to pay $1,000 for uncovered services, the Delta Dental Gold plan would still be less expensive than the Delta Dental Premium. If you look at the premiums for a family of four (2 adults and 2 children) the Delta Dental Gold is $104.44, Delta Dental Covered California is $168, and the Delta Dental Premium is $214.

Finally, if we assume that you would pay the average negotiated rates for the dental services, over a 5-year period, they would cost $5,850. Even the most expensive Delta Dental PPO Premium plan yields a savings of $640 over just paying cash for the services. Of course, everyone has different dental needs when it comes to preventive and restorative procedures. A dental HMO plan may make more financial sense, but I will save that for another blog post.

Quotes Delta Dental PPO plan through Dental For Everyone

Quotes Delta Dental PPO Premium Plans