A couple of the big gripes about dental insurance is that you have to wait to get coverage for major restorative services and dental implants are almost never covered. Morgan White Group has released a dental plan underwritten by Delta Dental that has no waiting periods and covers the increasingly popular dental implants. The premiums are also reasonable compared to other dental PPO plans.

Several times per month I will be contacted by someone who has just received the bad news from their dentist that they need lots of major dental work. The work may include fillings, crowns, and potentially dental plants if a tooth needs to be extracted because of its poor condition. Most dental plans will have a 6-month waiting period for minor restorative work such a tooth filling. In addition, the plans won’t cover any major restorative services, such as crowns and extractions, for 12 months.

An often-overlooked benefit of dental insurance is that if you use a dentist in-network with the dental plan, you will be paying the contracted rate for the minor and major restorative services, even if the dental plan is not covering part of the cost. However, it is the cost-sharing that prospective dental plan members are looking for to reduce their out-of-pocket expense for the dental procedures.

Immediate Coverage for Dental Implants

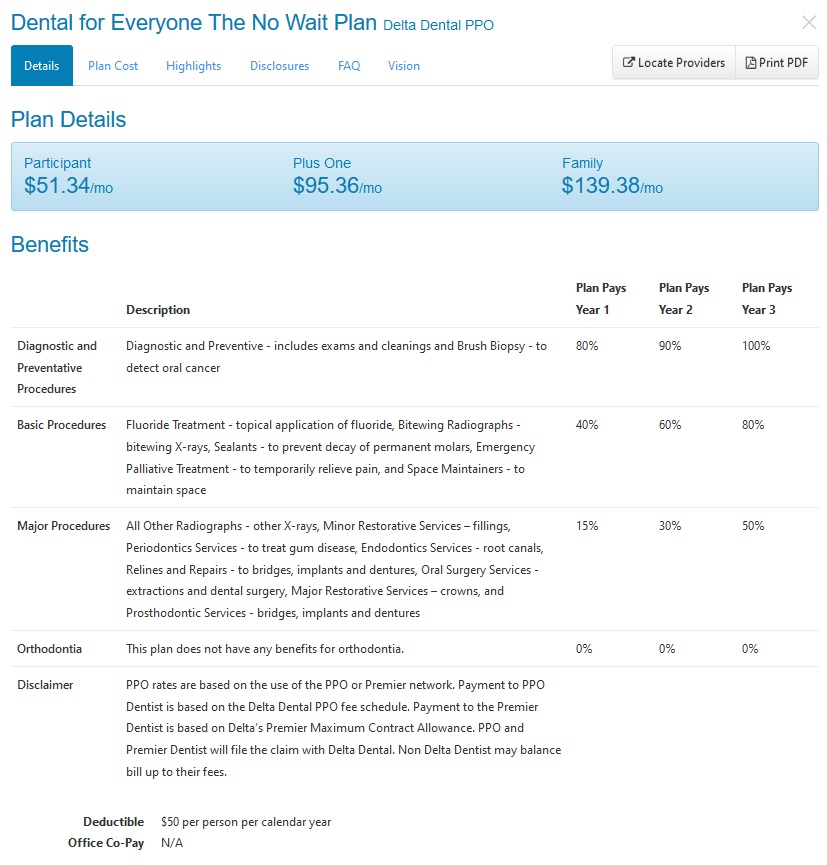

The new Dental for Everyone No Wait Plan through Delta Dental is just as it sounds; it has no waiting periods for either minor or major restorative dental work. There is a $50 deductible before the plan will provide any cost-sharing for those services. The No Wait plan also has a relatively high calendar year maximum benefit of $2,000. The maximum benefit is the total amount of cost-sharing the plan will pay on a member’s behalf during the year for all services.

The monthly No Wait plan premiums for a 55-year-old individual in Northern California were just $51.34 in August of 2019. A two-person household had a monthly premium of $95.26 and the family plan was $139.38. For a comparison, the Dental for Everyone Delta Dental Gold plan with a $1,000 maximum benefit and traditional waiting periods, and no coverage for dental implants, was $39.28 per month. Both the Gold plan and the No Wait plan use the same Delta Dental PPO network.

The big dental plan rate drivers are usually the maximum benefit amount, the network, and if the plan covers orthodontia. In general, the larger the maximum benefit, the higher the monthly plan premium. So, I was surprised at the No Wait plans relatively low monthly premiums for a plan that covered dental implants and a $2,000 maximum benefit. However, some of the other plan elements have been tweaked to reduce the liability of Delta Dental for some services.

For instance, most dental plans will immediately cover 60% to 100% of the cost of exams, cleanings, and x-rays with no waiting period. The No Wait plan covers 80% of cleanings and exams in the first year and only 40% of bitewing x-rays. While there is no waiting period for minor or major restorative dental work, the plan will only cover 15% of the contracted rate in the first year for those services. That cost-sharing jumps to 30% in year two and 50% in year three.

$2,000 Maximum Benefit

Now before you cast a cynical glance at the plan for low cost-sharing in the early years, remember that the maximum benefit is $2,000. If a $1,000 crown is reduced by 15%, or $150, that’s almost three months of plan premiums for an individual. If you can space out the major dental work – radiographs, periodontics and endodontic services, relines, oral surgery, crowns, bridges, dentures, implants, etc. – over a couple of years, the plan might just provide cost-sharing equal to or greater than the monthly premiums.

People usually fall into two camps when it comes to dental insurance. They either have no need for it, believing it costs more than the benefits, or they see the long-term value proposition of having dental insurance. I understand both perspectives and don’t necessarily advocate for serious consideration of dental insurance if a person has excellent oral hygiene, has no history of dental problems, and sees their dentist regularly.

I continue to have dental insurance just to make myself get routine regular cleanings and exams. I know I would procrastinate if I didn’t have dental insurance and I had to pay the $100 plus for the pain of getting my teeth cleaned. But after years of great check-ups, I did need a couple of crowns recently. Instead of a $2,000 dental bill, I only paid $1,000. Did the cost-sharing benefit of the dental plan cover my plan premiums? It did for that year, but not for the five years I went with out having any crowns or fillings. Although, I believe that the regular cleanings and exams helped delay the need for those crowns and other minor fillings.

Most health plans include pediatric dental services for children 18 years old and younger. Consequently, I wouldn’t give a lot of consideration to the No Wait family plan. Plus, orthodontia is not covered in the No Wait plan. But if you are over 50 years old and know that you have immediate dental issues that need to be addressed, or will have in the next couple of years, the No Wait plan from Morgan White Group Dental for Everyone, underwritten by Delta Dental, may be a good option. It is also one of the few plans available to individuals and families that will provide coverage and cost-sharing for dental implants. As always, carefully read the limitations and exclusions document to get a full understanding of the plan. If you have additional question, please don’t hesitate to reach out to me, Kevin Knauss, and I will find answers to your question.

No_Wait_Services_Limits_Exclusions_Delta_Dental_MWG_2019

No Wait Plan from Dental for Everyone, through Morgan White Group, underwritten by Delta Dental. No waiting periods, coverage for dental implants.

Podcast