Even after you have your Covered California health plan all set, the subsidy can suddenly vanish. How did Covered California lose your subsidy? Sometimes, returning the subsidy is as simple as clicking a few boxes. Other times, you will need to do some research to find why the subsidy vanished.

Hunting For The Lost Subsidy In Your Covered California Account

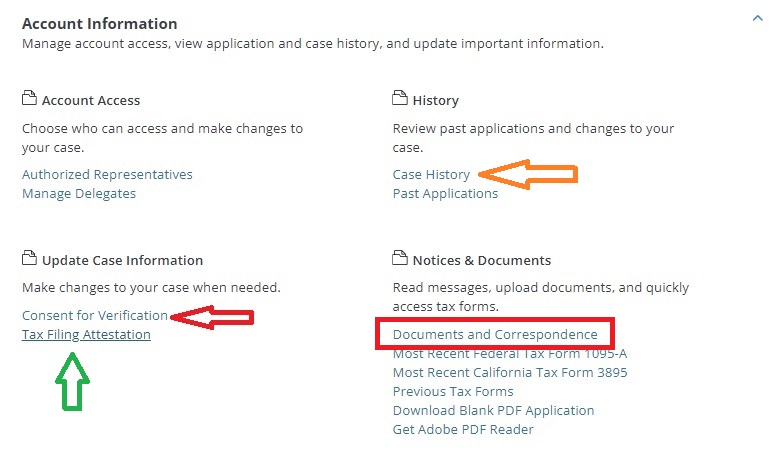

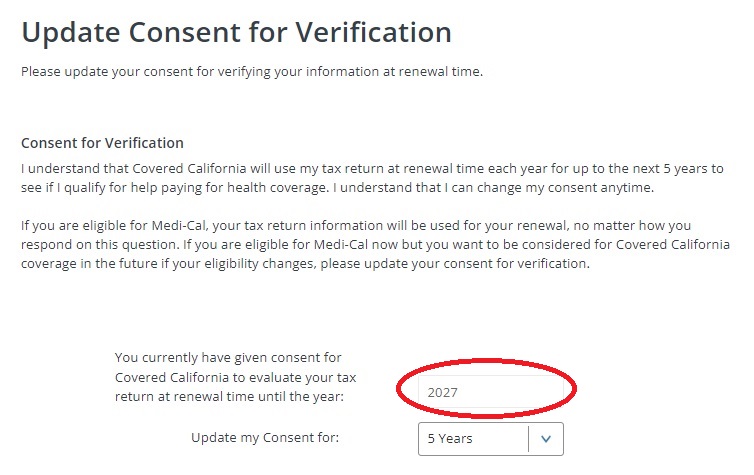

First, when you are in your Covered California account, scroll down to Account Information and expand the box. The first review is to check your Consent for Verification. If the consent has expired, Covered California cannot extend the subsidies. They need your consent for verification to check federal data bases to make sure you have filed taxes and other conditional information.

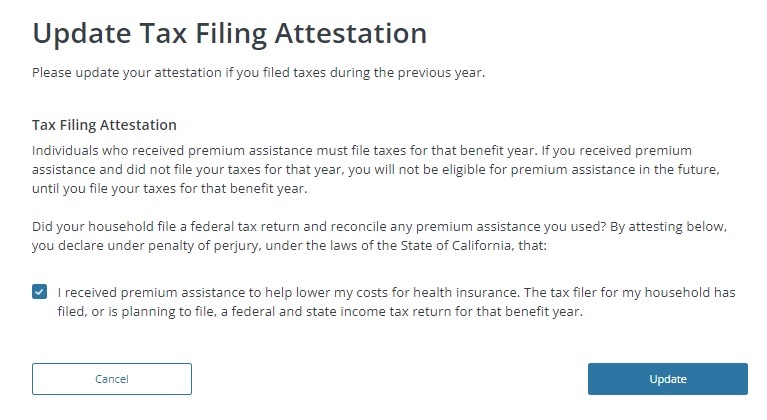

Second, if you file your federal taxes with an extension, it may not have registered when Covered California checked the federal data base. Click on Tax Filing Attestation if you have filed your taxes for the last year or are in the process of doing so. Usually Covered California has sent letters to you that some of the conditions have not been met.

Covered California Documents and Correspondence Clues

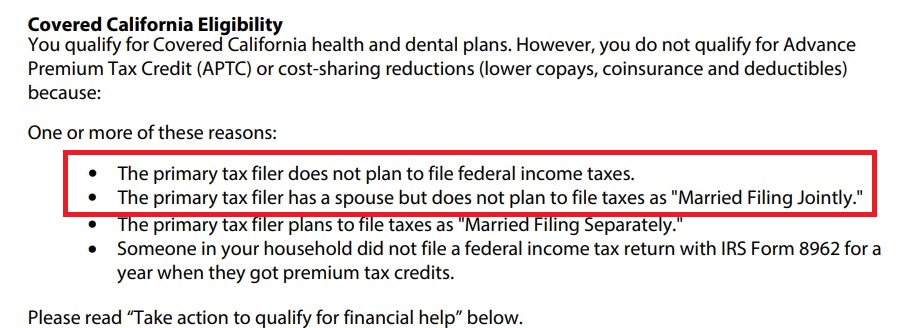

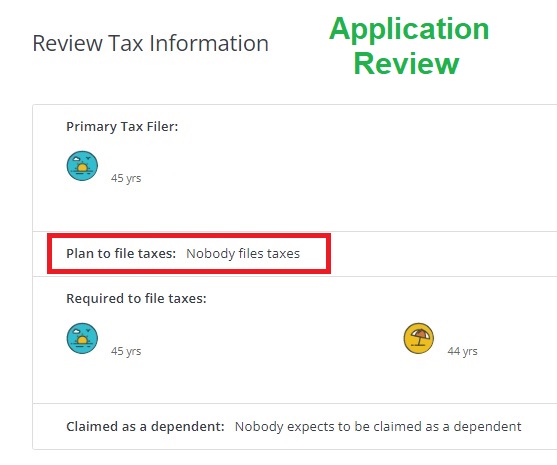

From the Account information menu you can click on Documents and Correspondence and view the most recent letters from Covered California. Often times the letters will indicate why there is an issue with your account, health plan enrollment, or loss of the subsidy. For one family the letter indicated they were not filing taxes. The subsidies are based on the condition that you agree to file a federal tax return.

Medi-Cal Strikes Again!

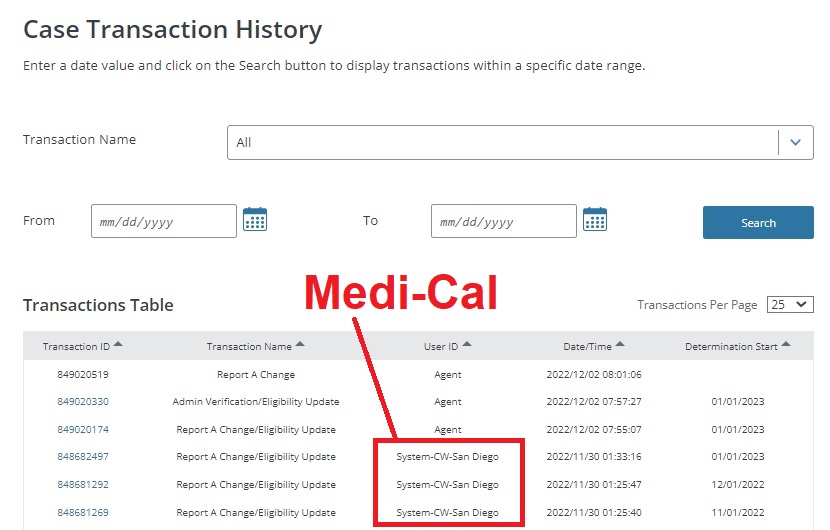

We were perplexed as to how this family’s tax filing status had been changed. Whenever anyone makes a change to a Covered California application, it is logged. From the Account Information menu, select Case History to review who made changes and when.

In this particular case, the user ID of System-CW-San Diego alerted us that a case worker at San Diego County Medi-Cal had reviewed the application. I cannot say that the case worker changed the tax filing status. There are instances when the Medi-Cal system does not properly mesh with the Covered California CalHEERS software. There are times when conditional information is just erased or changed because of an incompatibility with the data fields.

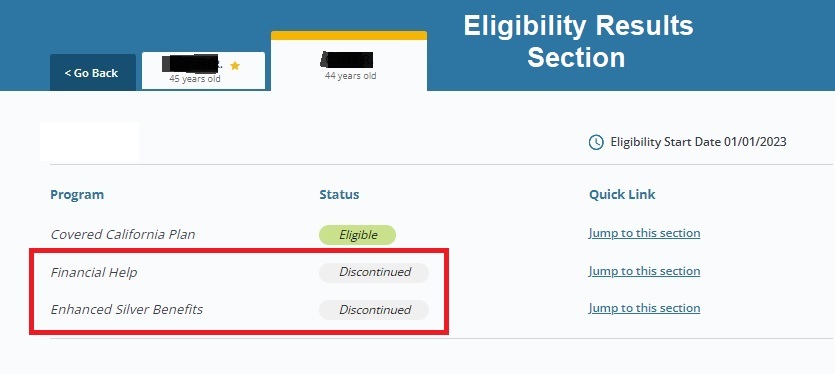

Regardless, all the tax filing status information was set to unchecked status. In other words, after Medi-Cal reviewed the application, the Covered California application indicated the family was not expected or required to file taxes. Without the agreement to file taxes, the household could be enrolled in a Covered health plan, but they could not receive the Advance Premium Tax Credit subsidy.

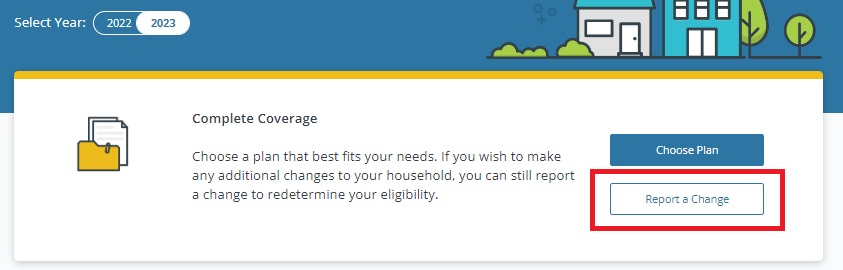

Simple issues like this can also be detected from the application review link on the homepage. To correct the issue it is necessary to Report a Change. You can then navigate to the section with the incorrect information, make the necessary changes, and submit the application. It is very important to submit the application for the changes to be reported in the Covered California system. After we Reported a Change and indicated tax filing status, the subsidies returned for the household.